Class Action Filed Against Solaris Energy Over Misleading Claims

Glancy Prongay & Murray LLP (“GPM”) has filed a class action lawsuit in the United States District Court for the Southern District of Texas, titled Pirello v. Solaris Energy Infrastructure, Inc., et al., Case No. 25-cv-01455. This case is on behalf of individuals and entities who purchased or acquired Solaris Energy Infrastructure, Inc. (“Solaris” or the “Company”) SEI securities between July 9, 2024, and March 17, 2025 (the “Class Period”). The plaintiff’s claims are made under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 (the “Exchange Act”).

Investors are notified that they have 60 days from the date of this notice to request the Court to appoint them as lead plaintiff in this action.

IF YOU SUFFERED A LOSS ON YOUR SOLARIS INVESTMENTS, CLICK HERE TO INQUIRE ABOUT POTENTIALLY PURSUING CLAIMS TO RECOVER YOUR LOSS UNDER THE FEDERAL SECURITIES LAWS.

What Occurred?

On July 9, 2024, Solaris announced its agreement to acquire Mobile Energy Rentals LLC (“MER”). The acquisition was completed on September 11, 2024.

However, on March 17, 2025, Morpheus Research published an investigative report. The report alleged that MER was merely a “$2.5 million revenue equipment leasing business based out of a condo with zero employees, no turbines, and no track record in the mobile turbine rental industry.” It further disclosed that one of MER’s co-owners, John Tuma, had a criminal record, including “environmental crimes and lying to the court ‘on multiple occasions under oath.'” The report detailed Tuma’s involvement in an “$800 million gas turbine scandal” characterized by bid rigging and corruption. Furthermore, it noted that despite being a small local switchgear rental business at the end of 2023, MER underwent significant changes prior to its acquisition, acquiring most of its turbines financed through $71 million in debt, which Solaris later assumed. Contrary to claims made by Solaris regarding a “contracted and diversified earnings stream,” it was revealed that “96% of its Power Solutions revenue was derived from a single customer.”

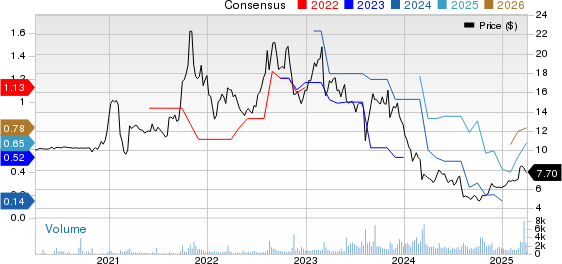

Following this news, Solaris’ stock price plummeted by $4.15, or 16.9%, closing at $20.46 per share on March 17, 2025, with unusually high trading volume.

What Are The Lawsuit’s Allegations?

The class action complaint alleges that throughout the Class Period, the Defendants made materially false and misleading statements, neglecting to disclose significant adverse facts about the Company’s operations and prospects. The lawsuit claims that the Defendants failed to inform investors that: (1) MER had negligible corporate history in mobile turbine leasing; (2) MER lacked a diversified earnings stream; (3) MER’s co-owner was a convicted felon linked to turbine-related fraud allegations; (4) this meant Solaris overstated the acquisition’s commercial prospects; (5) Solaris inflated profitability metrics by failing to properly depreciate its turbines; and (6) as a result, the Defendants’ positive assertions about the Company’s prospects were materially misleading and lacked a reasonable basis.

If you purchased or acquired Solaris securities during the Class Period, you may move the Court within 60 days from the date of this notice to request the Court to appoint you as lead plaintiff.

Contact Us To Participate or Learn More:

To learn more about this action or if you have questions regarding this announcement or your rights in these matters, please contact:

Charles Linehan, Esq.,

Glancy Prongay & Murray LLP,

1925 Century Park East, Suite 2100,

Los Angeles, California 90067

Email: [email protected]

Telephone: 310-201-9150,

Toll-Free: 888-773-9224

Visit our website at www.glancylaw.com.

Follow us for updates on LinkedIn, Twitter, or Facebook.

When contacting via email, please include your mailing address, telephone number, and the number of shares purchased.

To be part of the Class, you do not need to take any immediate action. You may hire your counsel of choice or remain an absent member of the Class without taking action.

This press release may be viewed as Attorney Advertising in some jurisdictions according to applicable laws and ethical rules.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250328953399/en/

Contact Us:

Glancy Prongay & Murray LLP,

1925 Century Park East, Suite 2100

Los Angeles, CA 90067

Charles Linehan

Email: [email protected]

Telephone: 310-201-9150

Toll-Free: 888-773-9224

Visit our website at: www.glancylaw.com.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.