Investing in Technology Stocks Amid Tariff Concerns

President Donald Trump’s tariffs have unsettled the stock market. The future of the trade war with China and other countries remains uncertain, potentially impacting global supply chains significantly.

Despite this, now may not be the time to hold back on investing, particularly in 2025. Instead, it could be wise to invest when others are hesitant. Technology stocks, in particular, seem promising. Market fears regarding how the trade war might affect the profits of major tech companies in 2025 present a buying opportunity for long-term investors.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy. Learn More »

Leading the Charge in Semiconductor Supply

Semiconductors hold strategic importance for the U.S., China, and other nations. Without them, the global economy would struggle to function efficiently. One key player in this sector is Taiwan Semiconductor Manufacturing (NYSE: TSM), commonly referred to as TSMC.

TSMC manufactures chips for giants like Nvidia, Amazon (NASDAQ: AMZN), and Alphabet. With factories in Taiwan and the U.S., the company is planning further expansions in the coming years.

The firm recently announced a significant expansion in the U.S., committing to invest an additional $100 billion domestically. Countries are eager for resilient semiconductor supply chains, as these chips are essential for cloud computing, artificial intelligence (AI), and electric vehicles.

TSMC’s main source of revenue comes from AI and cloud computing. Last quarter, 59% of its revenue stemmed from high-performance computing (HPC), a 7% increase from the previous quarter. With the AI market booming, TSMC anticipates continued growth in this area. It forecasts revenue to rise by more than 20% year over year in 2025.

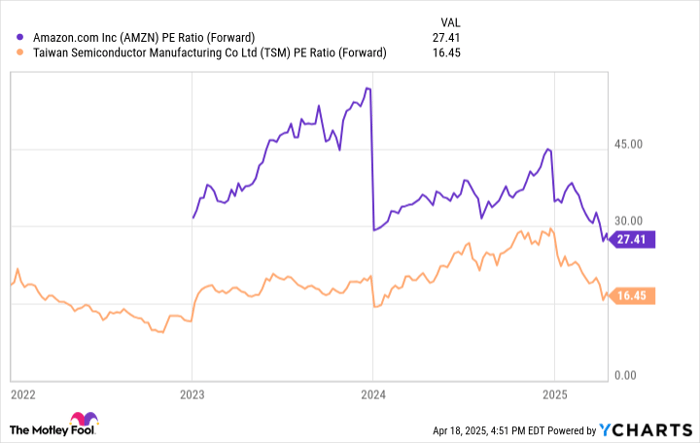

Currently, TSMC shares are priced with a forward price-to-earnings (P/E) ratio of 16.5, which appears low for a company benefiting from substantial industry trends and a leading position in semiconductor manufacturing.

AMZN PE Ratio (Forward) data by YCharts; PE = price to earnings.

Amazon Positioned for Future Success

Another technology company offering a compelling opportunity is Amazon, which is also a customer of TSMC. The company’s stock has faced pressure due to tariffs, but its extensive diversification positions it well for sustainable growth. While tariffs may challenge Amazon’s e-commerce sellers tied to Chinese manufacturing, the company provides a marketplace for goods, coupled with vital services like fulfillment, advertising, and Prime subscriptions.

Amazon’s robust North American retail revenue, approximately $400 billion, is likely to continue increasing. Moreover, the crown jewel of the business, Amazon Web Services (AWS), is experiencing significant tailwinds from AI-related spending due to its high computation needs.

Currently, AWS revenue is growing at 19% year over year, exceeding $100 billion annually. Its operating income in 2024 approached $40 billion, illustrating the division’s impressive profit margins. With the enduring trend of cloud adoption over traditional data centers, AWS is positioned to maintain robust revenue growth for years to come.

Following an early 2025 downturn, Amazon stock is trading at a historically low forward P/E ratio of 27.4. While this might not seem exceptionally cheap, the company has ample opportunity to enhance its profit margins, which currently are around 11% in 2024. With AWS’s rapid expansion, margins could realistically exceed 15% in the next few years, suggesting significant potential for profit growth.

Therefore, investing in Amazon, along with Taiwan Semiconductor Manufacturing, emerges as a strong opportunity in today’s market climate.

Should You Invest $1,000 in Amazon Now?

Before purchasing stock in Amazon, it’s important to consider this:

The Motley Fool Stock Advisor analyst team recently identified the 10 best stocks to invest in, and Amazon didn’t make the list. These chosen stocks have the potential for exceptional returns in the upcoming years.

For instance, when Netflix was recommended on December 17, 2004, a $1,000 investment would now be worth $532,771!* Similarly, if you invested $1,000 in Nvidia when it was recommended on April 15, 2005, it would be worth $593,970!*

Overall, the Stock Advisor has delivered an impressive average return of 781 %, far outperforming the S&P 500’s return of 149% over the same period. Don’t miss out on the latest top ten list when you join Stock Advisor.

*Stock Advisor returns are as of April 21, 2025.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, also holds a board position with The Motley Fool. Brett Schafer owns shares in Alphabet and Amazon. The Motley Fool has investments in and recommends Alphabet, Amazon, Nvidia, and Taiwan Semiconductor Manufacturing. For more details, review The Motley Fool’s disclosure policy.

The views and opinions expressed here represent those of the author and do not necessarily reflect those of Nasdaq, Inc.