Internet Software & Services Industry Outlook: Resilience Amid Economic Slowdown

The Internet-Software & Services industry currently faces challenges stemming from a slow economy. Traditionally sensitive to economic shifts, the industry’s forecasts have fluctuated throughout the past year as interest rate projections changed. Many companies are focused on cutting costs, with operating expenses decreasing to maintain profitability despite lower revenue. Investment in capital projects is being restrained, unless by certain key players.

In this environment, companies such as RingCentral (RNG) and Criteo (CRTO) are distinguishing themselves for several reasons. They are effectively leveraging artificial intelligence (AI), which supports revenue growth and mitigates the effects of the current economic downturn. Furthermore, they have successfully established systems for client retention through subscription models and various platforms.

As a crucial component of the digital economy, it is difficult to envision the long-term decline of this industry. Its diversity creates complexities; however, recent months have shown an upward trend in industry valuations.

Overview of the Industry

The Internet Software & Services industry is relatively compact, primarily focusing on facilitating platforms, networks, and services for online enterprises while enhancing customer interaction with Internet-based services.

Key Themes Influencing the Industry

- Technology Adoption: The growth of businesses in this sector heavily relies on technology uptake. Companies that have established their platforms are now advancing the use of AI, while others strive to keep pace to remain competitive. This push for modernization is accelerating technology adoption, particularly for data collection and analysis, whether on-premise or in the cloud. The emergence of numerous cloud-first companies is driving a consistent demand for Internet-delivered software and services.

- Economic Conditions: Despite recent rate cuts, the economy continues to decelerate, posing challenges for an industry that prospers during strong economic conditions. An economic slowdown typically results in customers opting to purchase fewer software and services. Additionally, geopolitical tensions, particularly in Europe and the Middle East, are impacting oil prices and supply chains, contributing to economic uncertainty. Consequently, the outlook for 2025 is still not very clear.

- Volatile Markets and Stability Preferences: The current political climate significantly affects the performance of individual companies within the industry. Serving a diverse array of markets adds to the unpredictability of outcomes for the sector. However, many players are increasingly adopting a subscription-based model, which lends relative stability and allows companies with critical offerings to maintain core customer bases while adjusting prices as needed.

- Infrastructure Needs: The shift towards cloud operations and heightened demand for supporting software and services necessitates significant infrastructure investments, increasing costs for companies. This leads to fluctuations in profitability as new infrastructure depreciates and debt levels are managed. Nevertheless, many industry players have successfully reduced debt over the past few years, positively impacting their financial standing.

Zacks Industry Rank Shows Potential for Growth

The Zacks Internet – Software & Services industry falls within the broader Zacks Computer and Technology sector. Presently, it holds a Zacks Industry Rank of #45, positioning it in the top 18% of around 250 classified industries.

This favorable Zacks Industry Rank reflects strong growth potential in the sector. Historically, industries ranked in the top half have outperformed those in the bottom half by a ratio exceeding 2 to 1. However, caution is warranted regarding recent aggregate estimate revisions. Both fiscal year 2025 and 2026 estimates have seen considerable fluctuations, with the 2025 estimate steady through July 2024, experiencing a decline in August, then rising again briefly before tapering off. Similarly, the 2026 estimate reflected a comparable pattern of ups and downs. Overall, estimates have weakened over the past year.

Before diving into stock recommendations, let’s examine the recent performance and valuation landscape of the industry.

Improving Stock Market Performance

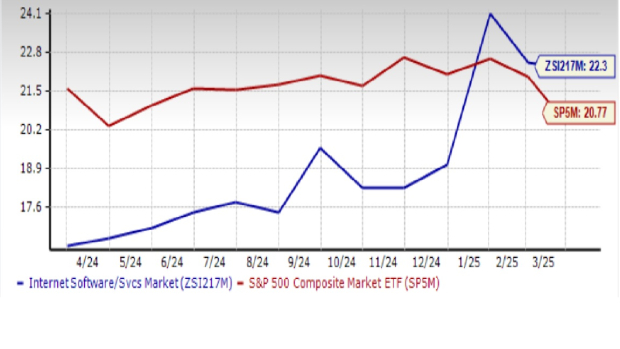

The Zacks Internet – Software & Services Industry lagged behind both the broader Zacks Computer and Technology Sector and the S&P 500 for much of 2024. However, it reversed this trend starting in February and outperformed both benchmarks this month.

The industry recorded a return of 9.5% over the past year, compared to 7.1% for the broader sector and 8.8% for the S&P 500.

One-Year Price Performance

Image Source: Zacks Investment Research

Current Valuation Insights

The industry is trading at a forward 12-month price-to-earnings (P/E) ratio of 22.3X. This represents a 7.4% premium over the S&P 500 and a 7.0% discount compared to the broader technology sector. Historically, technology stocks command higher multiples due to investor preference for innovation. Notably, the current multiple exceeds the industry’s median level of 18.3X observed over the past year.

The industry has fluctuated within a range of 16.4X to 24.1X during the previous year, as illustrated in the chart below.

