Nasdaq Declines Over 13%, Alphabet Emerges as a Strong Investment

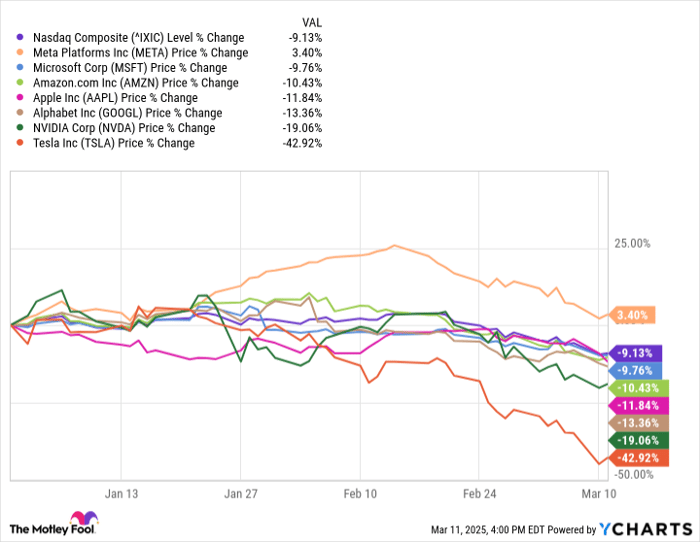

Less than three months ago, the Nasdaq Composite reached an all-time high, continuing a significant upward trend established over the past two years. However, the index has since dropped over 13%, with a notable 9% decline occurring this year alone, signaling a correction phase as of March 11.

Reflecting the index’s trend, many major tech stocks have experienced similar outcomes this year. Notably, among the “Magnificent Seven” stocks, only Meta Platforms has remained in positive territory so far this year.

Where to invest $1,000 right now? Our analyst team has released their recommendations for the 10 best stocks to buy now. Learn More »

^IXIC data by YCharts

Many companies involved in artificial intelligence (AI) saw considerable growth in the last couple of years, but the recent Nasdaq correction has impacted some of these stocks significantly. Amid this volatility, one lesser-known AI stock has shown resilience and could offer promising returns during this downturn: Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL).

Alphabet is at the Forefront of AI Innovation

Alphabet has been a leader in AI advancements, with its research company, DeepMind, focusing on developing sophisticated AI models, machine learning algorithms, deep learning frameworks, and reinforcement learning systems. Although DeepMind doesn’t receive as much public attention as other Alphabet entities, its contributions to AI innovations, such as the Gemini model, have been significant.

Having established itself as a pioneer in AI, Alphabet benefits from in-house research and development, positioning itself ahead of rival tech companies that are still constructing their AI frameworks or relying on external models, such as those from OpenAI.

In 2024, Alphabet allocated $52 billion towards capital expenditures, and the projection for this year is approximately $75 billion. Considering the central role of AI initiatives in Alphabet’s growth strategy, it is reasonable to assume that a substantial portion of this budget will support AI-driven projects. While increased spending doesn’t ensure success, it reflects the company’s commitment to investing in its most promising segments.

If Alphabet reaches its planned spending of $75 billion, it would represent a more than 130% increase compared to 2023.

GOOGL Capital Expenditures (Annual) data by YCharts

Google Cloud’s Growth Trajectory

The cloud computing sector is a high-growth area for many large tech firms, including Alphabet. The Google Cloud platform, while trailing behind Amazon Web Services (AWS) and Microsoft Azure in market share, has seen its share double in the past seven years to 12%, leading its closest competitor, Alibaba Cloud.

For the fourth quarter (Q4), Google Cloud reported $12 billion in revenue, reflecting a 30% year-over-year increase. Alphabet’s CEO, Sundar Pichai, indicated that demand for the AI-enhanced Google Cloud platform continues to strengthen, contributing to its financial growth.

While Google advertising will remain a primary revenue source for Alphabet, Google Cloud is beginning to contribute significantly to the company’s overall financial health. In Q4, Google Cloud represented 12% of Alphabet’s total revenue of $96.5 billion, up from about 5% just five years prior.

GOOGL Revenue (Quarterly) data by YCharts

Alphabet Appears to be a Bargain

Just a few months ago, Alphabet’s stock traded at nearly 34 times its earnings. While this was not as high as some other Magnificent Seven stocks, it certainly wasn’t a bargain either. Following the recent market declines, Alphabet’s stock has now entered a more attractive price range, trading at just over 20 times its earnings, significantly lower than its previous average.

GOOGL PE Ratio (Annual) data by YCharts

Investing in high-growth stocks carries inherent risks, particularly with volatile tech companies like Alphabet. Nevertheless, current prices present a lower risk than what was available just a couple of months ago. Future price movements remain uncertain, and for those interested in Alphabet, now could be an opportune moment to start purchasing shares. To mitigate the effects of potential further declines, consider dollar-cost averaging by spreading out the timing of your investments.

Seize Your Second Chance at a Potentially Lucrative Investment

Do you ever feel like you missed the opportunity to invest in the best-performing stocks? If so, you won’t want to miss this chance. Our expert analysts occasionally provide a “Double Down” Stock recommendation for companies poised for significant growth. If you’re concerned about having missed your chance, now may be the perfect time to invest before opportunities evaporate. The statistics speak volumes:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $315,521!*

- Apple: If you invested $1,000 while we doubled down in 2008, you’d have $40,476!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $495,070!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, making now an ideal time to act.

Continue »

*Stock Advisor returns as of March 14, 2025.

John Mackey, former CEO of Whole Foods Market and an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook, is also a board member at The Motley Fool. Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board, along with Stefon Walters, who has investments in Alibaba Group, Apple, and Microsoft. The Motley Fool recommends a position in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla, as well as options on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.