“`html

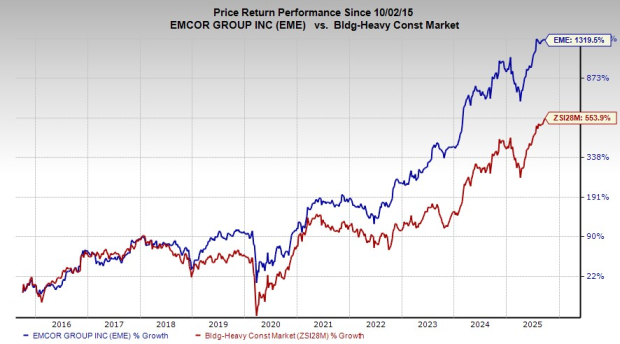

EMCOR Group, Inc. (EME) has seen a significant rise in revenue due to the AI hyperscale data center spending boom, which is projected to reach approximately $400 billion in capital expenditure by 2025. The company’s stock has increased by 820% over the past five years and is expected to grow its earnings per share (EPS) by 17% in 2025 and 8% in the following year.

Global data center infrastructure spending is anticipated to hit $7 trillion by 2030, while U.S. electricity demand is forecasted to grow by 75% by 2050. EMCOR is well-positioned in the electrical construction and energy infrastructure sector, aiming to double its sales from $8.80 billion to $17.60 billion between 2020 and 2026.

Despite a slowdown in year-over-year growth expected for 2026, EMCOR’s EPS is projected to quadruple, rising from $6.41 per share in 2020 to $27 per share in 2026. The company currently trades at around 23.6X forward earnings, consistent with its industry and the S&P 500.

“`