Forward 12 Month Price-to-Earnings (P/E) Ratio

Image Source: Zacks Investment Research

Two Stocks to Consider

RingCentral Inc. (RNG): Based in Belmont, California, RingCentral’s AI-driven product suite includes Unified Communications as a Service (UCaaS), Contact Center as a Service (CCaaS), Video & Events, and RingSense AI solutions. Its achievements are not only attributed to innovative communication and collaboration offerings but also to a diverse network of strategic partners, global providers, channel partners, and third-party developers.

The company’s latest AI initiatives…

RingCentral and Criteo Report Positive Developments Despite Market Challenges

Solutions at RingCentral Inc. (RNG) are performing exceptionally well, with the company reporting that its average recurring revenue (ARR) from new products surpassed $50 million for the first time in the last quarter. Among its latest offerings is the AI receptionist (AIR), a digital phone assistant that accurately records essential details during calls, such as decisions and action items. It also generates context-aware chat messages and SMS in real-time.

In addition, the quarter highlighted a 7% growth in enterprise ARR, with 30 deals each exceeding one million dollars. A significant milestone for the company is its partnership with GenPact, a global leader in advanced technology services, which employs around 125,000 people across more than 30 countries.

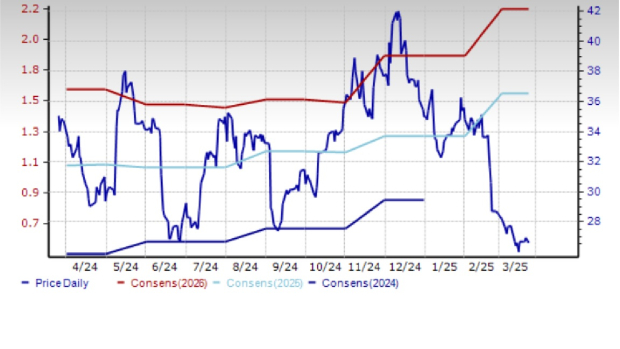

Despite these achievements, shares of this Zacks Rank #1 (Strong Buy) company have declined by 24.7% over the past year. However, the Zacks Consensus Estimate for 2025 has recently risen by a penny within the last 30 days, while the 2026 earnings estimate remains unchanged. Analysts predict revenue growth of 5.7% in 2025, followed by 2.5% in 2026 and 6.26% in 2027.

Price and Consensus: RNG

Image Source: Zacks Investment Research

Criteo S.A. (CRTO): This Paris-based company provides a comprehensive commerce media platform that delivers marketing and monetization services globally across North and South America, Europe, the Middle East, Africa, and the Asia-Pacific region. Criteo’s unified, AI-driven platform connects advertisers directly with retailers and publishers to facilitate commerce on retail sites and the open Internet.

Aiming to leverage AI technology, Criteo strives to broaden its ecosystem encompassing advertisers, retailers, and third-party platforms, utilizing its commerce dataset to enhance its AI models. Nonetheless, the advertising market has faced challenges due to macroeconomic factors, including geopolitical tensions in Ukraine and the Middle East, as well as inflation and rising interest rates. Despite this, Criteo successfully utilized its Retail Media platform to cushion some of these market effects. As more brands and retailers adopted its platform, a networking effect positively influenced its outcomes. Currently, Criteo boasts a robust client base of approximately 17,000, with a client retention rate of around 90% for three consecutive years.

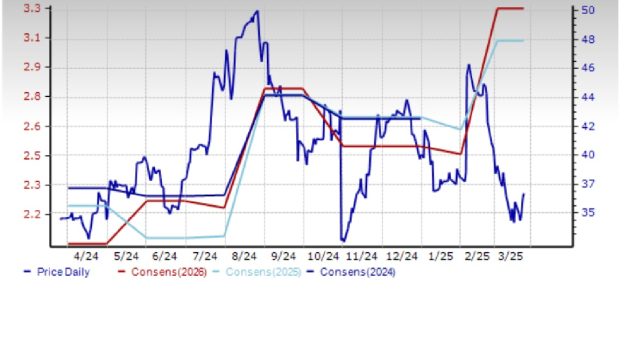

Shares of this Zacks Rank #2 (Buy) company have risen by 3.3% over the past year. The Zacks Consensus Estimate for 2025 has increased by 43 cents (10.3%) during the last 60 days, while the 2026 earnings estimate has seen a boost of 76 cents (18.3%). Analysts forecast a sales increase of 4.8% for this year with earnings projected to grow by 0.9%. Anticipated earnings growth for the following year stands at 6.5%, supported by a 6.9% uptick in revenue.

Price and Consensus: CRTO

Image Source: Zacks Investment Research

7 Best Stocks for the Next 30 Days

Recently released: Experts have identified 7 elite stocks from Zacks Rank #1 Strong Buys, which they consider “Most Likely for Early Price Pops.”

Since 1988, the complete list has outperformed the market by more than 2 times, averaging an annual gain of +24.3%. Don’t overlook these hand-picked stocks.

Ringcentral, Inc. (RNG): Free Stock Analysis Report

Criteo S.A. (CRTO): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.