Intuit’s Upcoming Earnings Report: Key Financial Projections Revealed

According to Next earnings Date.com, Intuit (NASDAQ: INTU) is set to report earnings on May 22 after market close. Analysts predict earnings of $10.90 per share with expected revenue of $7.56 billion. A look at Intuit’s recent earnings history shows the following:

| Period | Earnings Date | Earnings |

|---|---|---|

| Q2 2025 | 2/25/2025 | 3.320 |

| Q1 2025 | 11/21/2024 | 2.500 |

| Q4 2024 | 8/22/2024 | 1.990 |

| Q3 2024 | 5/23/2024 | 9.880 |

| Q2 2024 | 2/22/2024 | 2.630 |

Intuit has demonstrated solid long-term earnings per share growth, indicated in its detailed earnings chart:

earnings-history-chart.png”>

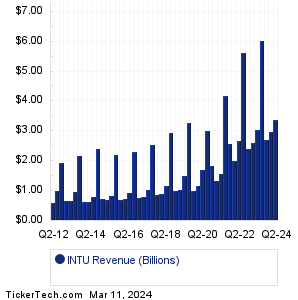

Revenue growth has been similarly robust, as illustrated in this revenue history chart:

However, earnings reports can introduce significant volatility in stocks as investors react to new data. This fluctuation is often of great interest to options traders, particularly given that Intuit has options available that expire on May 23.

Intuit’s current dividend yield stands at 0.63%. Dividend investors should review Intuit’s dividend history for insights and potential opportunities.

Related Insights:

• GALT market cap history

• GRCE historical stock prices

• AGGR shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.