Microsoft Corp. (MSFT) reported exceptional fourth-quarter fiscal 2025 results, exceeding the Zacks Consensus Estimate across all key metrics. Revenue from Productivity and Business Processes grew significantly due to strong Office 365 Commercial demand, while its Azure cloud platform surpassed $75 billion in annual revenues with a 34% growth rate. Microsoft also recorded over 100 million monthly active users on its AI Copilot products, demonstrating robust monetization of its AI investments.

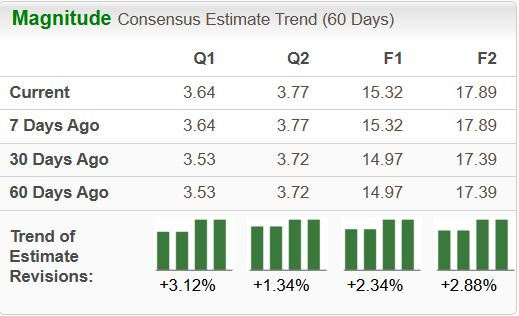

For first-quarter fiscal 2026, the Zacks Consensus Estimate shows projected revenues of $75.38 billion (up 14.9% year over year) and EPS of $3.64 (up 10.3%). For fiscal 2026, projected revenues are estimated at $320.3 billion and EPS of $15.32, indicating growth rates of 13.7% and 12.3% year over year, respectively. Azure currently holds approximately 20-24% of the global cloud market share, second only to Amazon’s 31%.

Brokerage firms’ average short-term price target for MSFT suggests a potential increase of 17.6% from its last closing price of $529.24, with a maximum upside of 28.1%. Year to date, MSFT’s stock price has climbed 25.5%, reflecting investor confidence in Microsoft’s ability to capture market growth in cloud and AI sectors.