Wall Street has been witnessing an impressive bull run since the beginning of 2023 barring last month. Year to date, — the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — have advanced 3%, 11.9% and 15.3%, respectively. The mid-cap-centric S&P 400 is up 6.7%. However, the small-cap specific Russell 2000 and the S&P 600 have gained just 2.7% and 0.4%, respectively.

U.S. small businesses are still suffering from high inflation and interest rates. On May 2, the CNBC|SurveyMonkey Small Business Survey for second-quarter 2024 reported that 24% of respondents believe the inflation rate has already reached its peak compared with 29% in the first quarter.

In the second quarter, 75% of respondents expect inflation to rise from here compared with 69% in the previous quarter. Likewise, 31% of the small business owners are, “very or somewhat confident” in the second quarter about the Fed’s ability to control inflation, down from 35% the previous quarter and on par with 31% from the second quarter of last year.

Confidence Remains Steady

Despite inflationary headwinds, the CNBC|SurveyMonkey report revealed that Small Business Confidence remains stable at 47% in Q2, on par with the Q1 level, and 46% reported in the second quarter of 2023.

The NFIB (National Federation of Independent Business) Small Business Optimism Index increased in April to 89.7 from 88.5 in March, marking the 28th consecutive month below the 50-year average of 98. Notably, the reading for March was the lowest since December 2012.

Our Top Picks

We have narrowed our search to five small-cap (market capital < $1 billion) stocks. These stocks have strong growth potential for the rest of 2024 and have seen positive earnings estimate revisions in the last 30 days. Finally, each of our picks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

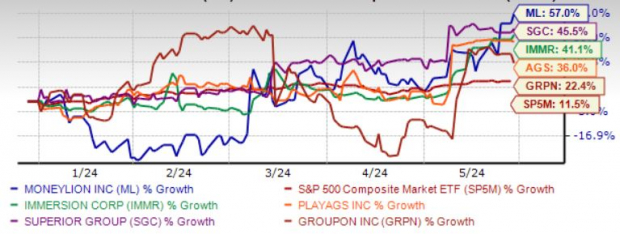

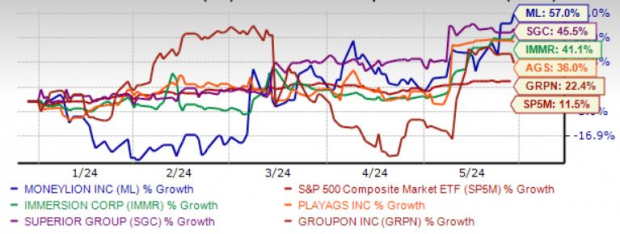

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Immersion Corp. IMMR develops hardware and software technologies that enable users to interact with computers using their sense of touch. IMMR focuses on four application areas: computing and entertainment, medical simulation, professional and industrial, and three-dimensional capture and interaction.

IMMR’s patented technologies, which are branded TouchSense, enable devices such as mice, joysticks, knobs, and medical simulation products to deliver tactile sensations that correspond to on-screen events.

Immersion has expected revenue and earnings growth rates of more than 100% and 12.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.6% over the last 30 days.

PlayAGS Inc. AGS designs and supplies gaming products and services for the gaming industry in the United States and internationally. AGS operates through three segments: Electronic Gaming Machines, Table Products, and Interactive Games.

AGS’ product line-up includes Class III EGMs for commercial and Native American casinos, video bingo machines for select international markets, table game products and interactive social casino products.

PlayAGS has expected revenue and earnings growth rates of 6.5% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 24% over the last seven days.

Superior Group of Companies Inc. SGC manufactures and sells apparel and accessories in the United States and internationally. SGC operates through three segments: Branded Products, Healthcare Apparel, and Contact Centers.

Superior Group of Companies has expected revenue and earnings growth rates of 4.4% and 38.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 17.2% over the last 30 days.

Groupon Inc. GRPN is benefiting from growing momentum across local and travel categories, particularly in the North America region. Increasing gift orders on the back of its v1.0 offering and growing focus on enhancing GRPN’s sorting and ranking algorithms to generate giftable deal feeds, is a positive.

Solid demand across GRPN’s enterprise customers is a plus. Groupon’s growing efforts to improve deal recommendation and quality assurance on the back of AI are contributing well to its top-line growth. GRPN’s cost reduction initiatives, such as the cloud cost optimization and ERP simplification projects, are acting as a tailwind.

Groupon has an expected revenue and earnings growth rate of 4.7% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved more than 100% over the last 30 days.

MoneyLion Inc. ML is a financial technology company that provides personalized products and financial content for American consumers. ML’s platform offers access to banking, borrowing, and investing solutions for customers. ML operates principally in Sioux Falls and Kuala Lumpur, Malaysia.

MoneyLion has an expected revenue and earnings growth rate of 23.9% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved more than 100% over the last 30 days.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Groupon, Inc. (GRPN) : Free Stock Analysis Report

Immersion Corporation (IMMR) : Free Stock Analysis Report

Superior Group of Companies, Inc. (SGC) : Free Stock Analysis Report

MoneyLion Inc. (ML) : Free Stock Analysis Report

PlayAGS, Inc. (AGS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.