Investor sentiment is rising as expectations grow for the Federal Reserve to potentially cut interest rates in September, following positive July inflation data from the Consumer Price Index (CPI). Particularly, financial sectors, especially banks like JPMorgan (JPM) and Citigroup (C), are seen as likely beneficiaries of a steepening yield curve, which could enhance their profit margins.

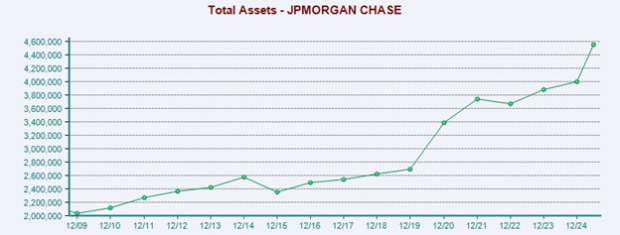

Both banks emerged favorably from the 2025 Dodd-Frank Act stress tests, with JPMorgan displaying a Common Equity Tier 1 (CET1) Capital Ratio of 15%, well above the required 4.5%. As the largest U.S. bank, JPMorgan holds over $4 trillion in total assets and has authorized a $50 billion share repurchase plan alongside a 7% dividend increase to $1.50 per share. Similarly, Citigroup raised its dividend by 7% to $0.60 per share and authorized a $20 billion share repurchase plan, maintaining a strong net cash position exceeding $400 billion.

Recent earnings estimate revisions also bolster the attractiveness of both stocks, with JPMorgan’s FY25 estimates up 5% to $19.50 and Citigroup’s projections indicating over 27% annual earnings growth. As the likelihood of a September rate cut increases, the outlook for these banks continues to strengthen.