US Equities Surge as AI Drives Tech Recovery

US equities have experienced significant growth since the bear market ended in late 2022, particularly following the Federal Reserve’s interest rate cuts. The technology sector, which faced the steepest decline, has rebounded, largely fueled by advancements in artificial intelligence. Nvidia (NVDA) stands out as a pivotal stock in this important market sector. Its market capitalization approaches $3.5 trillion, indicating its influence as a growth indicator. Furthermore, Nvidia’s superior graphics processing units (GPUs) are critical for the data centers built by major tech firms like Microsoft (MSFT).

The Launch of ChatGPT Sparks AI Competition

In November 2022, the debut of OpenAI and Microsoft’s ChatGPT chatbot ignited a new era for artificial intelligence. While AI technology existed prior to ChatGPT’s launch, its immense popularity triggered a wave of competition among major tech firms, such as Meta Platforms (META). Accordingly, semiconductor companies like Nvidia have seen tremendous gains. However, persistent high valuations among these tech stocks have led to speculation on whether this growth trend can be maintained.

Nvidia’s Earnings Forecast Indicates Strong Growth

During the November earnings call, Nvidia’s CEO, Jensen Huang, eased these worries by describing the demand for Nvidia’s latest chip as “insane.” Analysts from Zacks Consensus Earnings Estimates also share the optimism; they predict a year-over-year earnings growth of 125.38% for Nvidia in 2025.

Image Source: Zacks Investment Research

Concerns Shift from Demand to Supply in the Semiconductor Market

While the demand for AI remains strong, investors are increasingly focused on Nvidia’s ability to keep up with production. Two notable supply concerns include:

1. Blackwell Delays: The next generation of Nvidia’s AI chips faced delays because of design issues and overheating problems identified by Taiwan Semiconductor (TSM), a key supplier. Fortunately, these issues have been resolved, and production is set to pick up this month.

2. Accounting Issues at SMCI: Additionally, Super Micro Computer (SMCI) has faced scrutiny regarding accounting practices related to high-performance computing (HPC) solutions utilized in AI chips. Following months of falling shares due to a short-selling firm’s allegations, SMCI announced that an investigation revealed no evidence of fraud, boosting shares by over 20% after announcing a CFO replacement.

These supply-side concerns have been alleviated for NVDA.

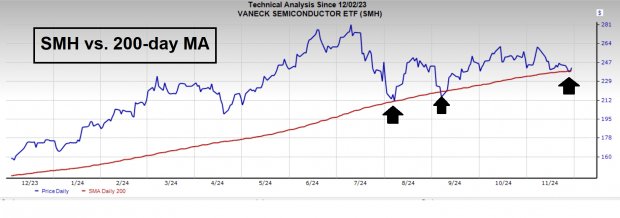

Semiconductor ETF at a Key Technical Level

Beyond the resolution of supply issues, there is further positivity surrounding semiconductor stocks as we approach the year-end. The Vaneck Semiconductor ETF (SMH) is approaching its 200-day moving average, a level that historically signifies market bottoms.

Image Source: Zacks Investment Research

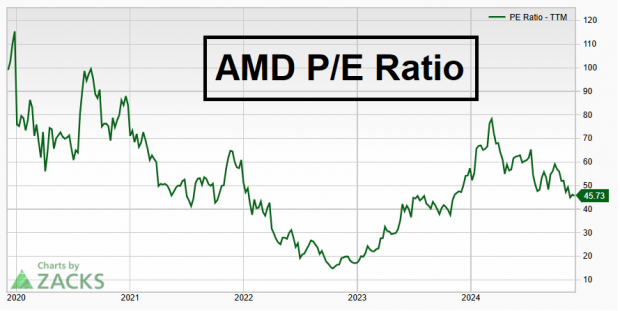

Attractive Valuations for Semiconductors

Semiconductor valuations currently present an appealing opportunity. Although some value investors express concerns over inflated valuations in the sector, it’s essential to recognize that the promise of higher growth justifies elevated valuations. Companies like Arm Holdings (ARM) and Advanced Micro Devices (AMD) have witnessed more attractive valuations as their stock prices stabilize.

Image Source: Zacks Investment Research

Conclusion: Semiconductor Stocks are Set for a Year-End Rally

With Nvidia addressing its supply challenges and a favorable technical setting, semiconductor stocks are poised for a potential rally as the year comes to a close.

Insight: Solar Industry on the Verge of Growth

The solar sector is expected to rebound, driven by a shift away from fossil fuels to support the booming AI industry.

Analysts predict that the clean energy market will attract trillions of dollars over the next few years, with solar energy projected to represent 80% of this growth. This presents significant opportunities for investment now and in the future. Identifying the right stocks will be crucial.

Discover Zacks’ latest solar stock recommendations for free.

For the most recent stock suggestions from Zacks Investment Research, download 5 Stocks Set to Double at no cost. Click here for your free report.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

ARM Holdings PLC Sponsored ADR (ARM): Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI): Free Stock Analysis Report

VanEck Semiconductor ETF (SMH): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.