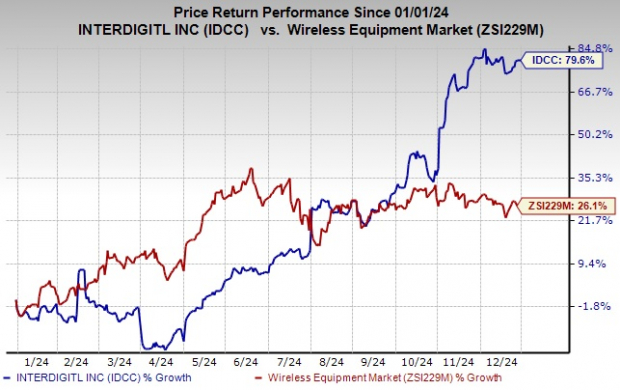

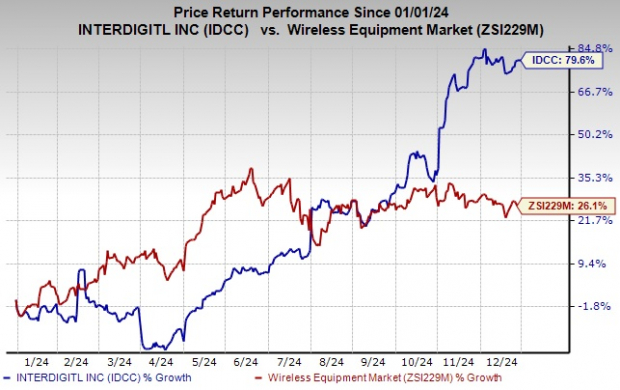

InterDigital’s Stock Soars by 79.6%: A Look into Its Business Model and Future Prospects

Shares of InterDigital, Inc. (IDCC) have surged 79.6% over the past year, fueled by strong market demand and a flexible business model. The company has also shown solid cash flow, which is encouraging for investors. Earnings estimates for the current fiscal year have increased significantly, up by 137.1% year-over-year, indicating promising growth potential.

With its impressive fundamentals, this Zacks Rank #1 (Strong Buy) stock stands out as a strong investment opportunity right now. You can see the complete list of today’s Zacks #1 Rank stocks here.

Image Source: Zacks Investment Research

IDCC’s Resilient Portfolio Drives Growth

InterDigital stands out with its established global presence and diverse product offerings, which are significant contributors to its growth. Beyond wireless technologies, the company is adding capabilities in sensors, user interfaces, and video, enhancing its market presence effectively. Given the expansive market potential for its licensed technologies, this diversification may considerably boost its value.

Notably, InterDigital focuses on licensing its array of technologies to major players in the wireless terminal equipment sector, including giants like Huawei, Samsung, LG, and Apple. Their strategy also includes forming agreements with new clients in handsets and consumer electronics, aiming to widen its reach further.

Looking ahead, InterDigital’s goal is to emerge as a leading designer and innovator in technology solutions for the mobile industry, the Internet of Things, and related fields. By leveraging its research and development strengths and industry expertise, the company is working to expand its licensing revenues and engage new licensees in adjacent tech sectors.

Positive Forecast for InterDigital

For 2024, InterDigital anticipates revenues between $855-$865 million, an increase from the previously estimated $690-$740 million, thanks to recent agreements with Oppo and Lenovo. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) are expected to reach $533-$543 million, a significant rise from earlier projections of $378-$416 million. Additionally, non-GAAP earnings are now forecasted at $14.69-$14.99, compared to last year’s estimate of $9.70-$10.95.

With a VGM Score of B, InterDigital also holds a strong long-term earnings growth expectation of 15%. The company has consistently surpassed earnings expectations, achieving an average surprise of 163.7% across the last four quarters.

Other Promising Stock Picks to Consider

Arista Networks, Inc. (ANET) holds a Zacks Rank #2 (Buy) and is expected to thrive due to strong momentum and diverse product lines. With a focus on software-driven, data-centric solutions, it aids clients in enhancing their cloud experiences, offering a solid growth outlook with an earnings surprise of 14.8% over the past four quarters.

Workday Inc. (WDAY), also with a Zacks Rank #2, specializes in enterprise-level software for human resources and finance management. Workday integrates finance and HR into one cloud system, transforming how businesses access analytical insights.

Qualcomm Incorporated (QCOM), another noteworthy Zacks Rank #2 stock, is well-positioned to achieve long-term targets with a solid 5G foundation and diversified revenue streams. Qualcomm is shifting focus from solely mobile communications to solutions for the intelligent edge.

Zacks Unveils Top 10 Stock Picks for 2025

Ready to discover Zacks’ top 10 picks for 2025?

Historical trends suggest impressive potential returns from these selections.

Since 2012, under the leadership of Sheraz Mian, the Zacks Top 10 Stocks portfolio has returned +2,112.6%, vastly outperforming the S&P 500’s +475.6%. This January 2, Sheraz will reveal the best 10 tickers to buy and hold for 2025. Don’t miss your chance to be a part of this investment strategy.

Be First to New Top 10 Stocks >>

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

To read the original article on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.