How to Safeguard Your Wealth From Rising Inflation Risks

Your guide to protecting and growing your wealth during periods of high inflation…

Polls indicate that the greatest concern for many Americans as they approach retirement is the fear of running out of money. This worry is valid and widespread.

In retirement, individuals often do not have a steady income, leading to less financial flexibility compared to their younger years. Many individuals dread the thought of exhausting their funds and being forced into inadequate living situations.

As we save for retirement or navigate through it, various financial threats loom over us. Danger can arise from factors like:

- Insufficient savings accumulation.

- High medical expenses.

- Investment losses.

From 2000 to 2019, inflation was not a major concern.

During that time, U.S. inflation averaged only 2.1% annually, which is below the long-term average of 3%. Consequently, the financial environment felt stable.

However, the future is uncertain.

In recent years, significant shifts have disrupted the United States’ monetary stability.

These shifts have the potential to transform our financial landscape, making “high inflation” one of the most serious threats retirees face now and for the following decade.

This article outlines why high inflation is not merely a temporary concern but a significant risk that could jeopardize millions of Americans’ savings.

More importantly, it discusses how you can defend yourself against inflation and potentially benefit financially amid uncertainty.

For those anxious about financial security in retirement, the information ahead is critically important.

The individuals who are most vulnerable include diligent savers who followed conventional guidelines for a secure retirement.

The Return of a 1970s Nightmare

The 1970s are remembered for several notable events including the Vietnam War, Watergate, and disco culture. However, this decade is also infamous for its intense economic instability and rampant inflation.

While the long-term inflation rate is 3%, it soared to an average of 7% annually during the 1970s.

This resulted in a significant devaluation of the U.S. dollar, losing over 50% of its value throughout the decade.

Moreover, high inflation severely impacted stock market performance. From 1966 to 1982, the inflation-adjusted Dow Jones Industrial Average lost approximately 75% of its value.

Managing finances, whether it be a business or retirement portfolio during that time, proved perilous. Even minor errors could lead to irrecoverable financial losses.

Many retirees who entered retirement during this turbulent era experienced financial devastation due to inflation.

Today’s environment reflects that same “strange and volatile” characterization. Beginning with the COVID-19 pandemic, the economy faced unprecedented challenges that generated newfound levels of uncertainty.

As governments responded by injecting massive amounts of money into the economy, inflation pressure began to crystallize.

Following the pandemic, geopolitical tensions, such as Russia’s invasion of Ukraine and the subsequent surge in oil prices, further complicated the economic landscape.

Consequently, inflation has re-emerged fiercely.

In January 2022, inflation spiked, marking a 40-year peak, and continued its upward trajectory.

Now, we face the prospect of extended high inflation akin to that of the 1970s.

It is critical for everyone to integrate a decade of potential inflation into their financial strategies.

This stands as one of the largest threats to your financial stability.

The key drivers behind this threat are often overlooked by financial advisors and mainstream media alike.

In the following sections, I will reveal critical insights that financial advisers may be reluctant to address. Thereafter, we will explore strategies to safeguard your investments and financial future.

Customer insights will also come from InvestorPlace’s leading analysts, Louis Navellier, Luke Lango, and Eric Fry.

For instance, Louis will discuss how stocks remain a viable hedge against inflation despite market fluctuations, while Luke will present arguments in favor of investing in the “new gold.”

These analysts will outline the best investment options to combat inflation. We will also provide simple actionable steps for you to consider if you wish to participate.

By Brian Hunt,

Two Megatrends Create a Historic Confluence Affecting Inflation

In geography, a “confluence” refers to the junction where two or more bodies of water, like rivers, meet. At these junctions, the flow characteristics of each river intersect, often resulting in a visually stunning blend of colors and tumultuous energy. A striking example of this phenomenon is the confluence of the Rhône and Arve rivers in Geneva, Switzerland, where the brown, silt-rich Arve contrasts sharply with the clear blue-green flow of the Rhône.

