Invesco Ltd. Sees Mixed Performance Amid Competitive Pressures

Valued at a market cap of $8.2 billion, Invesco Ltd. (IVZ) stands as a notable player in the investment management sector, providing a variety of investment products and services. Based in Atlanta, Georgia, the firm manages tailored equity and fixed-income portfolios, alongside offering mutual funds spanning equity, fixed-income, commodity, multi-asset, and balanced categories.

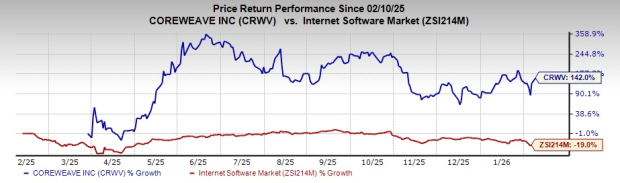

Comparative Market Performance Reveals Challenges

Over the past 52 weeks, Invesco’s stock has struggled to match broader market gains. The company’s shares have risen by 16.2%, while the S&P 500 Index ($SPX) has jumped 21.8%. Year-to-date, however, IVZ has outperformed the SPX with a gain of 5.2% compared to the index’s 2.7% increase.

Competition Intensifies Amid Vanguard’s Fee Cuts

Invesco’s performance contrasted sharply with the Financial Select Sector SPDR Fund’s (XLF) 31.2% return over the same period. On February 3, the stock fell 4.6% after Vanguard Group announced fee reductions for several mutual funds and ETFs, increasing competitive pressure across the asset management landscape, impacting major firms like BlackRock (BLK) and State Street (STT).

Strong Fourth Quarter Results Drive Stock Increase

Conversely, on January 28, Invesco’s shares surged nearly 9% after the release of its fourth-quarter and fiscal 2024 earnings. The company posted adjusted earnings of $0.52 per share and adjusted revenues totaling $1.2 billion—aligning with analysts’ expectations. This performance was bolstered by a year-over-year revenue and earnings increase of 10.6%, stemming from slightly reduced expenses, robust asset growth, and heightened performance fees. Notably, total Assets Under Management (AUM) grew 2.8% quarter-over-quarter and 16% year-over-year to $1.85 trillion, culminating in a $26 billion rise in AUM during the quarter.

Future Growth Projections and Analyst Ratings

For the current fiscal year ending in December 2025, analysts anticipate that IVZ’s earnings per share (EPS) will increase by 8.2% year-over-year to reach $1.85. The company’s recent earnings history has been somewhat mixed; it exceeded or met Wall Street estimates in three out of the last four quarters, while it fell short on one occasion.

As for current analyst sentiment, among the 18 analysts covering Invesco, the consensus rating is a “Hold,” consisting of two “Strong Buy,” 15 “Hold,” and one “Strong Sell” rating.

UBS Group Sets Price Target for IVZ

On February 4, UBS Group affirmed a “Neutral” rating on IVZ, upping its price target to $21, which suggests a potential upside of 14.2% from current levels. The mean price target of $19.72 signals a 7.2% increase, while the highest target of $22 indicates a promising 19.6% upside.

On the date of publication, Neharika Jain did not hold any direct or indirect positions in the securities discussed in this article. All information and data are intended solely for informational purposes. For more, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.