A Whiff of Change

International Flavors & Fragrances (IFF) recently completed the sale of its Cosmetic Ingredients business to Clariant, parting ways with brands like Lucas Meyers Cosmetics and IBR. This strategic move is just one in a series of measures aimed at optimizing the company’s portfolio for enhanced efficiency and growth.

Striking a New Tune

Back in December 2022, IFF unveiled a fresh strategic and financial vision, highlighting a shift towards a more focused growth strategy, improved cost efficiencies, and a revamped operational structure. By aligning itself more closely with its customers and market demands, IFF hopes to operate more effectively in its core end markets: Food and Beverage, Home and Personal Care, and Health.

A New Flavor Profile

Looking ahead, IFF is doubling down on investments in lucrative sectors like Flavors, Fragrances, Health, Cultures, and Food Enzymes. Shedding assets such as Microbial Control, parts of Savory Solutions, and Flavor Specialty Ingredients, the company is clearing the path for a more refined and agile business model.

Expanding Horizons

Continuing on this trajectory, IFF recently announced the impending sale of its Pharma Solutions business to Roquette for up to $2.85 billion. This unit, which comprises pharmaceutical excipients and specialty solutions for various applications, is projected to close in the first half of 2025, subject to customary conditions.

Embracing Transformation

These strategic moves are designed to refocus IFF on its core competencies, fortify its financial standing, and ultimately, deliver greater value to its shareholders.

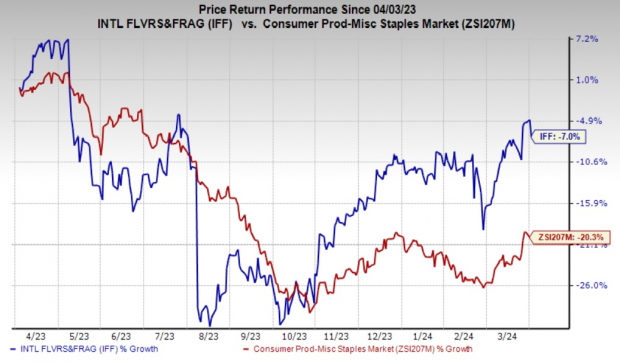

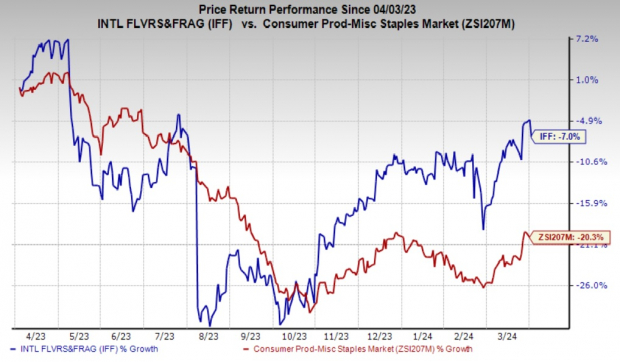

Price Performance

In the past year, IFF has faced headwinds, with its shares declining by 7% compared to the broader industry’s 20.3% slump.

Image Source: Zacks Investment Research

Insights and Projections

Currently sporting a Zacks Rank #4 (Sell), International Flavors faces challenges but remains an intriguing player in the Consumer Staples sector. For investors seeking alternatives, stocks like Pilgrim’s Pride (PPC), Vital Farms (VITL), and e.l.f. Beauty Inc. (ELF) offer compelling opportunities, with PPC earning a Zacks Rank #1 (Strong Buy) and VITL and ELF securing a Zacks Rank #2 (Buy).

Looking at growth prospects, Pilgrim’s Pride anticipates a significant uptick in fiscal 2024 earnings, supported by a robust 20% increase in earnings estimates over the last 60 days. Vital Farms and e.l.f. Beauty are also poised for growth, with strong earnings surprises and positive projections driving investor interest.

Despite its challenges, IFF remains a key player in the evolving consumer goods landscape, with strategic divestitures and recalibrations paving the way for a more focused and agile future.

Zacks Names #1 Semiconductor Stock

Curious about the next big trend in semiconductors? Don’t miss this opportunity to explore a stock poised for growth amidst a rapidly expanding market. Embrace the future with confidence!

Ready to learn more? Discover this Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Download the report on the 7 Best Stocks for the Next 30 Days here.

Read the original article on Zacks.com here.

International Flavors & Fragrances Inc. (IFF): Free Stock Analysis Report

Pilgrim’s Pride Corporation (PPC): Free Stock Analysis Report