Costco’s Mixed Q4 Performance Impact on Stock

Costco’s stock has decreased by 2.9% following its Q4 fiscal 2024 earnings report. This drop is influenced by negative market sentiment due to global tensions and mixed results in the last quarter. While earnings beat expectations, revenues fell short, suggesting cautious consumer behavior.

Image Source: Zacks Investment Research

Renewal rates in the U.S. and Canada slightly dropped to 92.9%, but an increase in paid household members and executive memberships indicates Costco’s strong customer loyalty and sales growth.

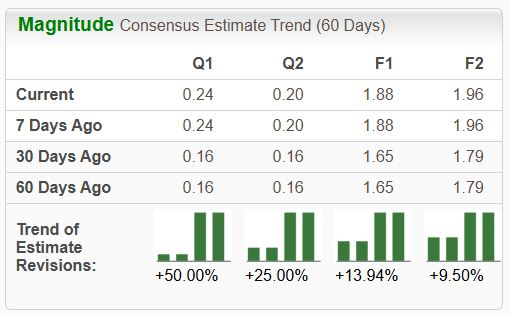

Costco’s Future Outlook and Analyst Forecasts

The Zacks Consensus Estimate for Costco’s earnings per share has been revised upwards, indicating positive sentiment. Estimates for the current and next fiscal year show expected growth rates of 10.1% and 8.8%, respectively. This steady growth trend is supported by Costco’s proven business model and membership renewal rates.

Image Source: Zacks Investment Research

Analyst Positivity Towards Costco Stock

Costco’s membership-based model and efficient operations drive its growth amidst competition. High renewal rates and strategic pricing ensure a loyal customer base. Analysts are optimistic about Costco’s ability to adapt to market trends, expand internationally, and enhance e-commerce capabilities for sustained growth.

With competitors like Walmart and BJ’s Wholesale Club ramping up e-commerce offerings, Costco must stay agile and focused on customer satisfaction to maintain its market leadership position. Managing inflationary pressures and operational costs will be vital for Costco’s continued success.

Is Costco’s Premium Valuation Justified?

Costco Stock Outperforms Industry

Costco’s stock has surged by 22.7% in the last six months, surpassing the industry’s 10.2% rise. This growth reflects strong investor confidence in Costco’s business strategy.

Image Source: Zacks Investment Research

High Valuation Raises Questions

Costco’s forward P/E ratio of 48.96 is significantly above the industry’s 29.4 and the S&P 500’s 21.57. Investors need to assess if Costco’s growth justifies its premium valuation, especially in a changing economic landscape.

Image Source: Zacks Investment Research

Post-Q4 Earnings Analysis

While Costco surpassed earnings expectations and showed strong membership growth in Q4, a revenue miss has raised concerns. The company’s strategic expansions and e-commerce growth offer long-term promise. However, its lofty valuation relative to peers and economic challenges may limit short-term gains. For long-term investors, Costco’s track record may justify holding, despite market uncertainties. Costco currently holds a Zacks Rank #3 (Hold).

“Stock Most Likely to Double” Revealed by Zacks’ Research Chief

Zacks has identified a stock with high potential for significant gains. With a rapidly expanding customer base and innovative solutions, this stock stands out in the financial sector. Past Zacks picks like Nano-X Imaging have surged over 100%, highlighting the potential of this latest selection.

Want more stock recommendations from Zacks? Download the free report about 5 Stocks Set to Double today.

Find out more about the stock market with these free stock analyses:

Amazon.com, Inc. (AMZN) Stock Analysis Report

Walmart Inc. (WMT) Stock Analysis Report

BJ’s Wholesale Club Holdings, Inc. (BJ) Stock Analysis Report

Costco Wholesale Corporation (COST) Stock Analysis Report

Read more insightful articles like this on Zacks.com.

The author’s opinions are independent and not endorsed by Nasdaq, Inc.