Global Partners LP (GLP) operates one of the largest terminal networks for refined petroleum products in the Northeastern U.S. As crude oil prices have surged over 15% in the past month to over $70 per barrel amid fears of supply disruptions due to Middle Eastern tensions and Canadian wildfires affecting about 350,000 barrels of oil production daily, GLP is positioned to benefit.

Projected total sales for GLP are set to increase by 37% in fiscal 2025 to $23.55 billion, up from $17.16 billion last year, accompanied by an annual earnings growth of 18%. The company currently has a payout ratio of 94% and an annual dividend yield of 5.8%, having raised its payout 17 times in the last five years.

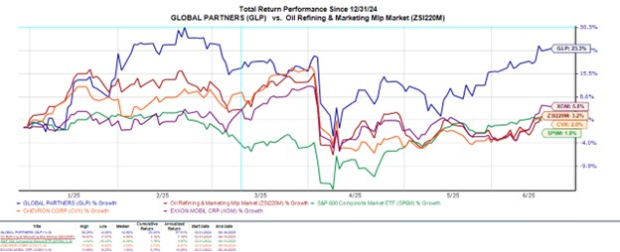

With a Zacks Rank #1 (Strong Buy), GLP’s performance has outpaced its market peers, showing a total return of +20% year-to-date without dividends. Earnings estimates for FY25 and FY26 have jumped more than 20% over the past two months, making GLP a potential strong addition to investors’ portfolios.