Nvidia’s Rapid Growth Driven by AI Spending

Nvidia (NASDAQ: NVDA) is poised to benefit significantly from an estimated $650 billion in capital expenditures planned by major hyperscalers in 2024. The company is expected to experience 57% revenue growth for fiscal 2026 and 65% for fiscal 2027, driven by surging demand for its graphics processing units (GPUs) amid a significant increase in AI infrastructure spending.

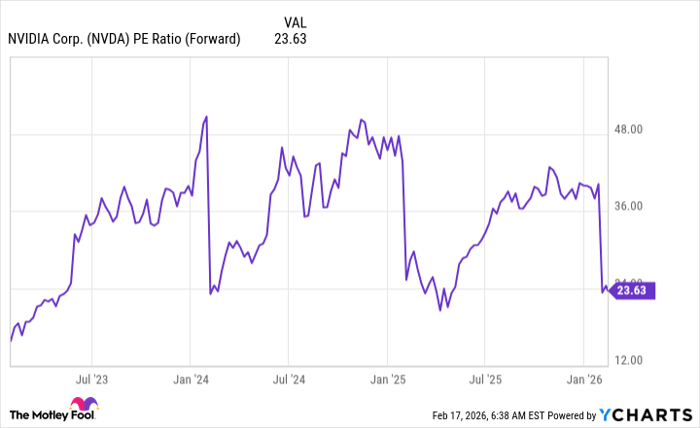

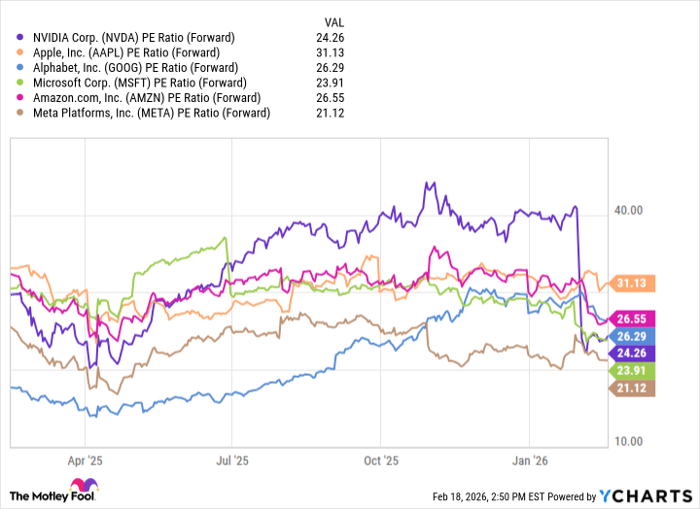

Analysts project that global data center capital expenditures will reach $3 trillion to $4 trillion annually by 2030, further bolstering Nvidia’s growth prospects. The stock is currently trading at under 24 times forward earnings, which analysts deem attractive given the company’s strong growth trajectory. Investors should note that Nvidia is set to report earnings on February 25, 2024, a date that could be pivotal for the stock.