What Analyst Ratings Mean for Alibaba’s Future

When investors consider buying, selling, or holding a stock, they often turn to analyst recommendations for guidance. Reports on rating changes can sway a stock’s price significantly. But how important are these ratings really?

We will examine the current insights from Wall Street analysts on Alibaba (BABA) and evaluate the reliability of these brokerage recommendations, helping you make informed choices.

Current Analyst Recommendations for Alibaba

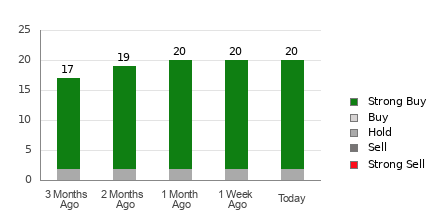

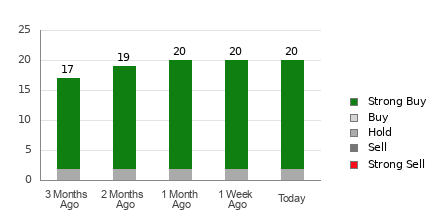

Alibaba has an average brokerage recommendation (ABR) of 1.20 on a scale from 1 to 5, where 1 represents Strong Buy and 5 signifies Strong Sell. This figure is derived from the recommendations made by 20 different brokerage firms. An ABR of 1.20 indicates a leaning toward Strong Buy.

Out of the 20 analysts, 18 have rated the stock as a Strong Buy, which makes up 90% of all recommendations.

Check price target & stock forecast for Alibaba here>>>

The Importance of Analyst Ratings

While the ABR suggests that buying Alibaba might be a smart move, relying solely on this information could be misguided. Studies show that brokerage recommendations often fail to lead investors toward stocks that will appreciate in value significantly.

This raises the question: Why might that be the case? Analysts at brokerage firms tend to carry a strong positive bias when rating stocks. Our research indicates that there are generally five “Strong Buy” ratings for every “Strong Sell.”

This imbalance can mislead retail investors, as analyst interests may not align with those of independent investors. Thus, using these ratings as a supplement to your own research can be more beneficial than relying on them alone.

Zacks Rank vs. ABR: Understanding the Difference

Here’s where things get a bit more technical. The Zacks Rank, a proprietary tool we offer with a rigorously proven track record, classifies stocks on a scale from 1 (Strong Buy) to 5 (Strong Sell), effectively predicting short-term stock performance. Pairing the ABR with Zacks Rank could enhance your investment strategy.

The ABR is distinctly calculated based on brokerage recommendations alone and is often expressed in decimal values (like 1.28). In contrast, the Zacks Rank utilizes earnings estimate revisions to create its scores, displayed as whole numbers—1 through 5.

Brokerage analysts tend to be overly optimistic due to their firm’s vested interests, leading to unbalanced ratings that may mislead investors.

On the flip side, the Zacks Rank is built on earnings estimate revisions, which have consistently shown a correlation with stock price movements over time.

Current Evaluation of Alibaba

Currently, the Zacks Consensus Estimate for Alibaba’s earnings has remained steady at $8.72 over the past month, painting a stable picture of the company’s financial outlook.

Analysts have maintained their views regarding Alibaba’s earnings potential, suggesting the stock may perform in line with the market in the short term.

Based on recent consensus estimates and several related factors, Alibaba holds a Zacks Rank of #3 (Hold). To discover the complete list of Zacks Rank #1 (Strong Buy) stocks, click here>>>>

In light of the ABR suggesting a Buy rating for Alibaba, a cautious stance may be wise.

Zacks Research Highlights Potential Winning Stocks

Our experts have pinpointed five stocks they believe hold the highest potential to gain over +100% in the coming months. Among these, Director of Research Sheraz Mian has spotlighted one particularly promising option.

This standout pick is part of a leading financial firm, boasting a rapidly expanding customer base of over 50 million, and offers a wide array of innovative solutions poised for significant growth. While past selections like Nano-X Imaging soared by +129.6% in just over nine months, not all of our top stock picks achieve the same level of success.

For more insights, view our top stock and 4 runners-up.

Looking for the latest recommendations from Zacks Investment Research? You can download our report on the 7 Best Stocks for the Next 30 Days to learn more.

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein reflect those of the author and do not necessarily represent those of Nasdaq, Inc.