Market Surge: Coinbase and First Solar Stocks Jump Over 20%

Coinbase Global COIN and First Solar FSLR experienced significant stock gains, leading the market up on news of a U.S.-China trade deal. On Tuesday, both stocks surged over 20%. Investors welcomed Coinbase’s inclusion in the S&P 500, coinciding with Bitcoin’s price rising above $100,000. First Solar’s stock gains stem from potential access to up to $10 billion in tax credits as lawmakers reassess exemptions in the Inflation Reduction Act, including the Investment Tax Credit (ITC-48E).

With COIN and FSLR now showing positive performance for the year, they boast impressive increases of over +300% and +200% respectively over the past three years. This surge may prompt investors to consider buying these stocks.

Image Source: Zacks Investment Research

Outlook for Coinbase and First Solar

Coinbase has acknowledged ongoing economic pressures and uncertainties in trade policy, predicting short-term volatility in the crypto market. However, it expects market stability to return later in Q2 and into Q3, driven by Bitcoin’s post-halving cycle, institutional adoption, and clearer U.S. crypto regulations.

Zacks estimates indicate that Coinbase’s total sales could grow by 10% in fiscal 2025, followed by a 5% increase in FY26, reaching $7.65 billion. Despite this, annual earnings are forecasted to decline to $3.97 per share in FY25 from last year’s EPS of $7.60. Nevertheless, FY26 EPS is projected to stabilize and rebound by 78% to $7.08, still below its peak of $14.50 per share post-IPO in 2021.

Image Source: Zacks Investment Research

On the other hand, First Solar had expected a larger impact from U.S. tariffs but anticipates $310-$350 million in advance manufacturing production credits this quarter. It maintains a positive long-term outlook, driven by strong demand in the U.S. market, supported by its vertically integrated production model and CadTel-based semiconductor technology.

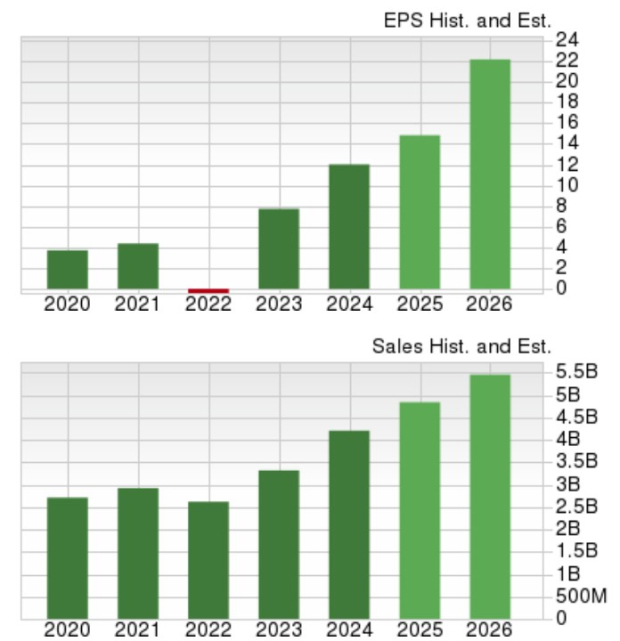

First Solar’s sales are projected to increase by 15% this year and are forecasted to rise another 13% in FY26, reaching $5.46 billion. Moreover, First Solar’s EPS is expected to jump 23% in FY25, with annual earnings anticipated to rise another 49% in FY26 to $22.16 per share.

Image Source: Zacks Investment Research

Analysts’ Perspectives

Following today’s positive developments, analysts at J.P. Morgan JPM observed that the new tax credit proposal aligns with optimistic investor expectations for solar stocks like First Solar. Wolfe Research also upgraded First Solar to outperform, contributing to its stock rally.

Additionally, Bernstein analysts noted Coinbase’s strong market position, predicting that the cryptocurrency exchange could see $16 billion in capital inflows due to its recent S&P 500 inclusion.

Bottom Line

As of now, both Coinbase and First Solar hold a Zacks Rank #3 (Hold). Analysts’ bullish sentiment may suggest potential buy ratings in the future, especially as earnings estimate revisions could trend upward, benefiting their growth trajectories.