Strategic Pivot and Business Expansion

International Flavors & Fragrances (IFF) has seized the reins of transformation, opting to divest its Pharma Solutions domain to Roquette for up to $2.85 billion. The decision marks a bold stride in IFF’s strategy playbook, aiming to streamline its operational focus and carve a niche in the competitive marketplace.

Roquette, a distinguished purveyor of plant-based ingredients, emerges as the suitor for IFF’s Pharma Solutions arm, renowned for its prowess in crafting pharmaceutical excipients. Owning an illustrious Global Specialty Solutions division catering to industrial and methyl cellulosic food applications, this segment reflects IFF’s commitment to pushing the boundaries of innovation.

The impending divestiture, set to conclude by the first half of 2025, underscores IFF’s relentless pursuit of portfolio optimization as heralded by its strategic roadmap unveiled back in December 2022. Embracing a forward-looking stance, the company seeks to usher in a customer-centric ethos and equivocally showcase its acumen across core sectors like Food and Beverage, Home and Personal Care, and the burgeoning Health market.

Embracing Change and Reaping Rewards

Foreseeing a landscape ripe for evolution, IFF sees a strategic merit in accentuating investments in high-yield sectors like Cosmetic Ingredients, Fine Fragrance, Flavors, Cultures & Food Enzymes, Health, Food Design, Fragrance Ingredients, and Consumer Fragrance. In a bid to amplify its commitment to these lucrative segments, IFF has already offloaded Microbial Control, parts of the Savory Solutions business, and Flavor Specialty Ingredients domains in recent times.

Furthermore, the company’s decision to offload the Cosmetic Ingredients division to Clariant for a cool $810 million reiterates its focus on honing its core competencies, shoring up its financial fortitude, and enhancing shareholder value. Like a seasoned sailor trimming the sails, IFF steers towards the horizon with a renewed vigor, ready to capitalize on emergent opportunities.

Stock Performance and Outlook

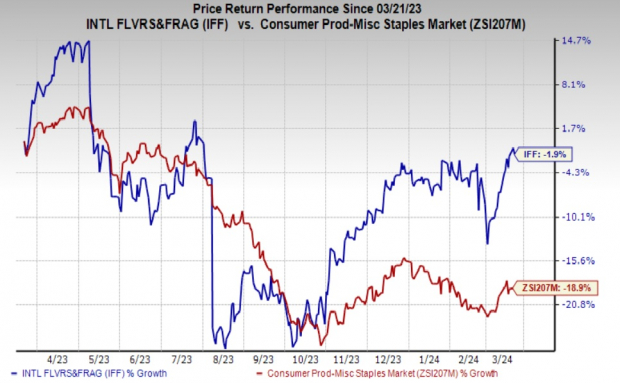

In the realm of financial vicissitudes, IFF’s stock has weathered the storm, dipping a modest 1.9% in the past year against the backdrop of the industry’s broader 18.9% decline. This nuanced stock performance underscores IFF’s resilience and ability to navigate the tumultuous waters of market dynamics.

Amidst the ebb and flow of market ebullience, it’s critical to note that International Flavors currently sports a Zacks Rank #4 (Sell). However, brighter prospects gleam on the horizon. Pilgrim’s Pride (PPC), Vital Farms (VITL), and e.l.f. Beauty, Inc. (ELF) figure as stalwart performers in the Consumer Staples universe, with PPC commanding a Zacks Rank #1 (Strong Buy), and VITL and ELF bagging a Zacks Rank #2 (Buy).

With an eye on future growth, IFF’s divestiture of its Pharma Solutions segment sets the stage for a transformative journey. As IFF redoubles its focus on strategic core markets, investors keen on futuristic growth trajectories may find solace in the company’s purposeful realignment.