Intuit Inc. (Ticker: INTU) has seen its stock drop 12% after reaching recent highs in late July. The decline presents an opportunity for investors to purchase shares ahead of fiscal Q4 2025 earnings, which are scheduled for release on August 21.

The company, known for its TurboTax software, has averaged 16% revenue growth over the past decade. It is projected to increase its sales by 15% in FY25 and achieve approximately $20.94 billion in revenue, marking a significant rise from $16.29 billion last year. Intuit’s AI-driven TurboTax Live service reported a 47% sales surge to $2 billion last quarter.

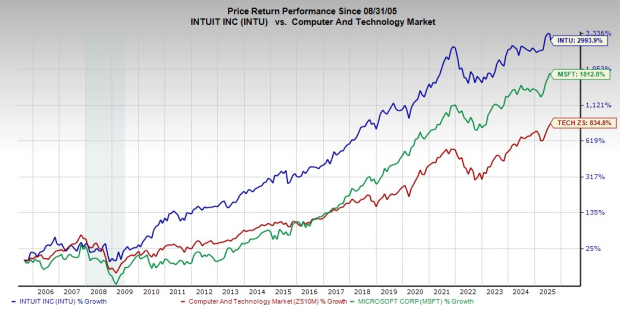

Despite a recent tumble following peaks earlier this summer, Intuit’s stock has increased roughly 3,000% over the past 20 years, significantly outperforming the tech sector’s 834% growth. The stock currently trades at a discount to its 10-year median valuation.