The Zacks Rank is an instrumental component of Zacks’ suite of products, providing investors with promising strategies daily. By leveraging Zacks’s exclusive earnings trend models, we unearth stocks with the highest potential for upward mobility.

Here, I present a diverse trio of stocks embodying top Zacks ranks, poised to enrich your investment portfolio.

Fiverr International: Gigs, Growth, and Grit

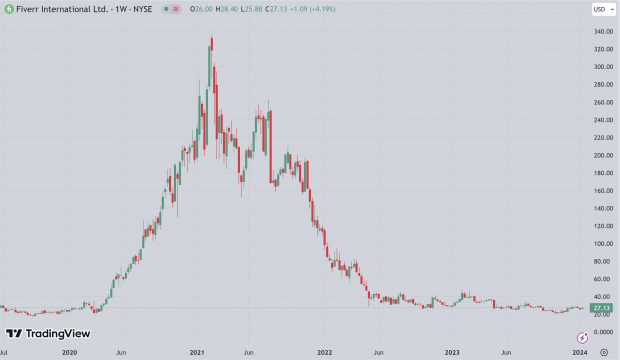

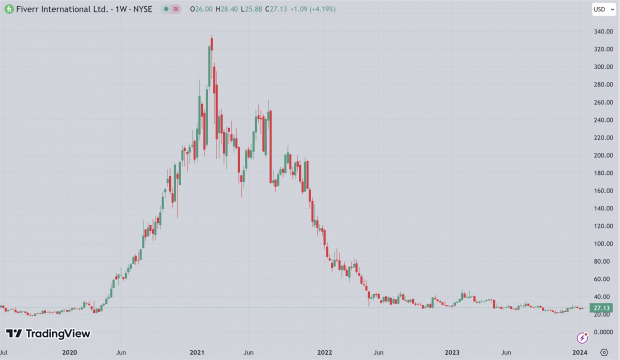

Fiverr International FVRR is a pioneering online platform linking businesses with freelancers providing an array of digital services. Launched in 2010, Fiverr enables individuals to offer services, or “gigs,” spanning graphic design, writing, programming, and marketing. The platform’s unique model empowers freelancers to set their service prices, commencing at $5, thus earning it the moniker “Fiverr.” FVRR has undergone a rollercoaster journey from IPO to the post-Covid era and into the present day. At present, the stock is trading below its IPO price in early 2019. Nevertheless, Fiverr International has achieved remarkable sales growth since its IPO, soaring from $76 million to $353 million annually.

Image Source: TradingView

Earnings projections for the freelancer marketplace have seen an upward trajectory for several months, earning it a Zacks Rank #1 (Strong Buy) rating. Forecasted FY24 sales are set to climb 12.5% YoY to $408 million, with anticipated EPS growth of 24% YoY to $2.37 per share.

Furthermore, based on next year’s earnings estimates, FVRR is trading at a mere one-year forward earnings multiple of 11.7x, representing an exceedingly low valuation for an internet company with substantial gross margins and robust sales growth.

Constellation Energy Corporation: Powering Progress, Energizing Investments

Constellation Energy Corporation CEG stands as the nation’s foremost producer of carbon-free energy, supplying 20 million homes and contributing 10% of the country’s renewable electricity supply. Through its diverse energy assets, including nuclear, hydro, wind, and solar generation facilities, it leads the industry’s transition to sustainable utilities.

Owing to its classification as both a utility stock, typically held for stable, low volatility returns, and an innovative, renewable energy enterprise, CEG embodies limited downside risks and asymmetric upside potential.

Constellation Energy Corporation boasts a substantial uptrend in earnings revisions, securing a Zacks Rank #1 (Strong Buy) rating. Projected EPS growth stands at an impressive 26.3% annually over the next 3-5 years.

Moreover, CEG is trading at a one-year forward earnings multiple of 17.6x, slightly surpassing the industry average yet remaining below its two-year median of 20.2x. Additionally, bolstered by robust earnings growth forecasts and an attractive valuation, Constellation Energy enjoys a PEG Ratio of merely 0.67x, signifying a discounted valuation.

Toyota Motors: Driven by Excellence, Racing to Rewards

Toyota Motors TM serves as a global automotive heavyweight headquartered in Japan, ranking among the largest automakers globally. Established in 1937, Toyota boasts a distinguished track record in producing a diverse array of vehicles, including sedans, SUVs, trucks, and hybrids.

The company has been an industry trailblazer in manufacturing practices, particularly renowned for its “Toyota Production System,” emphasizing efficiency and quality. Toyota maintains a global footprint, with subsidiaries and manufacturing facilities across various countries.

Toyota Motors has witnessed substantial earnings estimates revisions over recent months, earning it a Zacks Rank #1 (Strong Buy) rating. Current quarter earnings estimates have surged by 70%, with FY24 estimates climbing by 11.4%. FY24 earnings are also anticipated to escalate by 45% YoY to $19.31 per share.

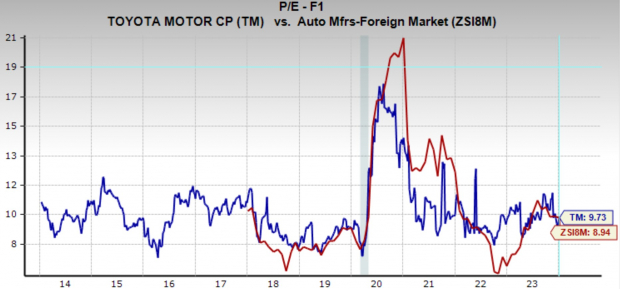

Image Source: Zacks Investment Research

EPS at TM are projected to grow at 24.6% annually, while the company is trading at a forward earnings multiple of merely 9.7x, bestowing the auto manufacturer with a PEG Ratio of just 0.4x, denoting an exceedingly alluring valuation.

Bottom Line