Top AI Stocks to Buy Amid Recent Market Sell-Off

Recently, artificial intelligence (AI) stocks have experienced a significant downturn compared to the broader market, driven by concerns over a trade war. Many AI stocks have dropped into double-digit losses, while the S&P 500 (SNPINDEX: ^GSPC) sits around 6% lower at this writing.

This market reaction appears to be a temporary overreaction, offering an opportunity for savvy investors. Consequently, I am looking to capitalize on this by increasing my positions in top AI stocks. My recommended buys include Nvidia (NASDAQ: NVDA), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and Taiwan Semiconductor Manufacturing (NYSE: TSM). Each of these companies has fallen by approximately 20% from their peak valuations, making them attractive investments while they remain undervalued.

Start Your Mornings Smarter! Subscribe to Breakfast News for daily market insights. Sign Up For Free »

Let’s delve deeper into each of these companies.

1. Nvidia

Nvidia has been a standout player in the AI sector since 2023, with its graphics processing units (GPUs) essential for the development and execution of AI models. Despite fears that demand for GPUs might decline due to evolving AI technologies, these concerns are mitigated by the substantial capital expenditures reported by Nvidia’s key clients.

Looking ahead, Nvidia is projected to achieve 65% year-over-year revenue growth, reaching $43 billion in the first quarter of fiscal 2026 (ending April 30). This surge is anticipated to be driven by the introduction of its latest chip generation, Blackwell, which significantly enhances performance compared to the prior Hopper architecture, enabling users to develop much more effective AI models.

For fiscal 2026, analysts forecast a 56% increase in revenue, suggesting that Nvidia’s growth trajectory remains robust.

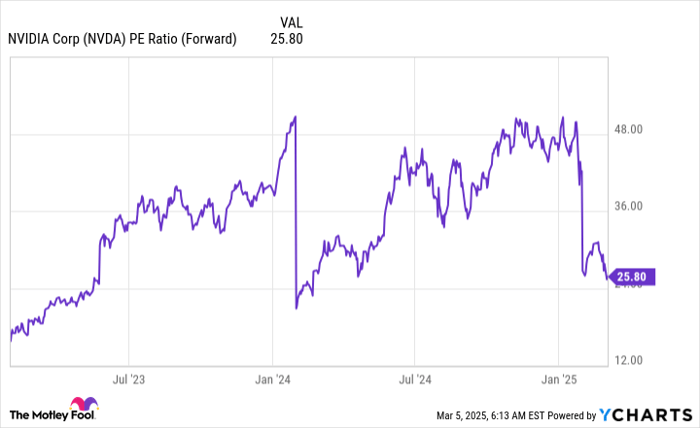

Notably, current market pricing reflects a different sentiment. Nvidia’s stock trades at less than 26 times forward earnings, marking its lowest valuation in about a year.

NVDA PE Ratio (Forward) data by YCharts

This valuation presents a compelling buying opportunity for those looking to invest in a long-term winner like Nvidia.

2. Alphabet

Alphabet presents an even more attractive price point than Nvidia, trading at an astonishing 21 times trailing earnings and 19 times forward earnings. For comparison, the S&P 500 is valued at 23.9 times trailing and 21.6 times forward earnings, indicating Alphabet’s stock is undervalued relative to the market.

This valuation discrepancy seems illogical given Alphabet’s robust performance, particularly in digital advertising through its Google search engine. In Q4, Alphabet recorded a 12% increase in revenue and a 31% rise in earnings-per-share (EPS), illustrating strong growth not typically associated with a company trading at a discount to the broader market.

Looking forward, analysts anticipate 11% revenue growth in 2025 and 2026, reinforcing Alphabet’s potential to outperform the market, especially given its current attractive stock price.

3. Taiwan Semiconductor

Taiwan Semiconductor Manufacturing (TSMC) has effectively mitigated fears surrounding potential tariffs by announcing a staggering $100 billion investment in the U.S. to establish three fabrication facilities, two packaging plants, and a research-and-development center. This recent commitment builds on an earlier $65 billion investment, totaling $165 billion.

This new investment positions TSMC well to avoid tariff-related risks, which had previously weighed on investor sentiment. As a critical player in the semiconductor industry, TSMC’s avoidance of these hurdles allows focus to shift back to its strong business fundamentals. The company expects its revenue from AI-related chips to grow at a yearly rate of 45% over the next five years, with overall revenue growth projected to reach 20%. This indicates TSMC is poised for substantial growth.

Additionally, TSMC’s stock trades for just 19.8 times forward earnings, making it another attractive buy in the current market.

TSM PE Ratio (Forward) data by YCharts

The valuation of TSMC is perplexing given its critical role in AI development, making it a strong buy at current levels.

Seize This Opportunity

Have you ever felt you missed an important investment opportunity? Now might be your chance to capitalize on these exceptional stocks.

Occasionally, our expert analysts recommend a “Double Down” on stocks poised for strong performance. If you think you’ve missed your chance, now is the time to take action before it’s too late. The numbers illustrate significant growth potential:

- Nvidia: A $1,000 investment when we doubled down in 2009 would be worth $292,207!

- Apple: A $1,000 investment when we doubled down in 2008 would have grown to $45,326!

- Netflix: A $1,000 investment when we doubled down in 2004 would now be $480,568!

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and this might be a rare opportunity.

Continue »

*Stock Advisor returns as of March 3, 2025.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury holds positions in Alphabet, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.