Market Experts Divided: Should You Buy Stocks Now?

Turn on the TV or scroll social media, and you’ll find numerous self-proclaimed market sages, financial influencers, and Wall Street whispers sharing their perspectives on stocks. The ‘experts’ have emerged from their bunkers, but they can’t seem to agree on future movements.

Some recommend buying the dip, while others suggest staying clear of the market. Many warn that we are experiencing another 2008. So, which path should investors take? Is this a historic buying opportunity, or a sign of a deeper collapse?

We aim to answer that question not with opinions, but with compelling data.

To us, the data suggests one clear message: If you have time on your side, it’s a good moment to be buying stocks aggressively. However, the final decision rests with you.

Here is what we see unfolding.

A Rapid Decline in Stock Prices

The recent market turmoil began with President Trump’s “Liberation Day” tariffs announced on April 2. Investors reacted strongly, causing significant market shifts. The next day, on April 3, the S&P 500 plummeted more than 5%, followed by another drop exceeding 5% on April 4.

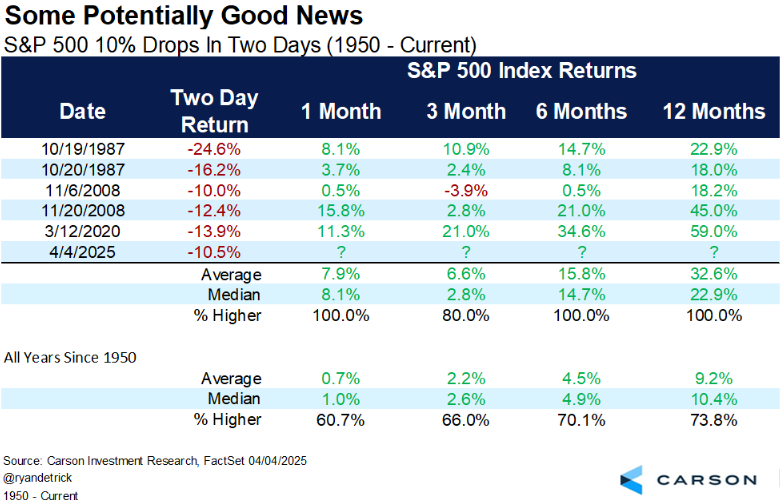

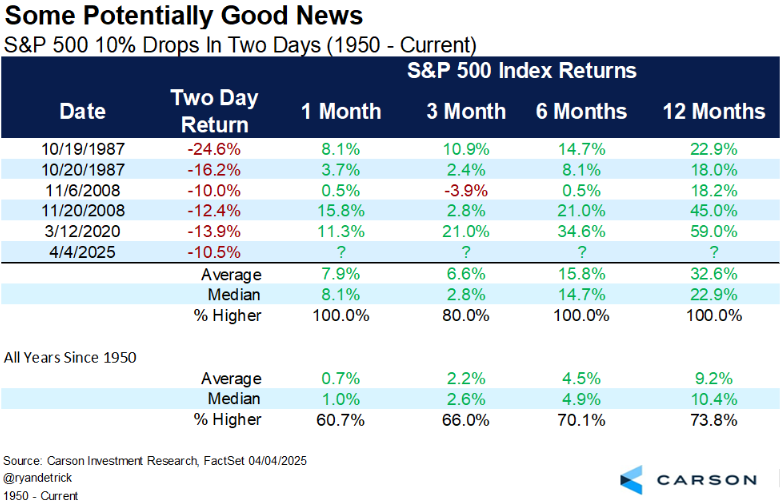

This led to a notable two-day decline of 10%—an event that is not just rare but nearly unprecedented.

Since 1950, such price actions have occurred only five times:

- Twice during Black Monday (1987)

- Twice during the Great Financial Crisis (2008–09)

- Once during the March 2020 COVID Crash

Here’s the important takeaway: Following each of the previous five instances, the S&P 500 was higher one year later. The typical 12-month return from these periods was 33%, with even the worst-case scenario yielding an 18% increase after a year.

