Evaluating AI Stocks: BigBear.ai and SoundHound AI’s Potential

As the market faces recent volatility, investors are identifying potential buying opportunities within emerging artificial intelligence companies.

Two companies gaining attention are BigBear.ai BBAI and SoundHound AI SOUN, both trending on Zacks.com. They are part of the Zacks Computers-IT Services Industry, which ranks in the top 33% of approximately 246 Zacks industries.

Let’s evaluate the investment potential for BigBear and SoundHound, with their current stock prices at $4 and $10, respectively.

Company Profiles: BigBear & SoundHound

BigBear, founded in Maryland, became public in 2021. It specializes in artificial intelligence, machine learning, cloud analytics, and cyber engineering. On the other hand, SoundHound, based in New York, launched its IPO in 2022 and focuses on conversational AI, providing businesses with an independent voice AI platform.

Revenue Growth Trends

Currently, both companies are not profitable but show promising revenue growth that could reflect future earnings potential.

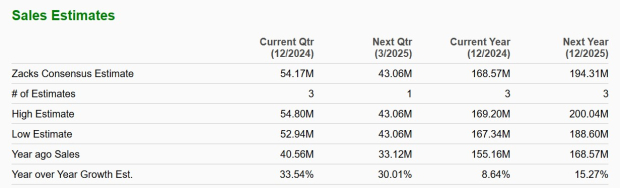

For fiscal 2024, BigBear’s sales are expected to increase by 8% to $168.57 million, up from $155.16 million in 2023. More promisingly, sales are projected to climb an additional 15% to $194.31 million in FY25. Investors can anticipate BigBear’s Q4 results to be released after-market hours on Thursday, March 6.

Image Source: Zacks Investment Research

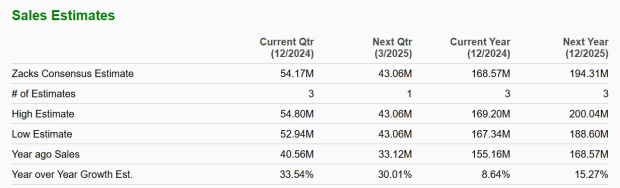

SoundHound, in contrast, nearly doubled its sales in FY24 to $85 million, with projections indicating a remarkable 96% increase to $166.2 million in the current year.

Image Source: Zacks Investment Research

Path to Profitability

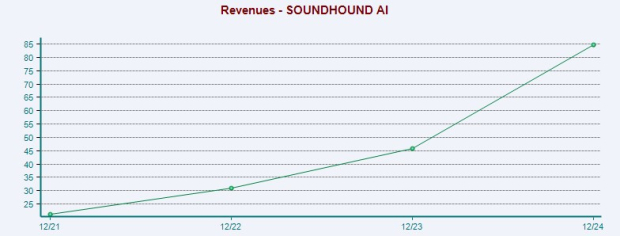

According to Zacks estimates, BigBear is expected to report an adjusted loss of -$0.75 per share in FY24, compared to -$0.40 in 2023. However, a smaller loss of -$0.20 per share is forecasted for FY25.

Image Source: Zacks Investment Research

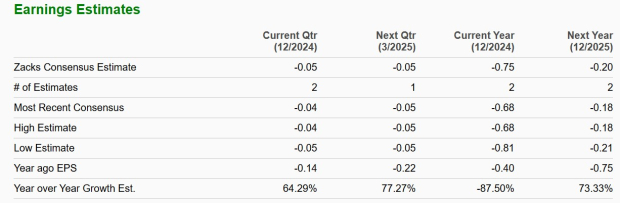

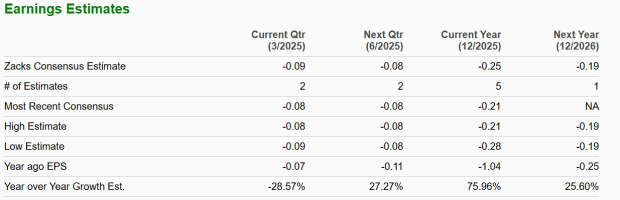

For SoundHound, the adjusted loss is projected at -$1.02 in FY24, a decline from -$0.38 in 2023. However, the company may get closer to profitability in FY25 and FY26, with estimated losses of -$0.25 and -$0.19 per share, respectively.

Image Source: Zacks Investment Research

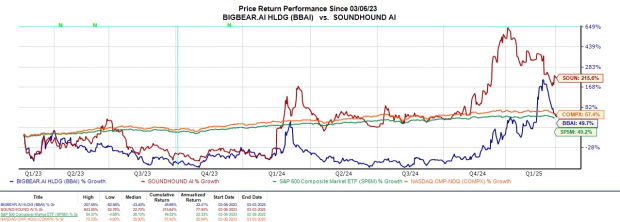

BBAI & SOUN Stock Performance

So far this year, BigBear’s stock has risen by 10%, while SoundHound shares have fallen by approximately 47% following an earnings loss that exceeded expectations for Q4 last Thursday. However, over the last two years, SoundHound’s stock has increased by more than 200%, and BigBear’s shares have gained 50%.

Image Source: Zacks Investment Research

Conclusion

Currently, BigBear and SoundHound hold a Zacks Rank #3 (Hold). Their revenue growth appears promising, which may enhance the risk-reward balance for potential investors. However, it is important for investors to keep an eye on their balance sheets, given that BBAI and SOUN are speculative stocks in the early stages of their business cycles.

Recently Released: Zacks Top 10 Stocks for 2025

Don’t miss the chance to explore our top ten stocks for 2025. Chosen by Zacks Director of Research Sheraz Mian, this collection has seen remarkable success. From its inception in 2012 through November 2024, the Zacks Top 10 Stocks portfolio has soared by +2,112.6%, significantly outpacing the S&P 500’s +475.6%. Sheraz has carefully selected the best ten companies to buy and hold for 2025.

BigBear.ai Holdings, Inc. (BBAI) : Free Stock Analysis Report

SoundHound AI, Inc. (SOUN) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.