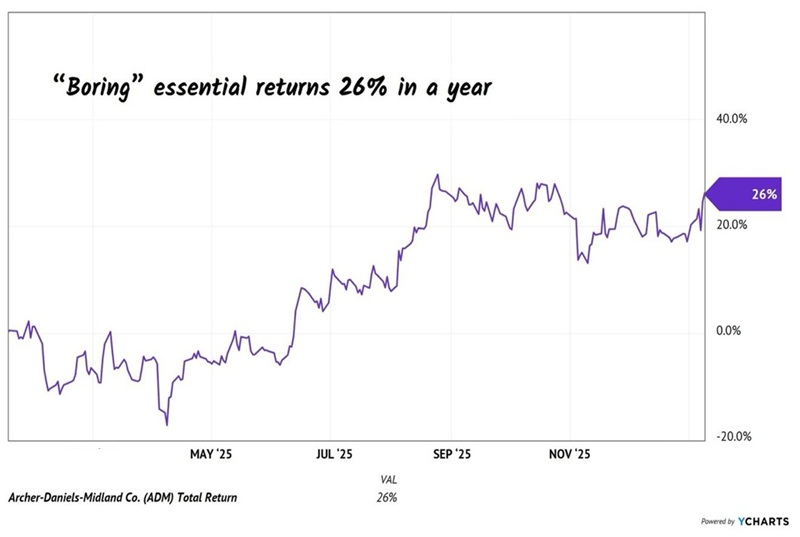

Archer-Daniels Midland (ADM) has delivered a notable 26% total return to investors over the past year, despite challenging market conditions. The company, known for processing essential food products, remains resilient as consumer demand for basic necessities persists, regardless of economic fluctuations.

Currently, ADM is optimizing its business by implementing cost-cutting measures expected to save between $500 million and $700 million annually over the next three to five years. The company’s aggressive share repurchase strategy has reduced its outstanding shares by 14% in the past five years, effectively boosting its earnings per share while maintaining its status as a “Dividend King” with over 50 consecutive years of dividend increases.

The firm is likely to benefit from new policies proposed by the EPA aimed at increasing demand for biomass-based diesel, which could enhance its profitability. As global populations continue to grow, ADM is positioned for long-term growth, making it a compelling choice for investors looking for steady returns amidst economic uncertainty.