“`html

Vertiv Holdings Co. (VRT) is scheduled to announce its third-quarter 2025 results on October 22, 2025. The company forecasts revenues between $2.51 billion and $2.59 billion, with organic net sales expected to rise by 20% to 24%. Non-GAAP earnings are anticipated to range from 94 cents to $1 per share.

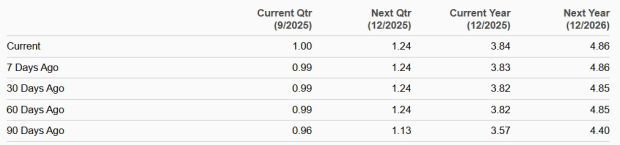

The Zacks Consensus Estimate for Q3 2025 revenues is $2.58 billion, reflecting a year-over-year growth of 24.6%, while the earnings consensus is set at $1 per share. Vertiv has outperformed earnings expectations in the past four quarters with an average surprise of 10.65%.

Year-to-date, Vertiv shares have surged 53.2%, surpassing the Zacks Computer & Technology sector’s growth of 23.1% and outperforming peers like Schneider Electric and Eaton. Despite strong growth prospects, the company faces challenges including execution issues and tariff costs, particularly impacting the EMEA region where sales are projected to be flat compared to 2024.

“`