Similar to these rivers, two significant megatrends are currently converging, leading to substantial changes in the global economy. As these trends play out over the next decade, they are likely to perpetuate high inflation.

The First Megatrend: Historical Money Printing

The first trend involves the unprecedented monetary policies enacted in response to the COVID-19 pandemic. Around the world, governments printed amounts of money never seen before, injecting billions into their economies. In fact, more money was printed in just three years than in the previous century combined. The accompanying chart illustrates how the U.S. monetary base surged in 2020.

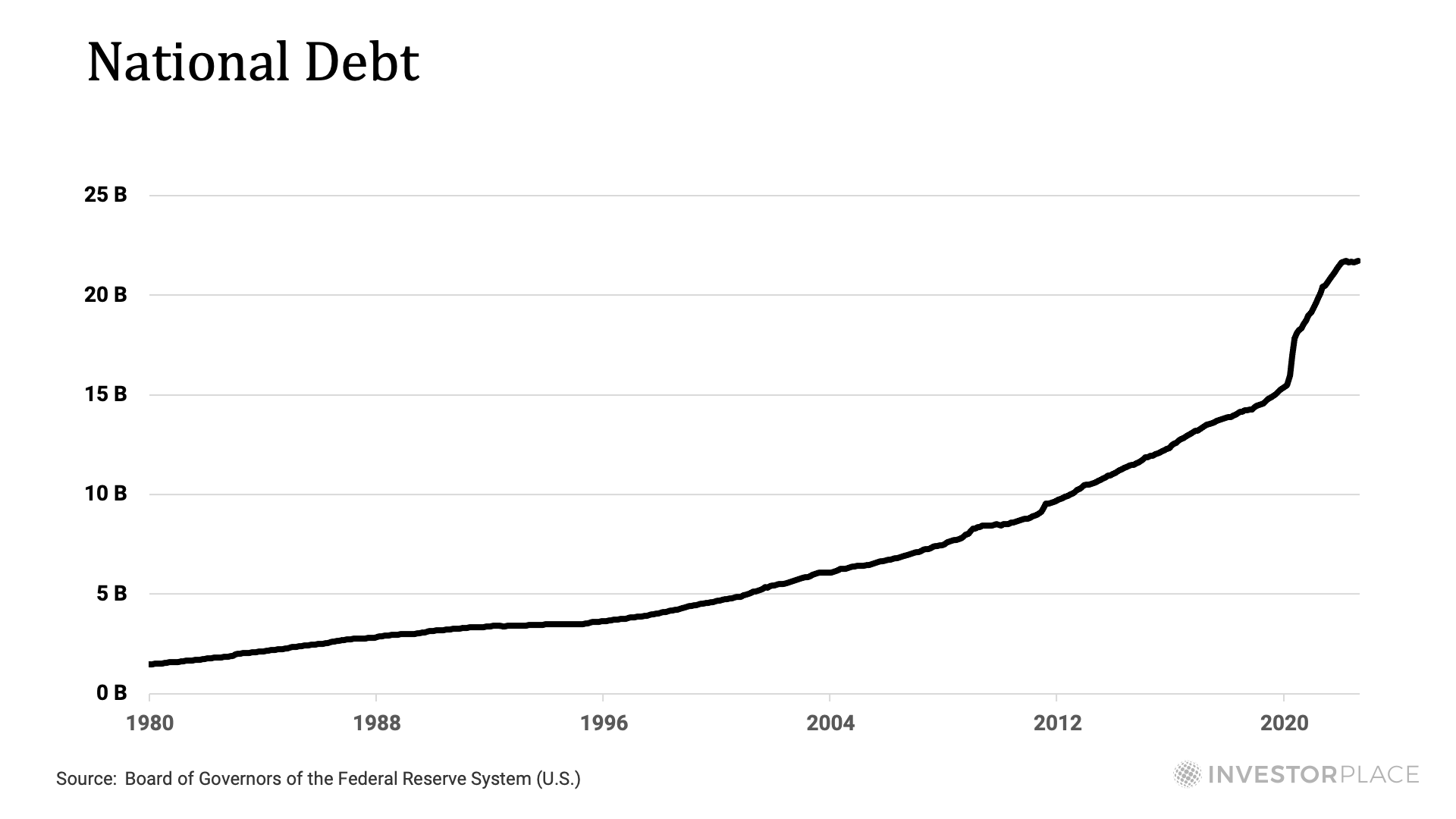

In February 2022, the U.S. national debt crossed the $30 trillion mark for the first time. This significant milestone represented an increase of nearly $7 trillion since January 2020, just before the onset of the pandemic. Beyond this staggering figure, the U.S. government is burdened with roughly $100 trillion in unfunded liabilities due to promises made through Social Security, Medicaid, and Medicare. Other major economies, including those in Europe and Japan, are grappling with similar financial challenges.

Unfunded Liabilities and Structural Issues

Despite the massive amounts spent by the government during the pandemic, the U.S. faces ongoing structural financial issues largely driven by debt. These challenges underscore the reality that high inflation may not only persist but could be exacerbated by the ongoing fiscal policies that resulted from recent global events.

As these two megatrends continue to converge, understanding their implications will be critical for investors and policymakers alike. Preparing for a future of high inflation remains essential, as the forces at work are powerful and transformative.

Understanding America’s Shift Towards Increased Government Dependency

The U.S. government’s spending has greatly exceeded its earnings for many years. Currently, the nation holds the title of owing the most money globally, with citizens seeking even more aid from public funds.

From Hard Work to Government Handouts: A Cultural Shift

In the 20th century, building a stable life in America seemed straightforward: hard work, contributions to society, savings, and minimal taxes. Most people shared this approach, gaining respect and value from their efforts.

