Microsoft’s $3 Billion Bet on India’s AI Future

Microsoft (MSFT) is making waves with its announcement of a $3 billion investment aimed at boosting cloud and AI infrastructure in India over the next two years. This initiative is part of a broader strategy for global AI expansion and aligns closely with India’s ambition to become an AI-first nation by 2047. Microsoft plans to train 10 million Indians in AI skills by 2030, following the success of its ADVANTA(I)GE program, which has already reached 2.4 million participants. This demonstrates Microsoft’s thorough approach to developing the market.

Strengthening Ties with Indian Enterprises

Microsoft’s deep commitment is highlighted by its partnerships with significant Indian businesses. The collaboration with RailTel focuses on creating an AI Center of Excellence to transform public services. Additionally, partnerships with Apollo Hospitals for healthcare innovation and Bajaj Finserv in financial services illustrate the extensive adoption potential of these technologies. Notably, Bajaj Finance aims to evolve into a FinAI company, targeting 200 million customers while predicting annual savings of INR 150 crore by 2026. This is seen as a positive early sign for Microsoft’s investment strategy.

Working with the Mahindra Group spans multiple sectors including automotive, agriculture, and finance, aiming to develop several AI projects. Mahindra’s initiation of a dedicated AI Division signifies strong industry potential for Microsoft’s AI technologies.

Focusing on Innovation and Sustainability

Microsoft is not just investing financially; it is also building a foundation for future growth. Through its AI Innovation Network, in partnership with Microsoft Research, the company aims to create innovative solutions. Collaborations with Physics Wallah to enhance math skills and SaaSBoomi for startup support are expected to benefit over 5,000 startups and 10,000 entrepreneurs, potentially attracting $1.5 billion in venture capital. This approach positions Microsoft well in one of the fastest-growing digital economies.

Moreover, Microsoft’s focus on sustainable AI infrastructure includes initiatives like zero-water cooling data centers and renewable energy partnerships with companies such as Amplus and ReNew. The commitment of $15 million towards community environmental projects through the ReNew collaboration underscores a balanced strategy that could be vital for long-term success in India.

Positioning for Future Growth

Microsoft has established a solid foundation in India with three operational data center regions and a fourth slated for 2026. This current infrastructure, combined with global success from Copilot – which has seen a 70% adoption rate among Fortune 500 companies – indicates significant potential in the Indian market. The partnership with India AI, a part of Digital India Corporation, further cements Microsoft’s position in advancing AI technologies.

Plans to skill 500,000 individuals by 2026 through various initiatives and the establishment of AI Productivity Labs in 20 National Skill Training Institutes across 10 states demonstrate Microsoft’s comprehensive strategy to secure a competitive edge in India’s fast-evolving tech sector.

The Zacks Consensus Estimate for Microsoft’s fiscal 2025 revenues stands at $277.69 billion, showing a year-over-year growth rate of 13.29%. Earnings are projected at $12.92 per share, reflecting a 9.49% increase from the previous year.

Image Source: Zacks Investment Research

Outlook for Investors: 2025 and Beyond

Investors eyeing Microsoft stock for 2025 should keep several factors in mind. The two-year investment timeline indicates a gradual adaptation for revenue but also promises substantial infrastructure improvements. Key metrics to watch include the success rates of enterprise partnerships, the pace of data center builds, the uptake of AI skills training, and the growth of the startup ecosystem.

Given Microsoft’s momentum in global AI initiatives and Copilot’s success, this investment in India might facilitate further growth avenues. However, it may be prudent for investors to observe execution metrics throughout 2025 before adjusting their positions significantly. Microsoft’s robust AI portfolio and commitment to market development could significantly influence its long-term trajectory.

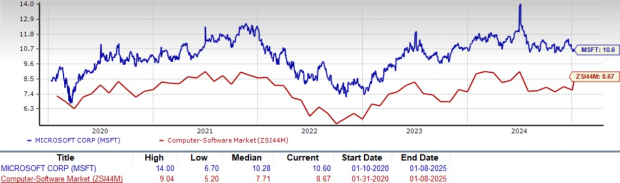

Microsoft’s current market valuation appears stretched, with a forward 12-month P/S ratio of 10.6X, which surpasses both the Zacks Computer – Software industry average of 8.67X and its historical median of 10.28X. This pricing reflects market optimism towards Microsoft’s future growth prospects, especially in cloud computing and AI, but raises questions about sustainability amidst elevated valuations.

Microsoft’s Valuation Metrics Under Scrutiny

Image Source: Zacks Investment Research

Investors should carefully evaluate the stock’s current premium valuation alongside its growth potential, especially considering a 13% price appreciation over the last year.

1-Year Stock Performance Overview

Image Source: Zacks Investment Research

Final Thoughts

As Microsoft advances its strategy in India through 2025, it is crucial for investors to track the evolution of enterprise partnerships, infrastructure advancements, and ecosystem development. While the potential for growth looks promising, the slow pace of technology adoption and the need for infrastructure enhancements suggest a cautious approach until more definitive execution indicators emerge. Currently, Microsoft holds a Zacks Rank of #3 (Hold). For a complete list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

Research Chief Names “Single Best Pick to Double”

Among countless stocks, five Zacks experts have pinpointed their top candidate expected to soar by over 100% in the near future. From these selections, Director of Research Sheraz Mian has identified one with the most explosive growth potential.

This company targets millennial and Gen Z consumers, raking in nearly $1 billion in revenue last quarter alone. A recent downturn makes this an ideal entry point. Not all Zacks recommendations succeed, but this particular one may outperform past picks like Nano-X Imaging, which surged by 129.6% in just over nine months.

Free: Discover Our Top Stock and Four Notable Alternatives

Interested in the latest stock recommendations from Zacks Investment Research? Today, you can download the 7 Best Stocks for the Next 30 Days report for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.