Exploring Promising AI Investments: Nvidia and Meta Platforms Eye Strong Growth Ahead

Despite the recent hype around artificial intelligence (AI) as an investment, experts believe there is significant growth potential still on the horizon for 2025. The tech industry is just beginning its journey into key AI applications, signaling further gains for companies engaged in this field.

For those ready to invest $1,000, Nvidia (NASDAQ: NVDA) and Meta Platforms (NASDAQ: META) are two stocks worth considering. Both have shown impressive performance over the past two years, and prospects for 2025 are equally promising.

Start Your Mornings Smarter! Get insightful financial updates daily with Breakfast news. Sign Up For Free »

Nvidia: A Leader in AI Investments

Nvidia has established itself as a frontrunner in AI investing, benefiting significantly from the industry boom. Its profitability from AI applications sets it apart from many competitors.

Major tech companies are investing billions in AI infrastructure, and Nvidia captures a large portion of these funds. Its graphics processing units (GPUs) and CUDA software have become standards in the industry, positioning Nvidia as a clear leader. As AI-focused firms seek increased computing power in 2025, Nvidia stands ready to seize new opportunities.

Analysts predict a staggering 52% revenue growth for Nvidia in fiscal 2026, with the fiscal year ending in January 2026. This follows a projected doubling of revenue in the current fiscal year. The upcoming Blackwell-architecture chips are expected to drive this growth, as they significantly outperform Nvidia’s earlier Hopper chips in AI training tasks, reportedly being four times faster.

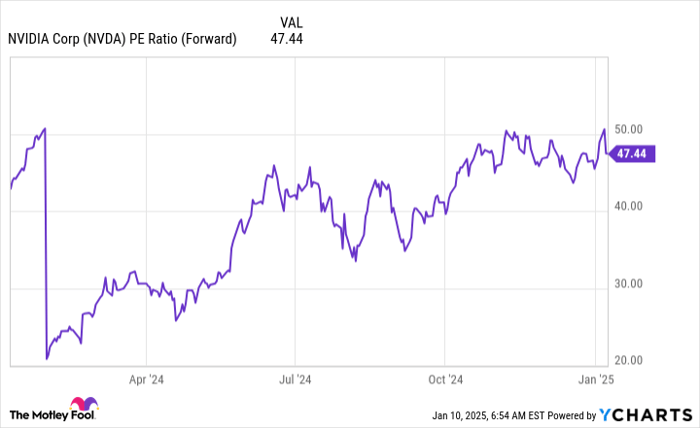

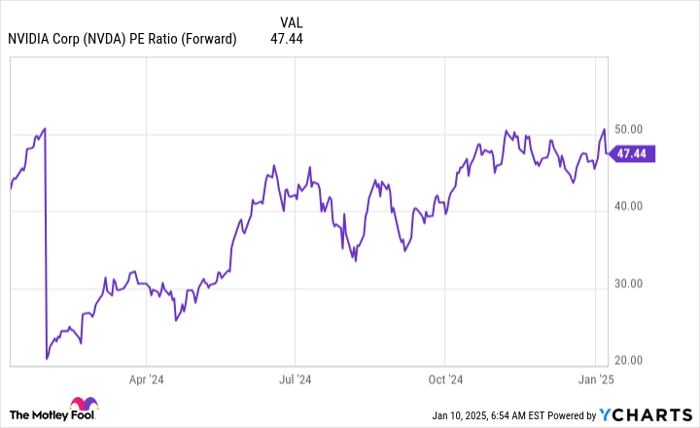

NVDA PE Ratio (Forward) data by YCharts.

Some critics argue that Nvidia’s stock is overpriced, currently trading at 47 times forward earnings. However, considering other tech giants like Apple (NASDAQ: AAPL) at 33 times and Amazon (NASDAQ: AMZN) at 36 times, Nvidia’s growth potential seems to justify a higher valuation.

Nvidia continues to represent a key investment in AI, making it a stock to watch closely.

Meta Platforms: Investing in the Future

Meta Platforms is making substantial investments in AI research to enhance the relevance of its popular social media channels, including Facebook, Instagram, Threads, WhatsApp, and Messenger. Much of its revenue is derived from advertising sales across these platforms.

In addition, Meta is heavily investing in augmented reality (AR) and virtual reality (VR), ventures that have yet to yield profits but may become successful if a competitive consumer product is developed.

Projected revenue growth for Meta stands at around 15% for next year, a slower pace than Nvidia, yet the stock is affordably priced.

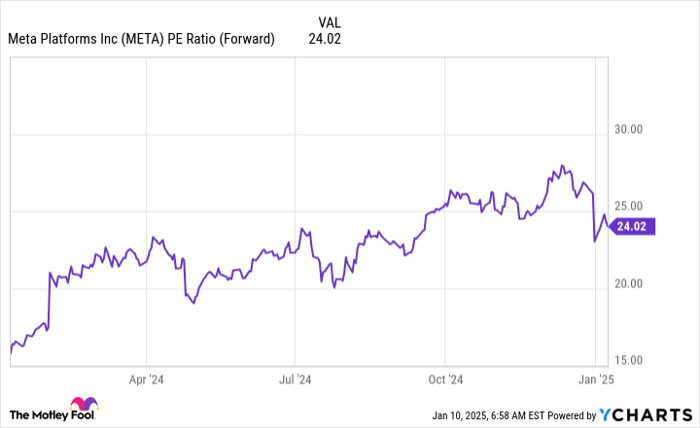

META PE Ratio (Forward) data by YCharts.

With a forward earnings ratio of 24, Meta’s valuation is reasonable when considering its robust base business and the potential for breakthroughs in AI-integrated products.

As an established player in AI, Meta retains a solid business model while exploring innovative technologies.

Is Investing $1,000 in Nvidia the Right Choice?

Before purchasing Nvidia stock, potential investors should take note:

The Motley Fool Stock Advisor analyst team recently highlighted what they see as the 10 best stocks for investors right now—Nvidia did not make this list. The recommended stocks are projected to deliver substantial returns in the future.

Reflecting on Nvidia’s past performance—had you invested $1,000 when it was first recommended on April 15, 2005, you’d be looking at an impressive $816,504 today!

Stock Advisor offers a structured approach to investing, including portfolio-building guidance, updates from analysts, and new stock picks each month. The service’s track record has more than quadrupled the S&P 500’s returns since 2002.

Discover the top 10 stocks »

*Stock Advisor returns as of January 13, 2025

Randi Zuckerberg, a former Facebook market development director and sister to Meta CEO Mark Zuckerberg, serves on The Motley Fool’s board. John Mackey, ex-CEO of Whole Foods Market, part of Amazon, also holds a position on the board. Keithen Drury has investments in Amazon and Nvidia. The Motley Fool endorses and holds positions in Amazon, Apple, Meta Platforms, and Nvidia. For more details, consult The Motley Fool’s disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.