“`html

The artificial intelligence (AI) sector, which has seen significant momentum during 2023 and 2024, faced various challenges in 2025, including U.S. trade policies, Federal Reserve uncertainty on rate cuts, recession fears, and competition from low-cost Chinese AI platforms. Despite this, the market has shown signs of recovery, bolstered by expectations of a U.S.-China trade deal.

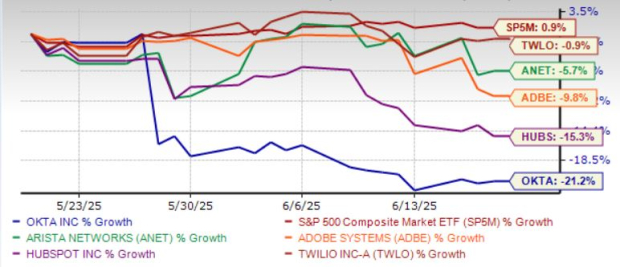

Several large-cap AI stocks reported negative returns last month, but select stocks present favorable short-term opportunities. Notably, Arista Networks Inc. (ANET), HubSpot Inc. (HUBS), Twilio Inc. (TWLO), Adobe Inc. (ADBE), and Okta Inc. (OKTA) have been identified as promising investments with Zacks Rank scores of 1 (Strong Buy) or 2 (Buy). ANET, for example, has a targeted price increase of up to 44% from its last closing price of $90.24.

Despite some setbacks, stocks like HubSpot and Twilio are projected to have substantial price increases to $645-$930 and $75-$170, respectively, indicating growth potential of 37.5% and 10.8%. Adobe and Okta also exhibit strong future price targets of 29.7% and 26.2% upside from their current prices of $378.04 and $99.

“`