U.S. stock markets experienced significant volatility in the first half of 2025, attributed to global tariffs imposed by the Trump administration, concerns over rising inflation, and fears of a pending recession. Recent positive economic data and easing inflation have led Wall Street to rebound, although uncertainties remain due to unresolved trade agreements with China and ongoing geopolitical tensions in the Middle East and Eastern Europe.

In response, investment in defensive consumer staples stocks is advised for stability. Key recommendations include:

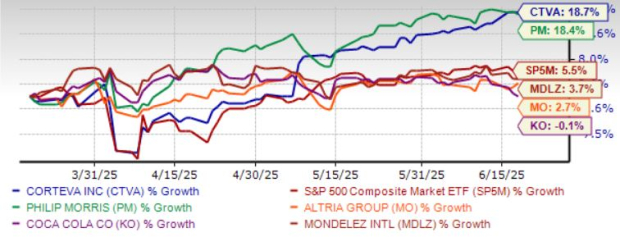

- Philip Morris International Inc. (PM): Expected revenue growth of 8.1% and earnings growth of 13.7%; current dividend yield of 2.94%.

- The Coca-Cola Co. (KO): Revenue growth of 2.5% and earnings growth of 3.1%; current dividend yield of 2.93%.

- Mondelez International Inc. (MDLZ): Revenue growth of 5.3%, earnings decline of -10.1%; current dividend yield of 2.83%.

- Altria Group Inc. (MO): Revenue decline of -1.4% but an earnings increase of 5.3%; current dividend yield of 6.92%.

- Corteva Inc. (CTVA): Revenue growth of 2.5% and earnings growth of 16.3%; current dividend yield of 0.92%.