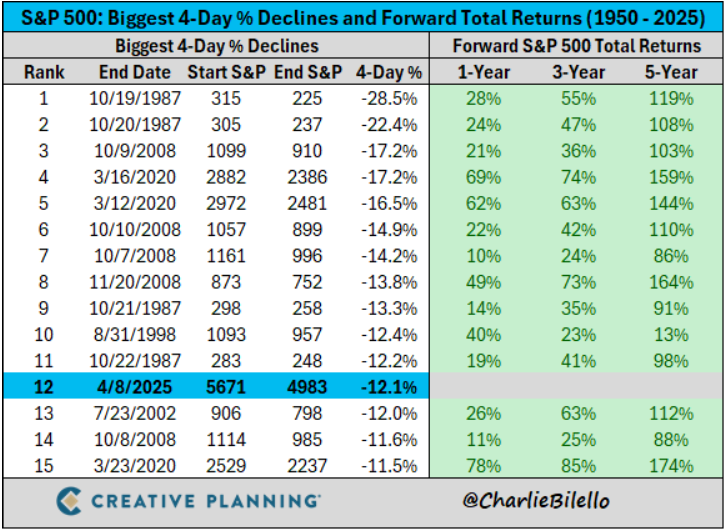

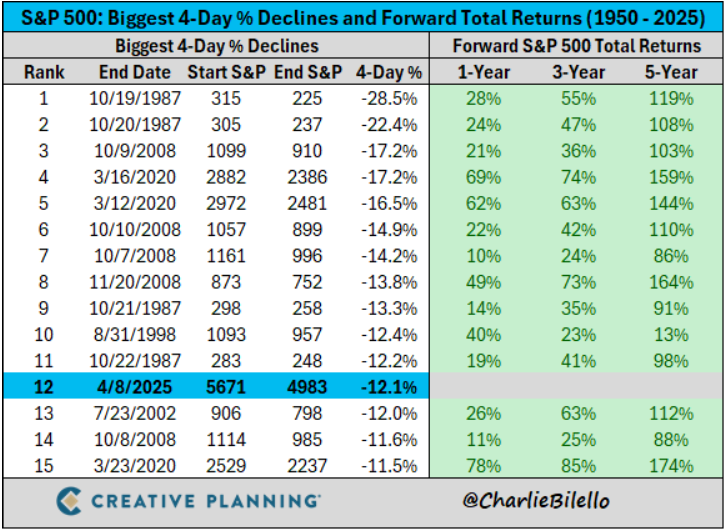

However, the sell-off didn’t halt after those initial two days. On the following Monday, the decline intensified, culminating in an 11% drop over three days. This marked the 11th-largest three-day decrease since 1950.

Tuesday, April 8, brought further setbacks, increasing the four-day drop to 12.1%—the 12th worst in modern market history.

Notably, in every previous case where the market fell by more than 10% in three days or by more than 12% in four days, it was up the following year.

In fact, stocks often experienced significant gains. The average return over the next 12 months after similar four-day declines is nearly 70%.

Market Analysis: Historical Trends Suggest Buy Opportunity Post-Rally

Following a significant surge, the market experienced a quick correction.

Positive Historical Indicators

On April 9, President Trump revealed a decision to pause country-specific reciprocal tariffs (excluding China) for 90 days. This announcement indicated a potential shift from trade war escalation toward negotiation.

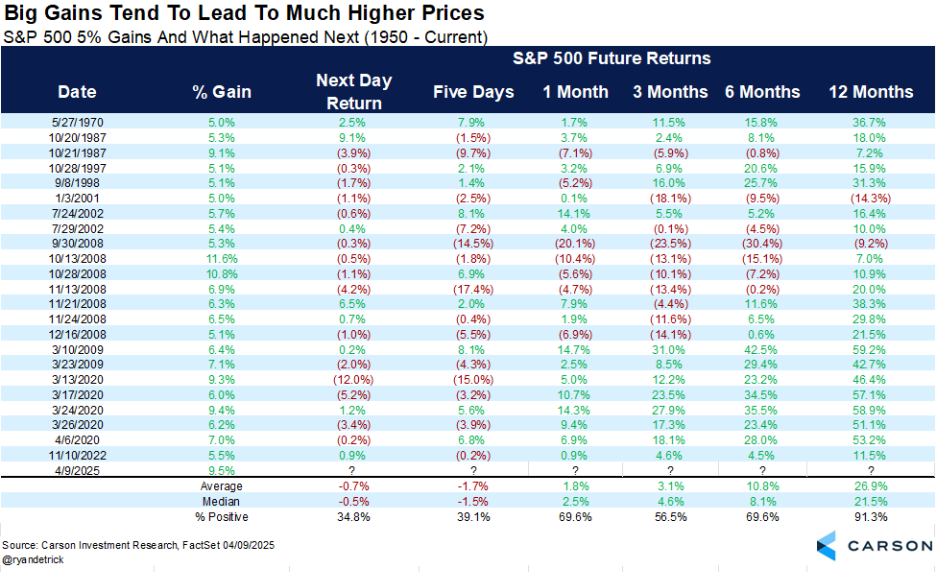

The response from the market was impressive, with the S&P 500 climbing 9.5%, resulting in one of the largest single-day gains in history.

Historically, since 1950, there have only been 23 instances where the S&P experienced a single-day rally of over 5%. Remarkably, the market closed higher one year following 21 of those events (an impressive 91% success rate), with an average return of 27%.

This aligns with the observed pattern: After a big selloff comes a substantial rally, creating a significant opportunity.

