Tech Rally Falters: Investment Opportunities in AI-Driven Non-Tech Stocks

Wall Street’s robust bull market, which began in early 2023, faced significant challenges last month. The technology sector had propelled the markets upwards, largely thanks to the rapid advancements in generative artificial intelligence (AI). However, investors felt the pinch as financial indicators shifted.

Currently, U.S. stock markets have slipped into negative territory year-to-date, with the tech-heavy Nasdaq Composite experiencing a correction. AI-focused companies, including those specializing in AI chipsets, data center equipment, and even nuclear power, have encountered the steepest declines.

Several factors have contributed to this downturn. Investors are grappling with the high valuations of AI-related stocks, the looming threat of a potential recession, uncertainties surrounding future interest rate cuts by the Federal Reserve, and increased competition from low-cost AI platforms emerging from Chinese firms like DeepSeek.

Despite these headwinds, the excitement around AI technologies continues. Here, we present five non-tech companies effectively integrating AI into their business models. These stocks have earned a favorable Zacks Rank and show strong price upside potential. Notable mentions include PayPal Holdings Inc. (PYPL), Visa Inc. (V), Upstart Holdings Inc. (UPST), Netflix Inc. (NFLX), and Johnson Controls International plc (JCI).

5 AI-Driven Non-Tech Stocks Worth Considering

Our five selected stocks are positioned for solid growth through 2025 and have experienced positive earnings estimate revisions in the last 60 days. Each stock carries a Zacks Rank #2 (Buy). For a complete list, you can find today’s Zacks #1 Rank (Strong Buy) stocks here.

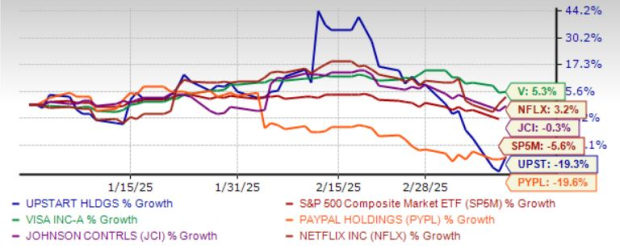

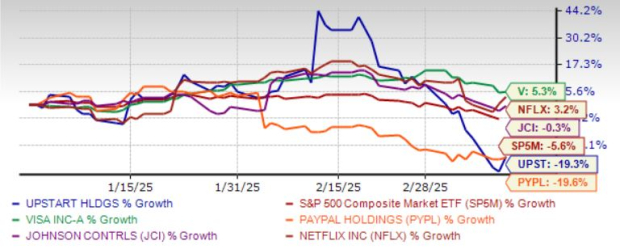

The chart below illustrates the year-to-date price performance of our five selected stocks.

Image Source: Zacks Investment Research

PayPal Holdings Inc. (PYPL)

PayPal is experiencing robust growth in total payment volume, driven by increased customer engagement on its platform. The company’s Venmo service is also seeing benefits from enhanced monetization and broader platform adoption.

Leveraging AI has enabled PayPal to refine user transaction experiences and gain deeper insights into consumer behavior. Its AI initiatives, including platforms like Fastlane and Ads, provide a technological advantage.

For the current year, PayPal is projected to see revenue and earnings growth rates of 3.7% and 8%, respectively. Over the past 60 days, the Zacks Consensus Estimate for earnings has been revised upward by 2.4%. PayPal’s return on equity (ROE) stands at 23.67%, outperforming both the industry average of 13.71% and the S&P 500’s 17.11%.

Positive Short-Term Prospects for PayPal Shares

Currently, PayPal’s stock trades at a forward price-to-earnings (P/E) ratio of 13.58x, lower than the industry average of 14.91x and the S&P 500’s 18.42x. Its price-to-sale (P/S) ratio is 2.12x compared to the industry’s 2.39x, while the price-to-book (P/B) ratio is 3.30x, against the industry’s 3.51x.

The average price target set by analysts for PayPal suggests a 36.2% increase from its last closing price of $68.62, with target estimates ranging from $70 to $125, indicating an upside potential of 82.2% and no projected downside.

Visa Inc. (V)

Visa’s strategic acquisitions and collaborations are promoting long-term growth while consistently boosting revenue. The company expects net revenues to increase in the low double digits for fiscal 2025. Growth is supported by rising payment volumes and ongoing technological investments.

The transition to digital payments offers Visa a competitive advantage, enhanced by substantial domestic volumes and a growing demand for fraud prevention services. In response, Visa has integrated AI into over 100 products, focusing largely on cybersecurity.

In the past decade, Visa has invested $3.5 billion to upgrade its data platform, a move that helps thwart approximately $40 billion in annual fraud attempts. Through innovation and AI-driven security, Visa is poised for robust future growth.

The expected revenue and earnings growth rates for Visa are 10.2% and 12.4%, respectively, this year (ending September 2025). Recent Zacks Consensus Estimates indicate a 0.7% earnings improvement over the past 60 days. Visa also offers a current dividend yield of 0.71%, with an ROE of 54.79%, significantly higher than the industry’s 13.71% and S&P 500’s 17.11%.

