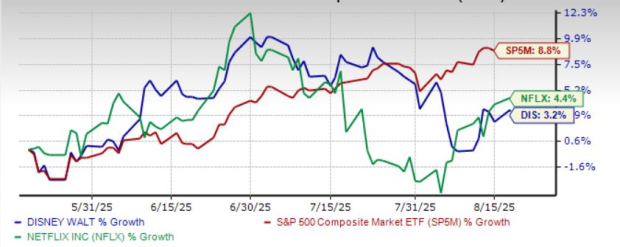

Netflix Inc. (NFLX) reported adjusted earnings of $7.19 per share for Q2 2025, exceeding estimates by 1.7% and up 47.3% year-over-year. Revenue reached $11.07 billion, marking a 16% year-over-year increase, driven by membership growth and higher subscription pricing. Netflix raised its 2025 revenue forecast to $44.8-$45.2 billion, with projections showing revenue growth of 15.5% and earnings per share growth of 31.4% year-over-year.

The Walt Disney Co. (DIS) announced third-quarter fiscal 2025 adjusted earnings of $1.61 per share, beating estimates by 10.3%, and revenue of $23.6 billion, a 2.1% year-over-year increase. As of June 28, 2025, Disney+ had 127.8 million subscribers, with expectations of over 10 million additional subscriptions in Q4 2025. The company projects fiscal 2025 earnings per share to be $5.85, reflecting an 18% increase from fiscal 2024.

Both companies have seen increased subscriber engagement and revised earnings estimates are positive, indicating a robust performance in the competitive streaming market.