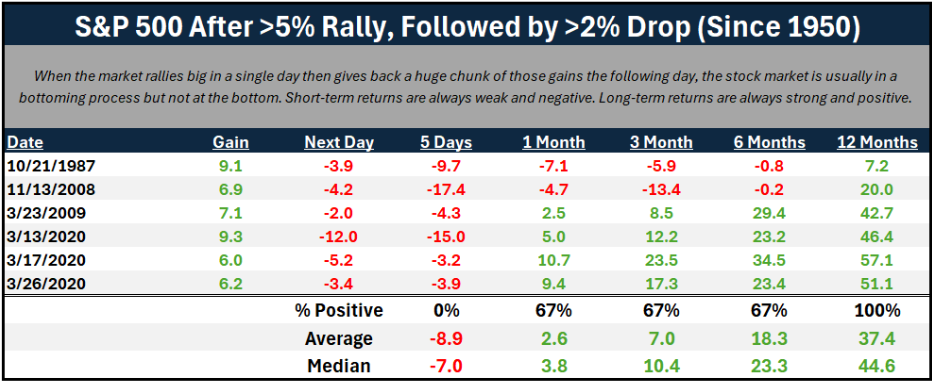

However, Thursday proved challenging; stocks relinquished a significant portion of the gains achieved on Wednesday.

The S&P 500 declined by 3.5%, leading some market analysts to label this a case of a “dead cat bounce.”

Yet, history suggests otherwise. Since 1950, every time the S&P 500 experienced a more than 5% rally in a single day, followed by a drop exceeding 2% the next day, the market was higher a year later. The average twelve-month gains in these instances were over 37%.

Thus, even following a retracement, the initial rally remains a bullish signal within historical context.

Market Sentiment and Future Outlook

Amidst the prevailing anxiety in the market…

Market Volatility Soars: A Rare Buying Opportunity Emerges

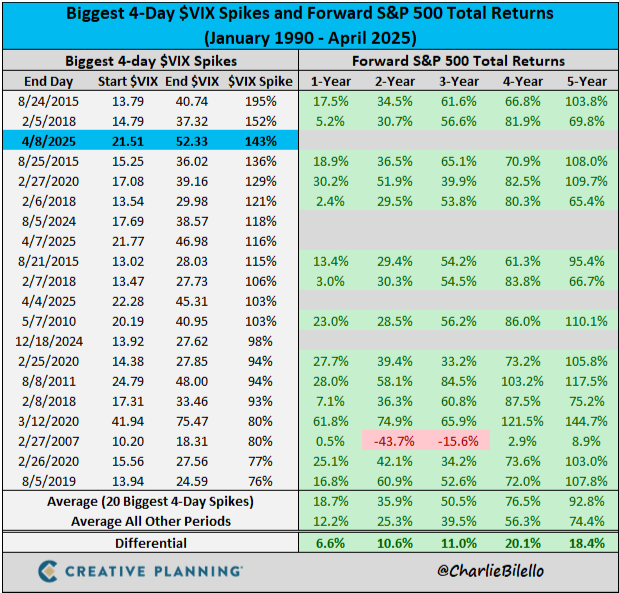

The volatility index (VIX), often referred to as Wall Street’s fear gauge, has surged over 100% in just a few days. Currently, it is at levels not seen since the 2008 financial crisis and the COVID crash.

What can we expect from markets after such spikes?

Historically, when the VIX exceeded 50 in 2008, stock prices increased by over 60% within a year. Similarly, during the COVID spike, stocks soared more than 70% in the following year.

Extreme fear rarely lingers long; instead, it often uncovers investment opportunities for those willing to take action.

Warren Buffett’s well-known advice is “Be fearful when others are greedy, and greedy when others are fearful.” However, many investors struggle to follow this guiding principle.

This current climate of fear manifests as:

- Double-digit percentage declines in a short timeframe

- Alarming headlines regarding trade wars and GDP downturns

- Experts predicting the next Great Depression

While many rush to the exits during such turmoil, history indicates that this is precisely when investors should consider buying.

Navigating the Current Market Opportunity

It’s important to clarify that we are not asserting this is the market bottom. In fact, it might not be.

Volatility remains high, and the ongoing situation with China presents additional uncertainties. More short-term challenges are possible.

However, here is a key point: You don’t need to pinpoint the exact bottom—just buy when prices are low enough.

Given current price trends, volatility indicators, and heightened fear levels, evidence suggests that we may already be in such a zone.

For investors with a six- to twelve-month horizon, the odds appear favorable.

All historical signals we analyze indicate this could be a generational buying opportunity for those willing to be patient.

While purchasing today may not feel comfortable, you could very well appreciate that decision a year from now.

Staying smart, patient, and focused on the long term will help you maximize this moment.

When it comes to buying during this market dip, AI 2.0 stocks may prove to be a strong investment. This pertains to AI technologies that can adapt to real-world environments—often referred to as embodied intelligence. This includes systems that can see, hear, walk, talk, lift, carry, organize, and learn.

There’s a clear reason why major tech companies are now showing interest in humanoid robots. This sector is where we anticipate the next trillion-dollar investment opportunities will emerge, and we’ve identified an intriguing way to engage with this next phase of the AI Boom.

Discover the details about our top AI 2.0 stock selection.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

For questions or comments regarding this article, please reach out to us at [email protected].