An Elevated Price Target Signals Bright Prospects

With a remarkable increase of 13.72%, the price target for InterContinental Hotels Group (LSE:IHG) has soared to 7,161.21 per share. This surge marks a new milestone set by analysts, surpassing the previous estimate of 6,297.08 from January 16, 2024.

The target price, an aggregate of multiple analyst predictions, now ranges from a modest 4,848.00 to an ambitious 9,161.25 per share. Notably, this average reflects a 16.73% dive from the latest closing price at 8,600.00 per share.

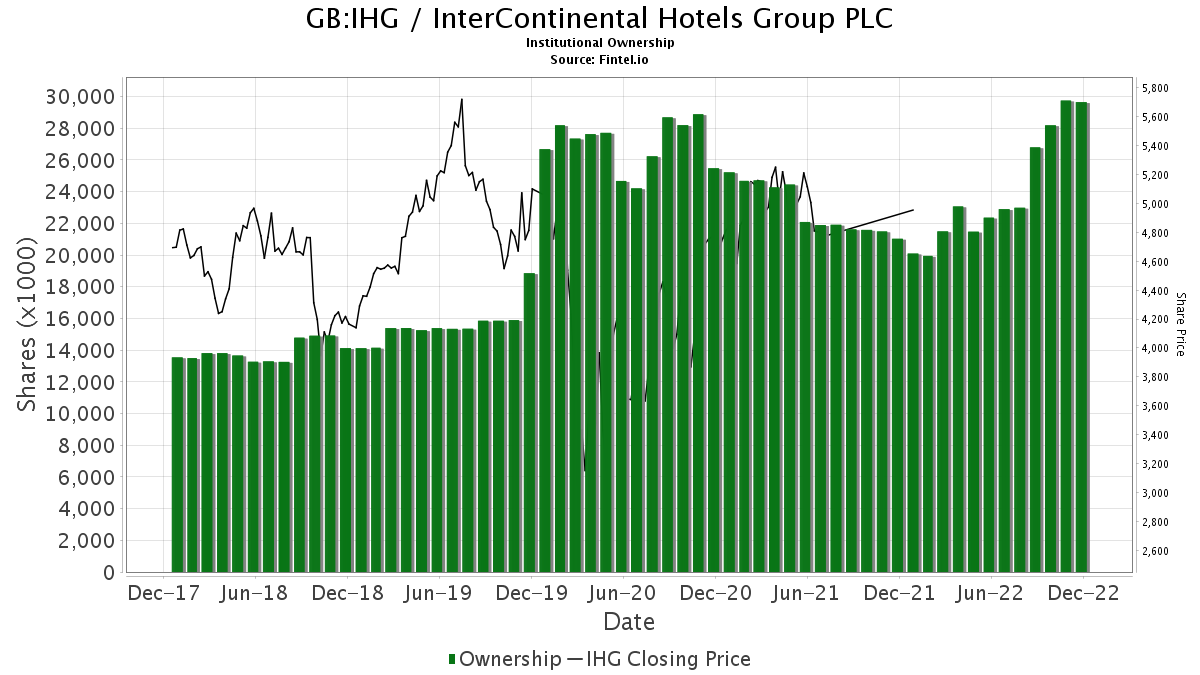

The Pulse of Institutional Confidence

Currently, 508 funds or institutions boast stakes in InterContinental Hotels Group, up by 34 entities or 7.17% in the previous quarter. The average portfolio weight dedicated to IHG has surged to 0.26%, marking a substantial 4.05% escalation. Institutions collectively own 37,156K shares, showing a noteworthy 5.61% rise in the past three months.

Insights into Shareholder Actions

AEPGX – EUROPACIFIC GROWTH FUND reveals a strong belief in IHG, holding 4,786K shares that represent 2.91% ownership. Impressively, the fund escalated its stake by 6.84%, marking a robust increase of 25.62% in portfolio allocation over the last quarter.

FIGSX – Fidelity Series International Growth Fund mirrors this optimism, holding 2,561K shares, equivalent to a 1.56% stake in the company. Over the recent quarter, the firm augmented its IHG holding by an impressive 10.05%, illustrating a 15.30% boost in portfolio allocation.

VGTSX – Vanguard Total International Stock Index Fund showcases a slightly different trend, holding 2,273K shares (1.38% ownership). Despite a modest 2.99% decrease in shares from its prior filing, the firm still managed a 3.36% increase in portfolio allocation toward IHG during the last quarter.

CWGIX – CAPITAL WORLD GROWTH & INCOME FUND remains steadfast with 2,250K shares (1.37% ownership), showing no changes in the quarter. Similarly, AMERICAN FUNDS INSURANCE SERIES – Growth-Income Fund Class 1 maintains its stake at 1,397K shares (0.85% ownership), reflecting stability over the last quarter.

Fintel stands out as a premier research platform catering to individual investors, traders, financial advisors, and small hedge funds.

Offering a wealth of global data, including fundamentals, analyst insights, ownership details, fund sentiment, and more, Fintel supports informed investing decisions. Notably, their exclusive stock picks leverage sophisticated, backtested quantitative models for enhanced profitability.

Discover more at Fintel

This insightful piece initially surfaced on Fintel.

The thoughts and perspectives articulated herein represent the author’s opinions and do not necessarily align with those of Nasdaq, Inc.