Investing in Uncertain Times: Is Kraft Heinz the Safe Bet?

Stock markets experience fluctuations regularly, impacting how investors react emotionally. Presently, many are selling assets while scouting for safer investments. One notable beneficiary has been high-yielding Kraft Heinz (NASDAQ: KHC). But is this the right refuge for investors?

Understanding Market Corrections

When Stock markets decline beyond significant benchmarks, the worry escalates. A ‘correction’ occurs when an index, notably the Nasdaq Composite, drops 10% from its peak. Corrections happen frequently and often serve as the precursor to a bear market, identified by a 20% or greater decline. Currently, fear appears to be permeating the market sentiment.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy now. Learn More »

Stock graph in front of them.” src=”https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F810659%2F23_11_28-a-person-covering-their-eyes-with-a-computer-image-of-a-falling-Stock-graph-in-front-of-them-_mf-dloadgettyimages-1409300273-1200×800-5b2df79.jpg&w=700″>

Image source: Getty Images.

Investor Behavior During Market Drops

As the market dips, two primary actions unfold. First, investors often sell beloved assets to mitigate possible losses. Consequently, this creates cash reserves prompting a search for safer investment options. Historically, consumer staples have been a common choice in turbulent times.

Focusing on consumer staples makes practical sense. These companies produce everyday essentials like toilet paper and food, which consumers continue to purchase even during economic downturns. Kraft Heinz stands tall as a consumer staples powerhouse and offers an attractive dividend yield of approximately 5%.

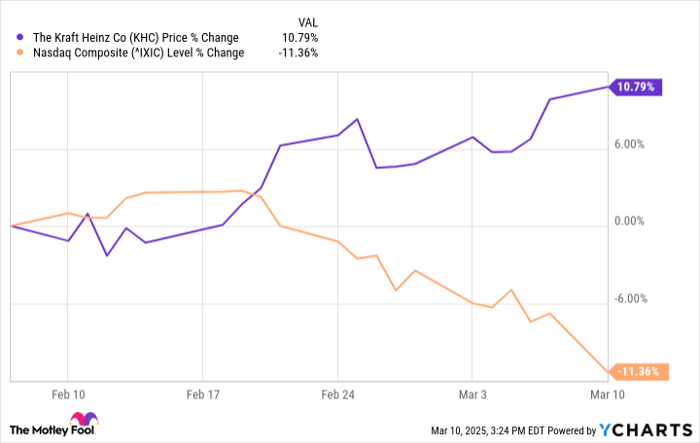

KHC data by YCharts.

Evaluating Kraft Heinz as a Safe Haven

The recent month saw the Nasdaq Composite decline around 10%, whereas Kraft Heinz’s Stock price increased by 10%, showcasing a 20% outperformance. This shift indicates a cautious, risk-averse investor sentiment. However, it’s crucial to avoid the trap of indiscriminate selling or buying.

Kraft Heinz’s dividend yield remains significantly higher than the consumer staples average of 2.6%. This premium yield stems from ongoing business challenges that the company has faced since the merger of Kraft and Heinz several years prior.

The initial merger intention was to streamline costs to boost profitability. However, there is a limit to cost-cutting before strategic revitalization becomes necessary. Following a management overhaul, Kraft Heinz pivoted towards enhancing its significant brands—a strategy similar to what proved successful for Procter & Gamble.

The challenge is that many of these key brands have struggled to gain traction. In the fourth quarter of 2024, organic sales for its priority brands fell by 5.2%, continuing a trend from previous quarters. The overall trajectory indicates a concerning performance rather than recovery.

While there’s potential for Kraft Heinz to regain growth, the current state of business does not fit the profile of a secure investment. Buyers should recognize that this stock represents a turnaround rather than a safe haven.

Considering Alternative Investments

For investors looking for stability during a market correction, opting for an exchange-traded fund (ETF), such as the Consumer Staples Select Sector SPDR ETF, might provide a more balanced and diversified approach. If stock selection is a priority, more consistent options like Coca-Cola or PepsiCo could prove to be better investments based on their robust fundamentals.

Exploring New Investment Opportunities

Feeling like you’ve missed out on prime investments in successful stocks? Our expert analysts occasionally issue a “Double Down” Stock recommendation for companies poised for substantial growth. If you’re concerned about missing your investment opportunity, now may be the right moment to act. The figures highlight potential success:

- Nvidia: Investing $1,000 when we doubled down in 2009 would yield $292,207!*

- Apple: A $1,000 investment in 2008 would now be worth $45,326!*

- Netflix: Investing $1,000 in 2004 would result in $480,568!*

Currently, we have “Double Down” alerts for three promising companies that may not present another similar chance soon.

Continue »

*Stock Advisor returns as of March 10, 2025

Reuben Gregg Brewer has positions in PepsiCo and Procter & Gamble. The Motley Fool recommends Kraft Heinz. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.