However, that perception has shifted over the past decade. Around 2010, American views on success and governance began to alter significantly. This change, often referred to as a “paradigm shift,” has directed the country away from the principles that once made it prosperous.

Today, American citizens who achieve success through diligence and financial prudence seem less valued. Increasingly, there’s a shift towards expecting government aid rather than fostering a solid work ethic.

The dignity of hard work is being diluted in favor of waiting for the next stimulus check or government benefit, moving us closer to what some describe as full-blown socialism.

We observe a potential increase in government involvement in the economy, while few proposed spending initiatives see rejection, regardless of their feasibility.

A Financial Reckoning: The Point of No Return

The ongoing discourse about capitalism versus socialism often overlooks the vital reasons behind the increasing government presence in the economy. Understanding these roots is essential.

I aim to provide insights rather than engage in political campaigning. While I discuss perhaps uncomfortable truths, they come from a place of concern for our collective financial future.

At present, the U.S. national debt has surpassed $30 trillion, translating to about $91,000 for every man, woman, and child. In 2021 alone, the government spent $2.8 trillion beyond its tax revenue, not accounting for over $100 trillion in Medicare, Medicaid, and Social Security obligations.

This dire financial picture is unlikely to improve soon. A significant factor in this worrying trajectory is the growing number of “net tax recipients”—those who receive more from government programs than they contribute through taxes.

Historically, under 20% of Americans were net tax recipients. Individuals valued hard work and self-reliance, aligning with the country’s foundational principles.

However, in recent decades, this percentage has dramatically increased. Politicians, seeking electoral success, have promised expanding benefits, leading to over half of the population receiving more in government assistance than they pay in taxes.

While having a social safety net is crucial, the current situation risks becoming a “social featherbed.” The financial stability of a nation deteriorates when more citizens rely on government aid than contribute to it.

A point of no return emerges when the majority can vote for more benefits while paying less. Citizens vote for ever-increasing government spending, sidelining politicians advocating for fiscal responsibility.

