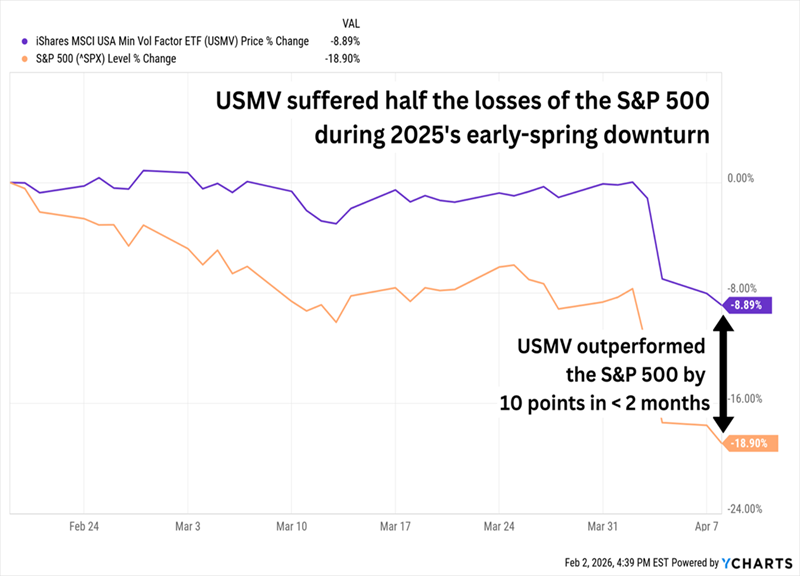

As the S&P 500 experiences heightened volatility, low-beta stocks are being highlighted as effective defensive investments. Stocks with betas below 1 are less volatile; for example, a stock with a beta of 0.5 would be expected to drop half as much as the S&P during a downturn. The iShares MSCI USA Min Vol Factor ETF (USMV) serves as a prime example, having only declined 9% during a period when the S&P 500 fell by 19%.

Several low-beta dividend stocks are now under consideration, notably Apple Hospitality REIT (APLE) with an 8.1% dividend yield, Campbell’s Co. (CPB) at 5.8%, Kraft Heinz (KHC) yielding 6.7%, and Flowers Foods (FLO) with an 8.4% yield. Each of these has unique circumstances impacting their performance and stability, with Campbell’s struggling with a three-year price decline, Kraft planning a corporate split, and Flowers facing debt challenges as it heads to the Supreme Court next month regarding a labor arbitration case.

Progressive Insurance (PGR) and Gaming & Leisure Properties (GLPI) are also noteworthy mentions. PGR is currently adapting its business with AI and boasting a yield around 7%, while GLPI maintains a stable dividend growth plan amid an unforgiving gaming landscape. Each of these stocks offers differing yields and degree of volatility, catering to investors looking to navigate current market uncertainties.