“`html

Investment Insights: Tech Stocks to Watch in 2025

Highlights

- Tech stocks focused on AI, cloud computing, data centers, 5G, and IoT are gaining market interest.

- Mid-sized firms like UiPath Inc., Fastly Inc., and Innodata Inc. are generating stock momentum.

- These lesser-known stocks exhibit strong revenue growth alongside favorable earnings estimates.

The stock market has faced significant fluctuations since early 2025, following two years of strong growth. The technology sector, once a star performer, has encountered heightened volatility during this period.

Concerns are surfacing among economists regarding the steep valuations within the tech sector, especially as investors remain cautious about the Federal Reserve’s interest rate plans for 2025.

Despite these challenges, the tech industry continues to show promise, driven by relentless innovation. Notable areas such as artificial intelligence (AI), cloud computing, the Internet of Things (IoT), and 5G technologies are gaining traction in the market.

For savvy investors, focusing on small and mid-sized companies in these innovative sectors may be wise. Noteworthy stocks with solid potential include UiPath Inc. (PATH), Five9 Inc. (FIVN), Innodata Inc. (INOD), Fastly Inc. (FSLY), and Jabil Inc. (JBL).

Strength in the U.S. Economy

The U.S. economy appears robust, highlighted by job growth data from December. Signs such as increased jobs, lower unemployment rates, steady wage growth, and fewer jobless claims suggest positive economic momentum.

Additionally, strong holiday retail sales, a healthy services sector, and improvements in manufacturing point to a resilient economy. While inflation persists, strong fundamentals on Main Street may support a recovery on Wall Street.

Top 5 Small and Mid-Sized AI Stocks for 2025

These under-the-radar companies show promise for revenue and earnings growth in 2025. Recently, their earnings forecasts have notably improved, suggesting that investors expect robust performance this year. Our selections hold a Zacks Rank of #1 (Strong Buy) or #2 (Buy). For a complete list of today’s top Zacks Rank stocks, click here.

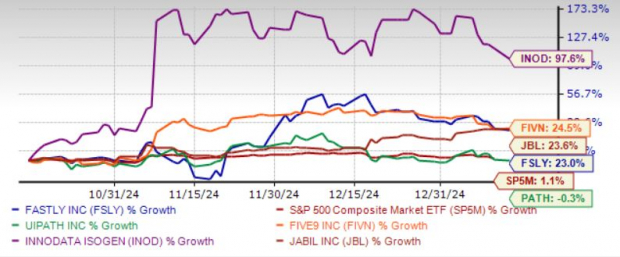

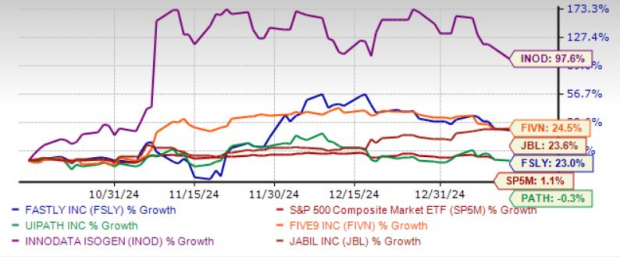

The chart below displays the price performance of our five highlighted stocks over the past three months.

Image Source: Zacks Investment Research

UiPath Inc.

Ranked #1 by Zacks, UiPath specializes in robotic process automation solutions across the globe, particularly in the U.S. and Europe. The PATH platform facilitates the management and execution of automation tasks within an organization.

Embedded AI, machine learning (ML), and Natural Language Processing (NLP) are integral to the PATH platform. Recent additions include generative AI features for specific business applications, enhancing automation capabilities.

UiPath anticipates revenue and earnings growth rates of 11% and 3.5%, respectively, for the current year, which ends in January 2026. The earnings forecast has risen by 6.7% over the past two months. The average price target from analysts reflects a 19.5% potential increase from its last closing price of $12.83.

Five9 Inc.

With a Zacks Rank of #2, Five9 offers intelligent cloud solutions for contact centers in the United States and India. The FIVN platform supports a wide array of customer service and sales functions through cloud-based applications.

