Exploring New Options for HPP Investors

Options traders for Hudson Pacific Properties Inc (Symbol: HPP) have new opportunities on the horizon, with the introduction of September 20th expiration contracts this week. These unique contracts, with 217 days until expiration, offer potential advantages for sellers of puts or calls in terms of achieving higher premiums than those with closer expirations. Stock Options Channel has identified one put and one call contract that deserve particular attention from investors.

A Closer Look at the Put and Call Contracts

Let’s delve into what these new options entail. The put contract at the $5.00 strike price is currently bidding at 35 cents. Selling-to-open this put contract commits investors to purchasing the stock at $5.00, while also entitling them to collect the premium. In doing so, the cost basis of the shares would amount to $4.65, serving as an appealing alternative for those eyeing shares of HPP. Furthermore, as the $5.00 strike represents a roughly 30% discount to the current trading price of the stock, there is an 83% chance that the put contract will expire worthless.

If the contract does expire worthless, the premium would yield a 7.00% return on the cash commitment, or 11.78% annualized, a scenario that Stock Options Channel fondly refers to as the YieldBoost.

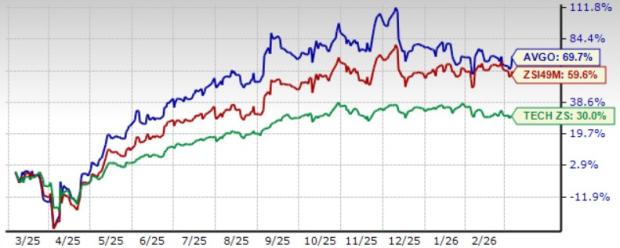

Visualizing the Trading History

Analyzing the historical trading performance of Hudson Pacific Properties Inc over the past twelve months, one can visualize the $5.00 strike in relation to that history. This offers valuable insight into the positioning of the put contract for potential investors.

Assessing the Calls Side

Shifting focus to the calls side of the option chain, the call contract at the $7.50 strike price is currently bidding at $1.10. Investors opting to sell-to-open this call contract as a “covered call” after purchasing shares of HPP stock at the current price level of $7.15/share are committing to sell the stock at $7.50. This strategic move, coupled with collecting the premium, could potentially garner a total return of 20.28% if the stock gets called away at the September 20th expiration.

However, there’s an important consideration. With the $7.50 strike standing as an approximate 5% premium to the current trading price of the stock, there’s a 45% chance that the covered call contract will expire worthless. Should this occur, the premium would provide a 15.38% boost of extra return to the investor, or 25.88% annualized, a phenomenon aptly termed the YieldBoost.

Understanding Implied Volatility

In the put contract example, the implied volatility stands at 83%, while in the call contract example, it is 73%. Meanwhile, the actual trailing twelve month volatility is calculated at 71%. This insight is critical for investors seeking to make informed decisions in the options market.

Exploring Further Options

For a comprehensive look at additional put and call options contract ideas, StockOptionsChannel.com is a valuable resource worth exploring.

Also see:

WAIR YTD Return

USMV YTD Return

Funds Holding ESUS

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.