Nvidia Stock: A Bargain in a Bear Market?

With the Nasdaq Composite now in bear market territory, several stocks are being viewed as bargains compared to their prior valuations. Among them is Nvidia (NASDAQ: NVDA), a standout performer since 2023.

Currently down about 35% from its all-time high, investors may be contemplating whether acquiring Nvidia now presents a once-in-a-lifetime opportunity for substantial returns. Is this true, or is Nvidia a potential value trap?

Where to invest $1,000 right now? Our analyst team has revealed what they consider the 10 best stocks to buy at this moment. Learn More »

The AI Race Is Still On

Nvidia has risen to prominence due to its crucial role in the ongoing AI race. The company manufactures graphics processing units (GPUs), essential tools that power many contemporary AI models. These GPUs can perform numerous calculations simultaneously, and their efficiency increases significantly when multiple GPUs work in clusters. This functionality provides immense computing power, crucial for training advanced generative AI models.

Despite Nvidia’s prominence, its stock has seen declines primarily due to market concerns that its largest clients—the AI hyperscalers—might reduce their data center investments. This hesitation is attributed to fears of an imminent recession, sparking caution regarding President Donald Trump’s tariff plan.

I acknowledge the validity of some concerns, yet I believe the AI race’s significance cannot be overstated. The hyperscalers possess formidable cash flows capable of sustaining data center investments, even amid temporary business challenges. Consequently, Nvidia’s growth trajectory remains mostly intact, suggesting that current stock prices may represent considerable bargains relative to prior months.

A Bright Future for Nvidia

Nvidia’s build-out projections further support the case for investing now. At the company’s 2025 GTC event, CEO Jensen Huang predicted that global data center capital expenditures would surge to $1 trillion by 2028. Given that 2024 witnessed around $400 billion in such expenditures and Nvidia generated $130 billion over the past year, this projection suggests a bright future for Nvidia’s Stock.

If Nvidia maintains its share of the expanding data center budget, it could potentially achieve around $325 billion in revenue from data centers alone by 2028, signifying impressive growth. Assuming a more conservative approach, estimating a more modest growth of $228 billion in additional revenue over the next four years would also be favorable.

Proceeding with a cautious outlook is prudent, especially with rising competition seeking to capture Nvidia’s market share. Custom AI accelerators pose the most significant threat, as they can outperform GPUs under certain workloads. Additionally, there remains uncertainty regarding the actual scale of data center expansions and whether the $1 trillion milestone will be achieved.

Even under conservative estimates, Nvidia’s stock appears to be a promising investment. If profits reach $127 billion based on the projected revenue growth by the end of 2028 and profit margins are maintained, Nvidia’s stock value should reflect this growth.

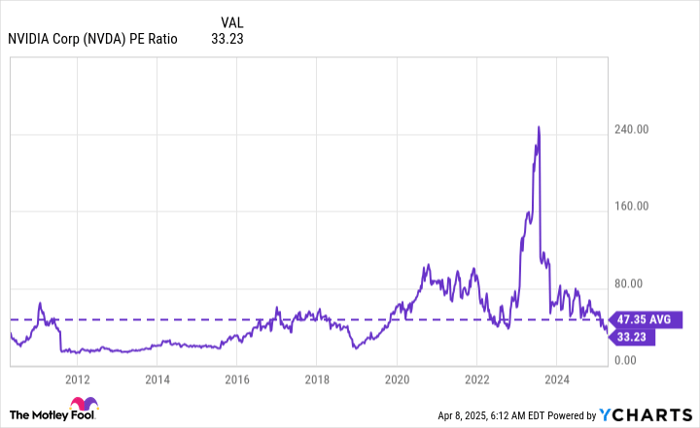

Although Nvidia’s stock valuation has decreased considerably in recent months, it is historically common for the shares to command a high valuation. For our analysis, we will assume the price-to-earnings (P/E) multiple for Nvidia will be around 30.

NVDA PE Ratio data by YCharts.

If we apply a P/E multiple of 30 to the forecasted $127 billion in profits, Nvidia’s market capitalization could reach around $3.81 trillion by the end of 2028. In contrast, with its current valuation at $2.38 trillion, this suggests Nvidia’s stock may hold approximately 60% upside from present levels.

These projections are based on conservative estimates. Therefore, I consider Nvidia an attractive stock to buy right now as its future growth is not fully reflected in its current price. However, potential investors should temper expectations regarding extraordinary returns compared to past performance.

Should You Invest $1,000 in Nvidia Now?

Before purchasing Nvidia Stock, it’s important to evaluate the following:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks for today’s investors—and Nvidia did not make the list. The stocks selected could yield significant returns in the years to come.

For instance, when Netflix was recommended on December 17, 2004, a $1,000 investment then would now be worth $496,779!* Similarly, if you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, you’d be looking at $659,306!*

It’s noteworthy that Stock Advisor has achieved a total average return of 787 % — significantly outperforming the 152 % return of the S&P 500. Don’t miss the latest top 10 stocks list when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of April 10, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.