Shares of Intuitive Surgical ISRG scaled a new 52-week high of $408.39 on May 22, 2024, before closing the session at $400.90.

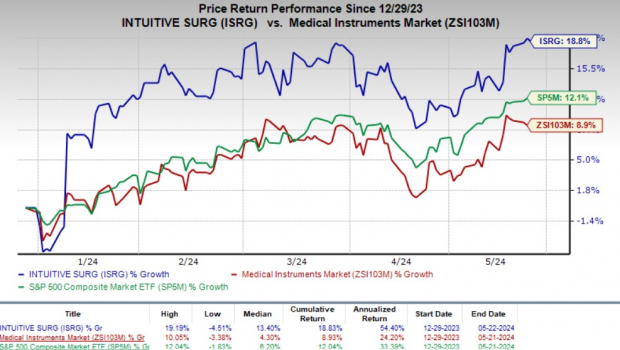

This Zacks Rank #3 (Hold) company’s shares have risen 18.8% year to date compared with 8.9% growth of the industry. The S&P 500 composite rose 12.1% during the same time frame.

Over the past five years, the company’s earnings increased at a CAGR of 6.5% compared with the industry’s 9.9% growth. The company’s long-term growth rate of 16.1% compares with the industry’s 22.5%. Intuitive Surgical’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 6.78%.

ISRG is witnessing an upward trend in its stock price, prompted by the continued growth in its da Vinci procedure volume, coupled with strong Ion procedure growth. The company’s initiative to increase the pricing of procedures should also continue to aid sales growth in 2024. Improving procedure volume, along with better system placements and services across all markets, should also drive top-line growth. However, ongoing supply-chain constraints, although easing, are likely to hurt the availability of devices.

Image Source: Zacks Investment Research

Let’s delve deeper.

Key Growth Drivers

Strength in Robotics: We are upbeat about Intuitive Surgical’s robot-based da Vinci surgical system, which enables minimally invasive surgery and reduces the trauma associated with open surgery. The da Vinci System is powered by robotic technology that has provided the company with solid exposure to medical mechatronics, robotics and AI for the healthcare space. ISRG gained FDA clearance for its da Vinci 5 fifth-generation multiport robotic system earlier this month. The system is believed to be the smoothest and the most accurate device in the company’s portfolio.

On its first-quarter 2024earnings call ISRG stated that its installed base of the da Vinci system grew approximately 14% year over year. The utilization of clinical systems in the field, measured by procedures per system, was up 2% from the prior-year quarter’s level.

Progress on the AI Front: We are also positive about the growing adoption of minimally invasive robot-assisted surgeries, self-automated home-based care, the use of information technology for quick and improved patient care, and the shift of the payment system to a value-based model. These developments indicate the high prevalence of AI in the MedTech space.

Per management, the rise of medical mechatronics, powerful computing, improved sensing, microfabrication and molecular imaging has provided new solutions to old problems. AI has been enhancing Intuitive Surgical’s product portfolio with clinical applications, diagnostic support, operational efficiency, electronic health record systems, practice workflows and supply-chain management.

Strong Q1 Results: ISRG’s solid first-quarter results also buoy optimism. Revenues were primarily driven by continued growth in the company’s da Vinci procedure volume. Intuitive Surgical has been raising the price of procedures to fight inflationary pressure, which also aided sales growth.Meanwhile, the absence of any significant disruptions from COVID during the first quarter aided results and may continue to boost procedure growth going forward.The gross and operating margins also improved. The declining trend in operating expenses is likely to continue in 2024 as well.

Downsides

Supply Constraints Hurting Performance: Intuitive Surgical has been facing supply constraints for several instruments, leading to a loss of sales as the company failed to meet demand. The ongoing geopolitical tensions with no resolution in the picture indicate that supply-chain issues are likely to persist, thereby continuing to hurt sales.

The company expects da Vinci 5 system placements to be choppy in 2024 due to constrained supply, thereby hurting growth prospects for the device. Customers may delay orders and wait for adequate supply before buying the fifth-generation da Vinci 5. Although the extension of catheter life for the Ion modulation system should boost supply, catheter supply is likely to remain challenging.

Intuitive Surgical, Inc. Price

Intuitive Surgical, Inc. price | Intuitive Surgical, Inc. Quote

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Medpace MEDP and Align Technology ALGN.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 13.6%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 29.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have risen 33.4% compared with the industry’s 11.2% growth year to date.

Medpace, sporting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 17.9%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 12.8%.

Medpace’s shares have risen 28.3% year to date compared with the industry’s 4.9% growth.

Align Technology, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 6.9%. Its earnings surpassed estimates in three of the trailing four quarters and missed the same in one, delivering an average surprise of 5.9%.

ALGN’s shares have lost 0.9% year to date against the industry’s 2.8% growth.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.