Cerebras Takes Aim at Nvidia: A New Era for AI Chips?

The artificial intelligence chipmaker Nvidia (NASDAQ: NVDA) has amassed close to a $3.2 trillion market cap, making it one of the largest chipmakers in the world. This growth reflects its influence, as it now makes up more than 6% of the broader S&P 500 index. Over the past five years, Nvidia has seen its annual revenues soar by 458%, with stock prices skyrocketing a remarkable 2,009%. Given the transformative potential of AI, it’s no wonder that investors are buzzing about Nvidia’s success.

However, such impressive gains inevitably draw competitors. One rising contender is gearing up for an initial public offering (IPO) with claims of producing chips that could outperform Nvidia’s at lower costs. Let’s delve into this emerging player.

Cerebras: Claiming to be 20x Faster?

Last week, the AI chipmaker Cerebras submitted its registration statement to the Securities and Exchange Commission (SEC) for a public offering. In a press release from 2021, Cerebras indicated a valuation of $4 billion following a $250 million series F financing round. The company is now seeking to go public with a target of $1 billion and a valuation estimated between $7 billion to $8 billion.

In its filing, Cerebras cites Nvidia as a key competitor, along with major AI firms such as Advanced Micro Devices, Intel, Microsoft, and Alphabet. Here’s a brief look at what Cerebras aims to achieve:

We design processors for AI training and inference. We build AI systems to power, cool, and feed the processors data. We develop software to link these systems into industry-leading supercomputers, simplifying complex AI tasks using well-known ML frameworks like PyTorch. Our clients utilize these supercomputers to train leading-edge models and leverage them to achieve speeds that alternative technologies cannot match.

Cerebras’s strategy emphasizes scale, as they have created a chip the size of an entire silicon wafer—marking the largest ever sold. They argue that this size enables more efficient data handling. Additionally, Cerebras offers a flexible model where customers can either purchase their hardware or access it via a subscription through their cloud service.

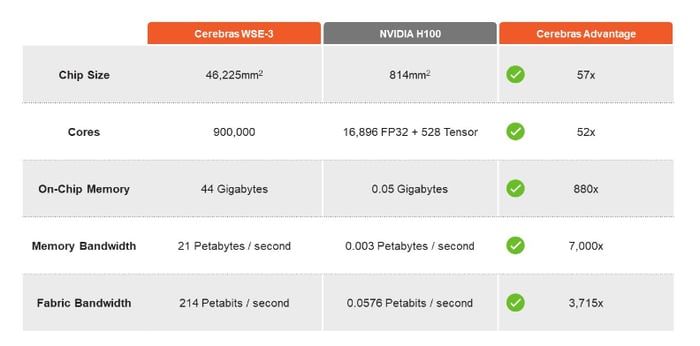

The company draws a direct comparison to Nvidia, mentioning it 12 times in the registration statement. Cerebras even includes a side-by-side comparison of its Wafer-Scale Engine-3 chip with Nvidia’s H100 graphics processing unit (GPU), recognized as the most powerful GPU in the market today.

Image source: Cerebras registration statement.

Cerebras CEO Andrew Feldman has stated that the company’s inference technology is 20 times faster than Nvidia’s, at a significantly lower price point. In 2023, Cerebras generated revenue of approximately $78.7 million, marking a year-over-year increase of 220%. Revenues surged to $136.4 million in the first half of 2024. Despite this growth, Cerebras has yet to turn a profit, with a loss of nearly $67 million reported in the same period. By contrast, Nvidia recently posted second-quarter revenue of $30 billion and a profit of about $16.6 billion.

Can Cerebras Compete with Nvidia?

With media attention highlighting its claims of speed and efficiency, Cerebras is certainly making waves in the market. The success of its IPO will largely depend on the enthusiasm investment bankers can generate during the roadshow and the overall market climate. Given the buzz surrounding AI and the relatively flat IPO landscape of recent years, Wall Street may be poised for significant interest.

Whether Cerebras can surpass Nvidia remains to be seen. Their offerings are robust, but they still need to align their financials more closely with Nvidia’s. Moreover, Nvidia has the advantage of established relationships with numerous significant clients and a dominant market share in the AI chip sector. The future will reveal if Cerebras can genuinely challenge Nvidia, especially regarding software compatibility with Nvidia’s CUDA, though Cerebras asserts its software removes the need for low-level programming in CUDA.

While Cerebras touts impressive capabilities, its revenue stream heavily relies on a single customer. In contrast, Nvidia’s expansive footprint in the AI chip market equips it with the resources necessary to adapt swiftly. Many questions remain, but this unfolding narrative promises to captivate market analysts.

Seize What Could Be a Lucrative Opportunity

If you thought you missed your chance to invest in top-performing stocks, you might want to reconsider.

Occasionally, our expert team identifies a “Double Down” stock—a recommendation for companies believed to be on the verge of significant growth. If you’re concerned you’ve lost your opportunity, now could be the right moment to invest before it slips away. Consider the following results:

- Amazon: An investment of $1,000 when we made our recommendation in 2010 would now be worth $21,266!*

- Apple: Similarly, a $1,000 investment from 2008 has turned into $43,047!*

- Netflix: Investing $1,000 in 2004 would see you with $389,794 today!*

Currently, we are issuing “Double Down” alerts for three remarkable companies, offering a rare opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.