New Options Unveiled for Intuitive Surgical: What’s Worth Watching

Investors looking at Intuitive Surgical Inc (Symbol: ISRG) have fresh options available today with an expiration date of March 7th. At Stock Options Channel, our YieldBoost analysis has explored the ISRG options chain to pinpoint noteworthy put and call contracts.

Put Options: A Strategic Move at $600.00 Strike Price

The put contract with a $600.00 strike price comes with a current bid of $16.50. If an investor opts to sell-to-open this put, they would agree to buy the stock at $600.00. However, by collecting the premium, their effective cost per share would drop to $583.50 (excluding broker fees). For those considering buying ISRG shares, this method offers a potentially appealing alternative to today’s price of $603.90/share.

Given that the $600.00 strike is about 1% below the current trading price, the probability that this put option expires worthless stands at approximately 59%. Stock Options Channel will continuously monitor these odds, publishing updated data on our website. If the contract does expire worthless, the premium earned translates to a 2.75% return on the cash commitment, or an annualized return of 23.34%, a concept we refer to as YieldBoost.

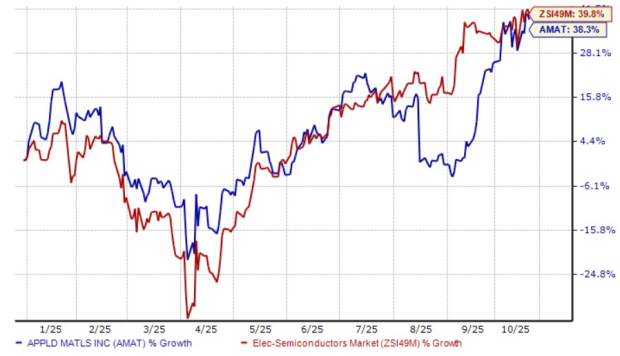

The chart below illustrates the past twelve months of trading for Intuitive Surgical, highlighting where the $600.00 strike sits within this historical context:

Call Options: Opportunities at a $620.00 Strike Price

On the call side, the contract priced at a $620.00 strike currently holds a bid of $16.70. If an investor purchases ISRG shares at the current price of $603.90/share and simultaneously sells the call contract as a “covered call,” they commit to selling the stock at $620.00. By accounting for the premium collected, this results in a potential total return of 5.43%, should the stock be called at the March 7th expiration (excluding any dividends and broker fees). However, if the stock rises significantly, the investor may miss out on further gains. Therefore, reviewing both the trading history and the fundamental health of Intuitive Surgical is crucial.

Below, the following chart depicts ISRG’s trading history over the past year, with the $620.00 strike highlighted in red:

The $620.00 strike is roughly 3% above the current trading price, which means the covered call could also expire worthless. In such a scenario, investors would retain both the shares and the received premium. Current analytics indicate that the chance of this happening is about 55%. As with the put option, Stock Options Channel will keep track of these metrics over time, publishing the data on our site. If the covered call expires without being exercised, it would yield an additional 2.77% return for investors, or 23.47% annualized — another YieldBoost.

The implied volatility for the put contract is at 28%, while the call contract’s implied volatility stands at 29%. In comparison, the actual trailing twelve-month volatility (reflecting the last 250 trading days and today’s price of $603.90) is calculated to be 25%. For more insights into additional put and call options, visit StockOptionsChannel.com.

![]() Explore the Top YieldBoost Calls of the Nasdaq 100 »

Explore the Top YieldBoost Calls of the Nasdaq 100 »

Also see:

- ZVO shares outstanding history

- RASF Insider Buying

- Autodesk MACD

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.