Promising Short-Term Outlook for Visa Shares

The short-term average price target set by brokers for Visa reflects a 15.2% increase from its latest closing price of $332.84, with a target range between $310 and $410. This suggests an upside potential of 23.2% and a downside risk of 6.9%.

Upstart Holdings Inc. (UPST)

Upstart Holdings operates an AI-driven lending platform that collaborates with banks to enhance access to affordable credit. The company provides loans across three segments: Personal Lending, Auto Lending, and Other. It offers various financial products, including personal loans, automotive retail loans, home equity lines of credit, and small-dollar loans.

AI is pivotal to Upstart’s operations, particularly through sophisticated credit risk models. This innovative AI platform allows Upstart to approve more loan applications compared to traditional credit scoring, all while maintaining lower annual percentage rates (APRs).

The AI-enhanced business model has expanded Upstart’s offerings, minimizing the need for human oversight, which in turn creates a faster and more efficient lending process for consumers.

Stocks with Strong Growth Potential: UPST, NFLX, and JCI

Subscribers can expect loan processing improvements with greater fraud detection from Upstart Holdings. The company anticipates a revenue growth rate of 59.3% and an earnings growth rate exceeding 100% for the current year. Notably, the Zacks Consensus Estimate for this year’s earnings has increased by more than 100% over the past month.

Short-Term Upside Potential for UPST Stock

Brokerage firms have set a short-term average price target for Upstart (UPST) that suggests a potential increase of 61.5% from its last closing price of $49.66. Current target prices range from $15 to $108, indicating a maximum upside of 117.5% with a potential downside of 69.8%.

Netflix Inc. and Its AI Innovations

Netflix, a leader in global streaming, employs artificial intelligence, data science, and machine learning to enhance user experience through personalized content recommendations. In the fourth quarter of 2024, the company reported strong member engagement, with average viewing times of about two hours per member per day, signaling robust retention rates.

The company’s AI system analyzes individual viewing habits to recommend tailored content. This innovative approach not only boosts subscriber satisfaction but also allows Netflix to offer high-quality streaming while minimizing bandwidth usage. By the end of 2024, it had amassed 301.63 million paid subscribers worldwide, reflecting a 15.9% year-over-year increase.

For the current year, Netflix expects revenue and earnings growth rates of 14% and 24%, respectively. The Zacks Consensus Estimate for current-year earnings has seen a 4% uptick over the last two months. Additionally, Netflix boasts a return on equity (ROE) of 38.32%, significantly higher than the industry average of 0.19% and the S&P 500’s 17.11%.

Short-Term Upside for NFLX Shares

Brokerage analysts project an average price target for NFLX that suggests a 20% increase from its last closing price of $919.68. Current target prices range between $800 and $1,494, representing a potential upside of 62.4% against a downside risk of 13%.

Johnson Controls International plc’s Growth Strategy

Johnson Controls International (JCI) is experiencing growth propelled by robust demand in its Building Solutions North America segment, driven largely by its HVAC platform. Strengthening control, security, and industrial refrigeration sectors contributes positively to performance in the EMEA and Latin America segments.

Recent investments in digital innovation, particularly the OpenBlue platform, have accelerated JCI’s growth. In November 2024, the company enhanced its OpenBlue Enterprise Manager Suite by expanding its AI features, which facilitate more autonomous building control for its customers.

The AI capabilities of the OpenBlue platform help facilitate improvements in facilities, optimize equipment, and deliver proactive services. Customers benefit from potential reductions of 30% in energy expenditures, 20% in maintenance costs, and enhancements in space utilization up to 10%.

For the current fiscal year ending September 2025, JCI anticipates revenue and earnings growth rates of -11.9% and -1.9%, respectively. The Zacks Consensus Estimate for current-year earnings has risen by 0.6% in the past month. Additionally, JCI offers a current dividend yield of 1.92%.

Short-Term Upside for JCI Stock

According to brokerage projections, the short-term average price target for JCI stock indicates a potential increase of 23.4% from its last closing price of $78.68. The target price currently ranges between $79 and $105, suggesting an upside potential of 33.5% with no projected downside.

Discover the Best Stocks for the Next 30 Days

Experts have recently highlighted seven elite stocks from the current pool of 220 Zacks Rank #1 Strong Buys, identifying them as “Most Likely for Early Price Pops.” Since 1988, this curated list has outperformed the market significantly with an average yearly gain of +24.3%. For insights into these chosen stocks, it’s advisable to pay attention to their performance.

For the latest recommendations from Zacks Investment Research, download the report on the 7 Best Stocks for the Next 30 Days. Explore free stock analyses for Visa Inc. (V), Netflix, Inc. (NFLX), Johnson Controls International plc (JCI), and Upstart Holdings, Inc. (UPST).

This piece was originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.