Focus on Long-Term Investments Amid Market Volatility

If you’re feeling anxious about the current market volatility, consider directing your attention to long-term investments. Shifting your perspective from the immediate future to the years ahead can help you tune out distracting short-term fluctuations.

Ultimately, it’s essential to reflect: “Will this matter in three to five years?” While the initial reaction may be yes, remember that five years ago, during the COVID-19 outbreak, many believed in a permanent shift away from in-person work—a prediction that proved incorrect.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy at the moment. Learn More »

Throughout tough times, strong tech companies have often maintained their leadership positions and emerged even stronger. Today’s market conditions present a similar opportunity. Savvy investors might want to consider three undervalued tech stocks that are positioned for growth in the coming five years.

My recommended stocks for long-term resilience are Amazon (NASDAQ: AMZN), Meta Platforms (NASDAQ: META), and The Trade Desk (NASDAQ: TTD). Although all three face short-term challenges, such as tariffs and economic uncertainty, their long-term prospects remain promising.

Amazon’s Position in a Tariff Climate

Amazon has been a focal point in the discussion of tariffs. The prevalence of products made in China on its platform means any changes in tariff rates could significantly impact profits. Recent turmoil around tariffs has raised concerns, but it’s critical to focus on long-term trends.

Should a protracted trade war with China arise, suppliers might shift their supply chains, a transition likely to stabilize within three to five years. Moreover, it’s important to note that Amazon’s overall profit comes more from services than its product sales.

Retailers typically operate on slim profit margins. For instance, Walmart reported $681 billion in sales last year, yielding a profit of only $19.4 billion—a margin of just 2.9%. In contrast, Amazon enjoyed a 9.3% profit margin in the same period, showing that its profit strategy relies heavily on higher-margin segments.

The company benefits from high-margin divisions like subscription services, advertising, and cloud computing through Amazon Web Services (AWS). Though AWS accounted for only 17% of Amazon’s revenue in 2024, it produced an impressive 58% of operating profits. Such divisions are insulated from downturns and will likely help boost Amazon’s profitability in the next few years.

Meta Platforms’ Resilience

Meta Platforms, formerly known as Facebook, oversees prominent social media platforms including Facebook, Instagram, Threads, WhatsApp, and Messenger. Its primary revenue stream comes from advertising, a sector that often faces cuts during economic downturns, as seen during the pandemic and recent recession fears.

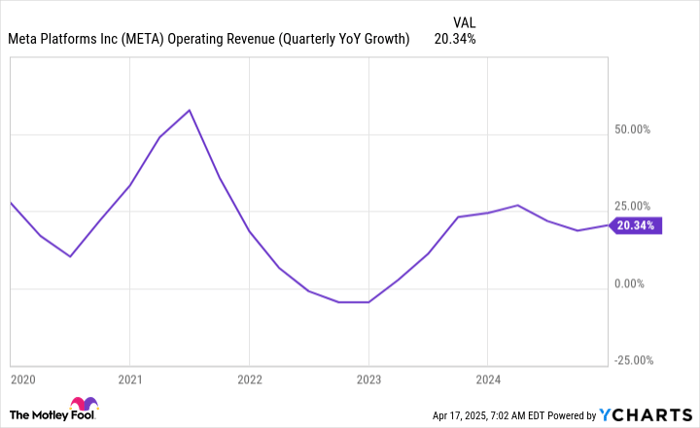

META Operating Revenue (Quarterly YoY Growth) data by YCharts

However, historically, Meta’s revenue rebounds robustly following downturns. I anticipate a similar recovery trend through 2025, suggesting that today’s pricing offers a favorable entry point for investors interested in Meta’s long-term growth.

The Trade Desk’s Future Potential

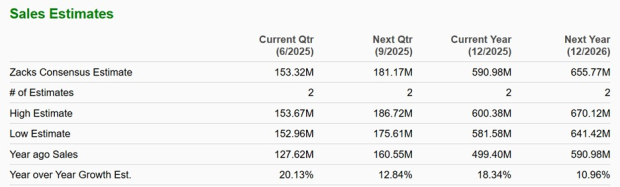

The Trade Desk operates within the advertising realm as a facilitator for ad buyers and sellers, ensuring optimal ad placements. Like Meta, it may experience temporary revenue dips due to economic factors, but it also faces challenges related to platform migration. Recently, the company shifted its users from its previous Solimar platform to a new system called Kokai, which led to execution issues and caused it to miss its revenue projections for the first time.

This setback is unlikely to persist five years into the future. The growth of programmatic advertising, which leverages artificial intelligence for campaign optimization, is set to expand significantly. As a market leader in this space, The Trade Desk is positioned to maintain its competitive edge in the years to come.

While the next five years may include challenges, I believe The Trade Desk’s stock will appreciate significantly in that time frame, prompting me to consider increasing my position in this company.

Should You Invest $1,000 in Amazon Now?

Before making any investment in Amazon, consider this:

The Motley Fool Stock Advisor team has pinpointed the 10 best stocks to buy right now, and notably, Amazon is not on the list. The selected stocks are poised to deliver substantial returns in the years ahead.

Take Netflix, for example, which was highlighted on December 17, 2004… if you invested $1,000 at that time, you’d have $524,747 today!

Or consider Nvidia, which made the list on April 15, 2005… a $1,000 investment back then would now be worth $622,041!

The Stock Advisor’s average return is 792 %— significantly outperforming the 153 % return of the S&P 500. Don’t miss the latest top 10 stock recommendations available through Stock Advisor.

see the 10 stocks »

*Stock Advisor returns as of April 21, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a board member for The Motley Fool. Keithen Drury has positions in Amazon and The Trade Desk. The Motley Fool has positions in and recommends Amazon, Meta Platforms, The Trade Desk, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.