“`html

Market participants are anticipating a potential 25 basis-point interest rate cut by the Federal Reserve in its September FOMC meeting, with the CME FedWatch indicating an 87.3% probability of this move. Additionally, there is a 64% chance of a total 50 basis-point cut by year-end, as the current Fed Fund rate stands at 4.25-4.5%.

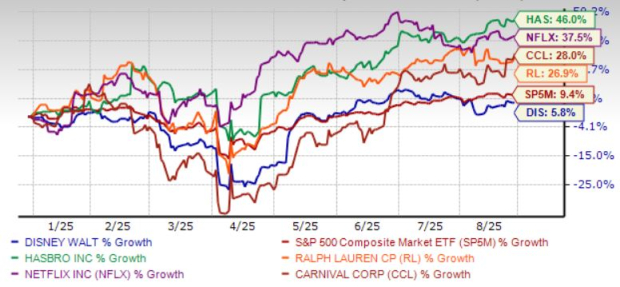

Key consumer discretionary stocks benefiting from this low-rate environment include Netflix Inc. (NFLX), The Walt Disney Co. (DIS), Carnival Corporation (CCL), Ralph Lauren Corp. (RL), and Hasbro Inc. (HAS), all holding a Zacks Rank #2 (Buy). NFLX has raised its revenue forecast to $44.8-$45.2 billion for 2025, while DIS expects a 18% increase in adjusted EPS for 2025. CCL has boosted its full-year guidance due to strong booking trends and higher onboard spending.

Ralph Lauren anticipates revenue growth of 6% with an earnings growth rate of 19.8% for the current year, while Hasbro expects a 6.6% revenue increase with a 21.5% growth in earnings. Overall, the low-interest-rate scenario is projected to enhance investment in growth sectors.

“`