Tesla’s Latest Event Fizzles, Leaving Investors Concerned

High Expectations Fall Flat

The saying “seeing is believing” rings true as investors had high hopes for Tesla’s (NASDAQ:TSLA) recent “We, Robot” event. Unfortunately, the stock has continued to decline in 2024, especially as the broader market experiences gains.

Changes and Announcements

Originally scheduled for August 8th but pushed to October 10th, the event was anticipated to showcase advancements in TSLA’s cybercab and full self-driving (FSD) technology.

During the event, Elon Musk introduced the new Cybercab, which is expected to launch before 2027 at a price of $30,000. He also unveiled a Robovan prototype meant to carry up to 20 passengers in urban areas, though no details on pricing or timeline were provided. Adding to the entertainment, a group of Optimus robots performed a dance.

Investor Feedback

Despite the show, investor James Foord expressed disappointment, stating that the 30-minute presentation failed to provide “verifiable evidence” that the timelines for FSD and new products could be met.

Foord, among others, is looking for tangible proof that Tesla has made real progress on its FSD technology in recent months. He stated, “We need to see an actual product hit the market, and the latest deadlines have to be met. Not doing so will be incredibly detrimental to investor confidence.”

Reasons for Cautious Optimism

Although feeling let down, Foord remains optimistic about Tesla’s potential. He highlights the extensive mileage logged by FSD, which surpasses that of competitors, suggesting that the technology is robust.

Additionally, Tesla’s “vertically integrated supply chain” allows the company to scale operations rapidly. Foord points to the existing Tesla inventory that could quickly facilitate the development of a robotaxi fleet.

However, Foord’s patience may run out soon. “I am giving Tesla one more year to produce something tangible, or I will be out of the stock,” he stated, downgrading Tesla to a Neutral rating. (To track Foord’s performance, click here)

Wall Street Weighs In

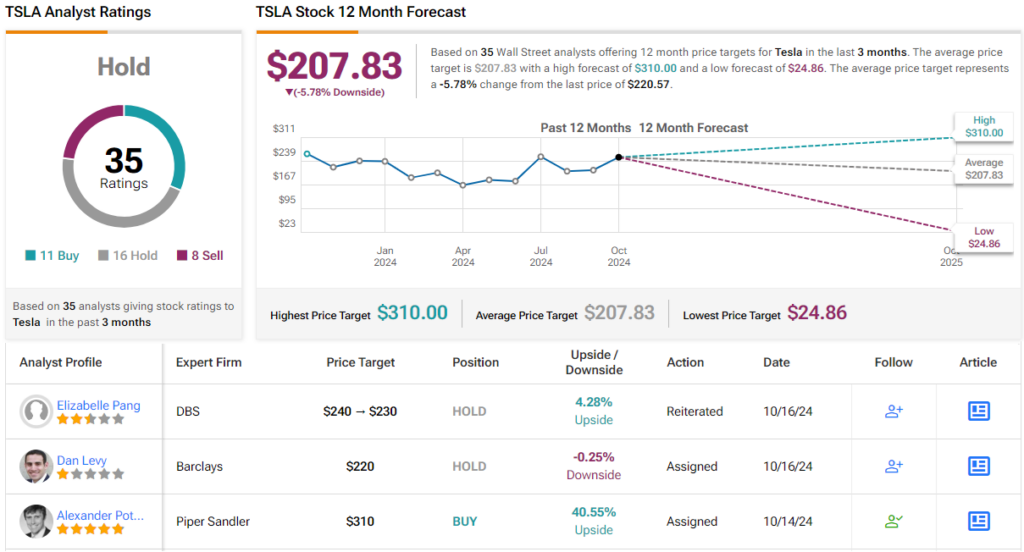

Foord isn’t alone in his disappointment. Wall Street’s view of Tesla shares remains mixed with 11 Buy, 16 Hold, and 8 Sell ratings, leading to a consensus rating of Hold (or Neutral). The average price target for the stock stands at $207.83, indicating an expected decline of approximately 5%. (See TSLA stock forecast)

For insights into promising stock options, visit TipRanks’ Best Stocks to Buy, which consolidates comprehensive equity data.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended for informational purposes only. It’s crucial to conduct your own analysis before investing.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.