New Yeti Options Trading Offers Strategic Opportunities for Investors

Investors in Yeti Holdings Inc (Symbol: YETI) have new options available for trading as of this week, with an expiration date set for April 17th. At Stock Options Channel, our YieldBoost formula has analyzed the new April 17th contracts, highlighting a specific put and call contract of interest.

Put Option Insight at $32.50 Strike Price

The put contract with a $32.50 strike price currently has a bid of $1.05. If an investor sells to open that put contract, they agree to purchase the stock at $32.50 while also collecting a premium. This action lowers the effective cost basis of the shares to $31.45 (excluding broker commissions), providing a potentially favorable alternative for those looking to buy shares of YETI at today’s price of $33.94.

This $32.50 strike represents a nearly 4% discount to the current trading price, suggesting that it is out-of-the-money by that percentage. Analytical data indicates a 66% likelihood that the put contract could expire worthless. Stock Options Channel will monitor these odds over time and publish trends on our website under this contract’s detail page. Should the contract expire worthless, the premium would yield a 3.23% return on cash commitment, or an annualized return of 27.45%, known as YieldBoost.

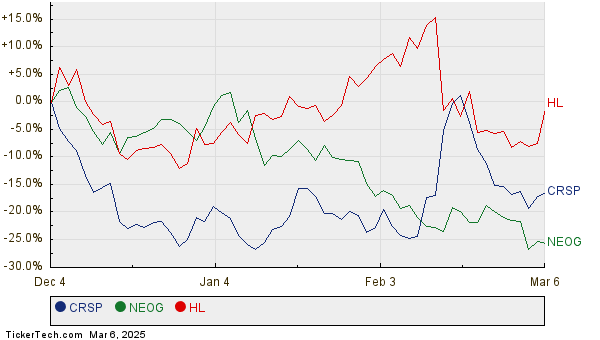

Visualizing Yeti’s Trading History

Below is a chart showing Yeti Holdings Inc’s trailing twelve-month trading history, with the $32.50 strike mark indicated in green:

Opportunities with Call Options at $35.00 Strike Price

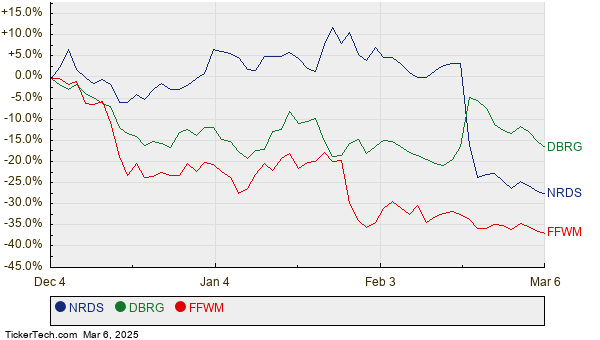

On the calls side, a contract priced at a $35.00 strike has a current bid of $1.35. An investor buying shares of YETI at the current level of $33.94 and subsequently selling to open this call contract as a “covered call” would be committed to selling the stock at $35.00. Including the premium from the call, this strategy could yield a total return of 7.10% if the stock is called away at expiration (excluding any dividends and broker commissions). However, substantial upside could remain if YETI shares surge, emphasizing the importance of analyzing both recent trading history and the company’s fundamentals.

The chart below displays Yeti’s trailing twelve-month trading history with the $35.00 strike highlighted in red:

This $35.00 strike reflects roughly a 3% premium over the current trading price, meaning it is also out-of-the-money. There exists the possibility that this covered call contract could expire worthless, allowing the investor to retain both their shares and the premium. Current analytical metrics indicate a 55% probability of this outcome. Stock Options Channel will track these odds and present a historical data chart on our website. If the contract expires worthless, the collected premium would represent a 3.98% extra return for the investor, or an annualized 33.80%, referred to as YieldBoost.

Volatility and Market Context

The implied volatility for both the put and call contracts stands at approximately 40%. In comparison, the actual trailing twelve-month volatility calculated from the last 250 trading days and today’s price of $33.94 is 39%. For additional put and call options strategies worth considering, please visit StockOptionsChannel.com.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

Also see:

- VAXX Stock Predictions

- KNSA Average Annual Return

- Funds Holding CSJ

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.