Understanding Brokerage Recommendations for Constellation Energy Corporation

Investors frequently depend on Wall Street analysts’ recommendations to determine whether to buy, sell, or hold a stock. News reports about changes in these ratings can significantly influence a stock’s price. But how much impact do these recommendations really have?

We’ll examine the insights provided by analysts regarding Constellation Energy Corporation (CEG) before discussing the reliability of these brokerage recommendations and how to leverage them effectively.

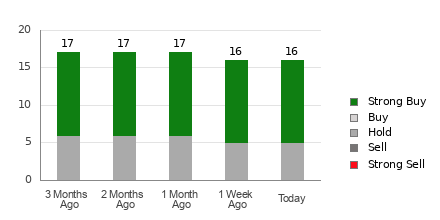

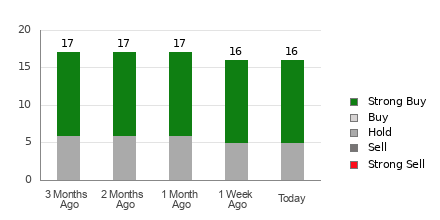

Currently, Constellation Energy Corporation holds an average brokerage recommendation (ABR) of 1.63 on a scale of 1 to 5 (where 1 is Strong Buy and 5 is Strong Sell). This average is based on recommendations from 16 brokerages. An ABR of 1.63 suggests a favorable outlook, leaning between Strong Buy and Buy.

Current Trends in Brokerage Recommendations for CEG

Discover price target and stock forecast for Constellation Energy Corporation here>>>

While the ABR indicates a strong buy sentiment for Constellation Energy Corporation, relying solely on this metric for investment decisions can be misleading. Research indicates that brokerage recommendations often fail to effectively guide investors toward stocks with the best potential for price appreciation.

Why is this the case? The strong economic interests of the brokerage firms lead to a notable bias in their analysts’ recommendations. Data shows that for each “Strong Sell” rating, there are typically five “Strong Buy” ratings given. Such patterns suggest that institutional interests may not align with retail investors, limiting the reliability of these recommendations for gauging a stock’s future price trends.

Instead, it’s wise to use analyst recommendations to validate your own research or refer to more proven tools for predicting stock price movements.

Our proprietary stock rating system, the Zacks Rank, has exhibited notable reliability through external audits. This tool classifies stocks from Zacks Rank #1 (Strong Buy) to #5 (Strong Sell) and serves as a dependable indicator of a stock’s near-term price performance. Validating the Zacks Rank with the ABR can enhance your investment decision-making process.

Differentiating ABR from Zacks Rank

Although both the ABR and Zacks Rank share a 1-5 scale, they measure different aspects. The ABR is calculated based on brokerage recommendations and typically presented with decimals (e.g., 1.28). Conversely, the Zacks Rank operates as a quantitative model that capitalizes on earnings estimate revisions and is denoted by whole numbers—1 through 5.

Historically, recommendations from brokerage analysts tend to be overly optimistic. Because of their affiliations with brokerage firms, analysts often issue more favorable ratings than warranted by research findings, which can mislead investors.

In contrast, the Zacks Rank leverages earnings estimate revisions, which research has consistently shown to correlate strongly with stock price trends.

Importantly, the Zacks Rank maintains balance across the spectrum of stocks that analysts cover, which ensures proportionality in its ratings. Unlike the ABR, which may lag in displaying timely updates, the Zacks Rank quickly reflects any revisions in earnings estimates from brokerage analysts, making it a more immediate tool for anticipating future price movements.

Should You Invest in CEG?

Recent earnings estimate revisions for Constellation Energy Corporation indicate the Zacks Consensus Estimate for the current year has remained stable at $9.39, showing no increase over the past month. However, analysts’ consensus shifts towards a more optimistic outlook for the company may signal potential share price growth.

The combination of the recent changes in consensus estimates and other related earnings metrics has led to a Zacks Rank of #2 (Buy) for Constellation Energy Corporation. For a comprehensive list of Zacks Rank #1 (Strong Buy) stocks, you can view them here>>>>.

Thus, the positive ABR for Constellation Energy Corporation could provide valuable insight for investors considering a position in the stock.

Exclusive Opportunity: Access to Zacks’ Buys and Sells for Just $1

Indeed, you read correctly.

A few years back, we surprised our members by offering 30 days of access to our picks for only $1, with no further obligations. Many took advantage of this offer; others hesitated, unsure if there was a catch. Our motive is straightforward: we want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more—each of which has closed numerous positions with significant gains in 2024 alone.

Access a Free Stock Analysis Report for Constellation Energy Corporation (CEG)

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.