Five9 features capabilities such as interactive virtual agents and AI-driven customer interaction management. In the third quarter of 2024, subscription revenue grew by 20%, contributing to a total revenue increase of 15% and a strong adjusted EBITDA margin of 20%.

Expected growth rates for revenue and earnings stand at 10.4% and 8.4%, respectively, for 2025. The earnings outlook has improved by 3.6% in recent months. Analysts project a price increase of 38.1% from the last closing price of $37.84, according to the latest estimates.

Innodata Inc.

Zacks Rank #1 indicates that Innodata operates as a leading data engineering company in various regions, including the U.S. and the U.K. The company’s operations consist of three main segments: Digital Data Solutions (DDS), Synodex, and Agility.

In its DDS segment, Innodata specializes in AI data preparation, including tasks like collecting and annotating training data for AI algorithms. They also provide data engineering services that help support AI initiatives for their clients, ensuring effective deployment and integration of AI objects.

“`

Three Tech Companies to Watch for Revenue Growth in 2025

Key players in tech are gearing up for significant revenue boosts, with promising earnings on the horizon.

Innodata Inc. (INOD)

Innodata specializes in data consolidation, extraction, compliance, and master data management. The company’s dedication to assisting Big Tech firms with generative models paid off in Q3 2024, generating $30.6 million in revenue from a single major client.

For 2025, Innodata anticipates a revenue growth rate of 34.6%, although earnings are expected to decline by 5.1%. Over the past 60 days, the Zacks Consensus Estimate for 2025 earnings has improved by 15.5%. Moreover, the average short-term price target from brokerage firms indicates a potential increase of 30% from the last closing price of $33.43.

Fastly Inc. (FSLY)

Fastly, currently holding a Zacks Rank of #1, provides essential infrastructure software for cloud computing, security, edge computing and streaming. On December 16, 2024, Fastly announced its Fastly AI Accelerator, enhancing the efficiency of large language model (LLM) applications for developers.

Fastly’s edge cloud platform improves processing and security for applications in the U.S., Asia Pacific, Europe, and beyond. Developers benefit from a more efficient platform requiring a single line of code to update AI applications, rather than multiple calls to AI providers.

The company expects its revenue to rise by 7% and earnings to soar by over 100% in 2025. The Zacks Consensus Estimate for earnings has jumped by 50% in the last two months. Fastly’s price-to-sales ratio stands at 2.33X, significantly lower than the industry average of 4.04X and the S&P 500’s 2.95X. Additionally, its price-to-book ratio of 1.28X compares favorably against 3.37X in its industry.

Jabil Inc. (JBL)

Jabil, rated #2 by Zacks, has been thriving due to strong momentum in the data center infrastructure, cloud, and digital commerce sectors. Its broad portfolio enhances resilience amid economic challenges.

Jabil’s robust free cash flow reflects sound financial management and efficient operations. The integration of generative AI is expected to significantly enhance the performance of its automated optical inspection machines.

For the fiscal year ending August 2025, Jabil forecasts a revenue decline of 5.4% but a slight earnings growth of 3.2%. Over the last month, the Zacks Consensus Estimate for the company’s earnings rose by 0.9%. Jabil’s price-to-earnings ratio of 17.57X is competitive against the industry average of 20.47X and is in line with the S&P 500’s 17.63X. Its price-to-sales ratio is at 0.63X, matching its industry average.

Investing in Infrastructure: Opportunities Await

The U.S. government is allocating trillions of dollars to improve infrastructure, which includes investments in AI data centers and renewable energy. This funding is creating opportunities for several companies positioned to benefit from this spending surge.

Discover five noteworthy stocks ready to capitalize on this growing trend in infrastructure investment.

Download insights on profiting from the trillion-dollar infrastructure boom today.

Get the latest recommendations with 7 Best Stocks for the next 30 days – available for free.

Free stock analysis report for Jabil, Inc. (JBL)

Free stock analysis report for UiPath, Inc. (PATH)

Free stock analysis report for Innodata Inc. (INOD)

Free stock analysis report for Five9, Inc. (FIVN)

Free stock analysis report for Fastly, Inc. (FSLY)

For further insights, click here to read more from Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.