The CNN Money Fear and Greed index signified a slight improvement in overall market sentiment, lingering in the “Extreme Greed” zone on Monday.

U.S. stocks concluded with an upbeat tone on Monday, with the S&P 500 reaching a new high before significant tech earnings announcements and the Federal Reserve’s interest-rate decision. The Federal Open Market Committee is set to commence its two-day policy meeting today.

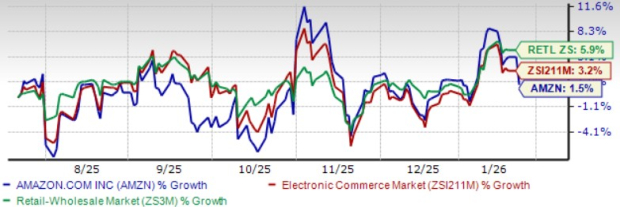

Shares of iRobot (IRBT) experienced an 8.8% dip on Monday following the termination of the acquisition agreement between the company and Amazon.com, Inc. (AMZN).

On the economic front, the Federal Reserve Bank of Dallas noted a 17-point decline in its general business activity index for manufacturing in Texas to a reading of -27.4 in January.

Most sectors on the S&P 500 closed positively, with consumer discretionary, communication services, and information technology stocks marking the most significant gains on Monday. However, energy stocks departed from the broader market trend, concluding the session in the red.

The Dow Jones surged by approximately 224 points to 38,333.45 on Monday. The S&P 500 progressed by 0.76% to 4,927.93, while the Nasdaq Composite jumped 1.12% to 15,628.04 during Monday’s session.

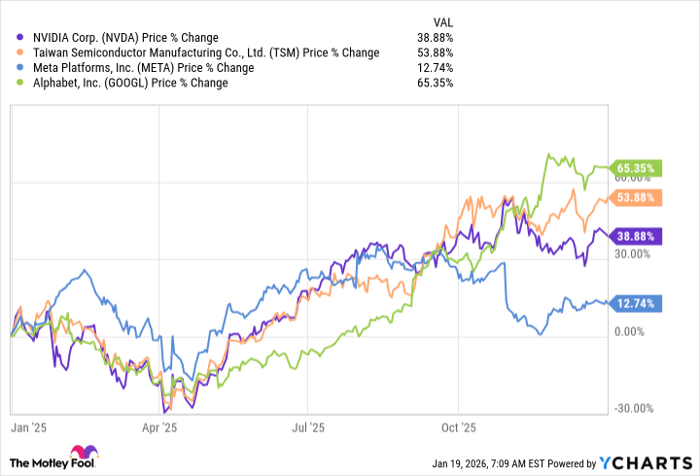

Investors anticipate earnings reports from Microsoft Corporation (MSFT), General Motors Company (GM), Alphabet Inc. (GOOG), (GOOGL) and Pfizer Inc. (PFE) today.

With the index reading at 76.9, it remained within the “Extreme Greed” territory on Monday, compared to a prior reading of 76.4.

What is CNN Business Fear & Greed Index?

The Fear & Greed Index serves as a gauge of the current market sentiment, premised on the notion that heightened fear tends to depress stock prices, while increased greed has the opposite effect. The index is derived from seven equally-weighted indicators and spans from 0 to 100, with 0 representing maximum fear and 100 indicating extreme greed.

Read Next: Perspective Therapeutics And 3 Other Stocks Under $2 Insiders Are Buying