Taiwan Semiconductor to Invest $100 Billion in U.S. Manufacturing

Taiwan Semiconductor TSM is making news today as the chip manufacturer announces a substantial $100 billion investment in U.S. manufacturing plants. This move aims to enhance TSMC’s footprint in the United States following its earlier commitment of $65 billion to establish fabrication facilities in Arizona.

This investment bolsters the supply chain for chip materials. TSMC’s products and services play a crucial role for many U.S. tech companies, particularly Apple AAPL, its largest customer.

Significance of Apple Partnership

As a key supplier for notable chip manufacturers, including Nvidia NVDA and AMD AMD, TSMC has a substantial relationship with Apple. The technology firm relies heavily on TSMC’s advancements for its MacBook computers, iPads, and iPhones.

In 2023, it was reported that Apple accounted for about a quarter of TSMC’s revenue, translating to approximately $17 billion. The strong collaboration with U.S. firms and government is reflected in TSMC’s anticipated revenue growth, projected to increase by 26% in fiscal 2025 to $113.63 billion, up from $90.08 billion last year. Furthermore, revenue is expected to rise by another 19% in FY26, surpassing $135 billion.

Image Source: Zacks Investment Research

EPS Growth and Positive Revisions

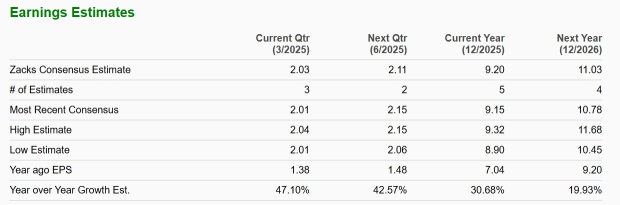

Acknowledged for its operational efficiency, TSMC’s annual earnings per share (EPS) are forecasted to jump 30% this year, reaching $9.20 compared to $7.04 in 2024. Additionally, EPS for FY26 is projected to rise by another 20%.

Image Source: Zacks Investment Research

Moreover, estimates for FY25 and FY26 have been adjusted upward by 4% and 1%, respectively, within the last 60 days.

Image Source: Zacks Investment Research

TSM Stock Performance and Valuation

Despite recent market fluctuations, TSMC stock has decreased by 9% in the first quarter of 2025, yet remains up by +30% over the past year. In the past three years, TSM’s stock has achieved gains near +70%, outpacing broader market indexes and Apple’s +48% performance.

Image Source: Zacks Investment Research

Currently trading around $178, TSM shares have a forward earnings multiple of 19.6X, close to their decade-long median and well below a high of 34.4X. Compared to the S&P 500’s 22.4X valuation, TSM might present a more affordable avenue to gain exposure to Apple’s market authority, especially with AAPL trading over $240 at a 33.2X forward earnings multiple.

Image Source: Zacks Investment Research

Conclusion and Final Thoughts

With its ambitious growth strategy and encouraging earnings estimate revisions, TSMC holds a Zacks Rank of #2 (Buy).

Although China has criticized TSMC for potentially jeopardizing Taiwan’s semiconductor industry for political leverage with the U.S., many investors recognize that expanding U.S. operations could be beneficial, especially given TSMC’s client roster, featuring major tech players like Apple, Nvidia, and AMD.

Just Released: Zacks Top 10 Stocks for 2025

Act fast to get in early on our top 10 stock picks for 2025. Selected by Zacks Director of Research Sheraz Mian, this portfolio has consistently outperformed, gaining +2,112.6% from its inception in 2012 to November 2024—more than quadrupling the S&P 500’s +475.6%. Sheraz has meticulously examined 4,400 companies and identified the best 10 to buy and hold in 2025. Be among the first to see these newly released stocks with significant potential.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click here for your free report.

Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Free Stock Analysis report

Apple Inc. (AAPL): Free Stock Analysis report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.