CEFs Flourish Amid Strong Stock Market in 2024

This year has been positive for the stock market, and closed-end funds (CEFs) yielding over 8% have also thrived. It’s no surprise; many CEFs invest in stocks and bonds from publicly traded companies, so when stocks perform well, CEFs usually follow suit.

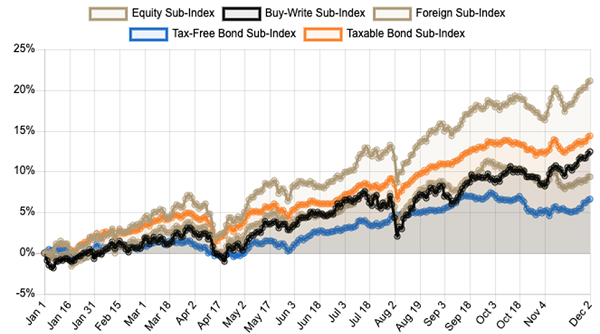

Strong Performance in CEFs

Source: CEF Insider

According to the proprietary indexes utilized by my service, CEF Insider, the equity sub-index leads with a remarkable 21% total return year-to-date. Corporate bonds follow closely at 14.3%. Municipal bonds, known for having lower volatility, have returned 6.6%, while foreign assets have risen by 9.4%.

Overall, CEF investors have benefited, particularly from high average yields of 8.2%. Yet, some funds have experienced downturns this year, despite generally rising profits across the board. It’s essential to explore the reasons behind these declines.

Examining underperforming CEFs will help identify funds to avoid in the future, and may even reveal buying opportunities if these funds have hit rock bottom.

CEF #1: Trouble for the Mexico Fund

We begin with the Mexico Fund (MXF), which I rarely discuss. One positive aspect is its 6.5% yield, which has been increasing since the pandemic. Unfortunately, this dividend isn’t enough to offset a decline in the fund’s market price this year, leading to a lower total return.

MXF’s Quick Decline

Over the past decade, MXF has struggled. It seemed to turn around earlier this year with a 2.7% annualized return after years of losses. Sadly, that gain has evaporated, and the fund now faces a 25.1% annualized loss for 2024, even taking into account its distributions.

Promises Followed by Losses

This decline began in spring, primarily due to Mexico’s low growth projections, with expected decreases from 3.3% in 2023 to 1.6% in 2024. Potential trade tariffs on U.S. exports only compound the risks facing investors in funds like MXF.

CEF #2: Highland Opportunities Faces Challenges

While MXF’s troubles stem from external trends, the Highland Opportunities and Income Fund (HFRO) has seen a price decline of 19.5% year-to-date due, in part, to management decisions. As of now, this is based on the fund’s market price-based total return (represented by the purple line below).

Interestingly, HFRO’s total return based on net asset value (NAV), which includes dividends, remains positive (illustrated by the orange line). Since CEFs have fixed share counts, discrepancies between NAV and market price can produce opportunities for investors.

HFRO’s Mixed Performance

Despite the relative stability in HFRO’s market price since summer, management has options to enhance returns. The fund’s name, “Highland Opportunities,” implies potential investments in a range of real estate and debt options, alongside equities. What has hindered this fund from making progress?

Upon review of HFRO’s key holdings, we notice that a significant portion of the investments comes from NexPoint properties:

Source: NexPoint Asset Management

While NexPoint likely believes their assets offer prime investment opportunities, the expected returns for investors have not materialized. The market’s perception reflects this, as HFRO’s discount has widened from 40% at the start of 2024 to over 50% now. Although this 8.7% yield could attract bids, significant gains remain improbable unless management alters its approach.

CEF #3: Underperformance for the Morgan Stanley China A Share Fund

The Morgan Stanley China A Share Fund (CAF) has become the third-worst performer in 2024, down 2.7% as of now. Oddly, this particular CEF is not focused on generating major income, as it only provides one varying distribution per year, translating to a yield of just 1% based on the last 12 months.

CAF’s decline cannot be attributed to unfavorable macroeconomic factors, unlike MXF. CAF invests in a market—China’s—that has largely prospered this year.

CAF’s Underwhelming Returns

While management decisions play a role in this underperformance, it’s worth noting CAF’s total NAV return is nearly up 3%. Similar to HFRO, CAF’s market position has also slipped, resulting in a larger discount during the year, currently at a markdown of 18.5%.

“`html

CAF’s Market Moves Highlight Fund Risk

Understanding CAF’s Recent Performance

The significant closing of CAF’s discount in February was followed by a rapid decline later that month. This situation reveals the risks involved: Speculation led to an increase in CAF’s market price earlier this year (as shown by the orange line below). However, the fund’s net asset value (NAV) remained unchanged (depicted by the light blue line), contributing to a drop in CAF’s market price (represented by the purple line).

Market Enthusiasm Turns to Loss

The surge in interest around this fund raises caution. It was unjustified for CAF to be priced higher than before, yet that occurred when trading volume increased. When these trades unwound later that month, losses persisted, and the fund has struggled to recover since March.

Conclusion

While these funds are not the worst options available in the closed-end fund (CEF) space, they are clearly facing challenges. Investors could have steered clear of potential pitfalls, particularly since 2024 has been favorable for American investments. Finance experts had advised avoiding CAF and MXF funds. Presently, while there are signs of improvement for HFRO, our preference lies with the average total return of 21.8% from the four corporate-bond funds in our CEF Insider portfolio as of now.

Exciting Opportunities for 2025: 4 AI Funds Offering 9.8% Yields

The discussion surrounding AI has reached a saturation point; however, if you missed the chance to invest in stocks like NVIDIA (NVDA) before their price surge, you might assume the opportunity has slipped by.

This is a misconception.

Currently, four CEFs present a chance to gain from transformative AI technology at an attractive price while also benefiting from a substantial 9.8% dividend.

With AI increasingly becoming integrated into various applications and devices, it is crucial to act quickly. As more investors look towards these overlooked funds, make sure you don’t miss your opportunity. Click here to discover these 4 unique “AI-Powered” investments and access a free Special Report detailing their names and tickers.

Also see:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`