This situation should concern anyone valuing the principles on which America was founded. As more citizens become net recipients, the overall financial health of the nation weakens.

The electoral landscape shifts into a competition to offer the most enticing benefits, often at the expense of sound fiscal policies.

As political support for responsible spending diminishes, we see a growing disdain for successful individuals and a troubling move towards economic instability.

Today’s discourse about the makers and takers resembles a troubling allegory—two wolves and a sheep deciding what to have for dinner.

This evolution, driven by a majority of net recipients, has developed gradually, resulting in the U.S. government potentially resorting to extensive money printing to manage its debts.

This approach poses significant risks, compromising the value of every dollar saved for retirement.

The Impact of Deglobalization on Prices

Moreover, a new megatrend—deglobalization—has emerged that threatens to complicate financial matters further. This trend is likely to lead to increased prices across the board, affecting the affordability of essential goods.

China’s Manufacturing Dominance: A Growing Threat to U.S. Economic Security

“Made in China.”

These three words can be found stamped on countless products in America, from clothes and toys to electronics and furniture. Over three decades, particularly from 1989 to 2019, the U.S. developed a reliance on affordable goods produced in China, significantly contributing to its rise as the world’s largest manufacturer.

The Evolution of China’s Role in Global Manufacturing

For much of the 20th century, China was not a significant player in the global economy. The country faced civil wars, foreign invasions, and struggled through communism, which hampered its growth. However, in the 1990s, China reopened its doors to international business, transforming its vast labor force into a manufacturing powerhouse.

As companies leveraged China’s low production costs, many North American and European firms relocated manufacturing operations there. Between 1989 and 2019, the United States became increasingly dependent on Chinese imports for various products, including medicines, clothing, toys, and electronics. This dependency was largely supported by the Chinese government, which subsidized industries to maintain low prices and eliminate competition from American manufacturers.

The Risks of Dependence on Chinese Manufacturing

This shift has led to a precarious reliance on China for critical products and raw materials. A significant portion of U.S. antibiotics—approximately 80%—now comes from Chinese production. The U.S. no longer manufactures much penicillin, a situation exacerbated as Chinese firms drove out their U.S. and European competitors with lower prices. As a result, any disruption in supply could trigger a public health crisis in America.

Moreover, the U.S. relies on China for over 50% of the ingredients necessary for many prescription drugs. In the event that China halts its exports, a substantial health crisis could emerge quickly.

Strategic Vulnerabilities and Rare Earth Metals

China’s control extends to critical materials like rare earth metals, which are essential for producing advanced technologies such as electric vehicle batteries, solar panels, and military equipment. The U.S. imports 80% of its rare earth metals from China, creating vulnerabilities that could impair national defense capabilities should access to these resources be restricted.

This situation paints a troubling picture: it resembles two armies facing each other on a battlefield, but one must plead to the other for essential supplies just to operate effectively.

COVID-19’s Wake-Up Call

The COVID-19 pandemic highlighted the dangerous implications of U.S. reliance on global supply chains, particularly those dependent on China. The potential for disruption due to pandemics, geopolitical tensions, or policy changes by Chinese leaders poses serious risks to U.S. economic security. This alarming reality has prompted many Americans to realize that reliance on Chinese manufacturing weakens our resilience and independence.

Future Directions: A Shift Toward Onshoring

In response to these vulnerabilities, the U.S. is poised to experience a significant “onshoring” movement. This transition aims to bolster American manufacturing capabilities, increasing the domestic production of essential goods, including clothing, electronics, and medical supplies. However, achieving true self-reliance will require over a trillion dollars in investments and may take as long as 20 years to complete.

While this endeavor is crucial for the nation’s security, it may also lead to increased prices on everyday products due to the reshaping of the economy. Ultimately, the movement toward bolstering U.S. manufacturing is essential for achieving a secure and self-sufficient economy.

Ukraine Invasion Spurs Inflation and Threatens Retirement Savings

Impact of Ukraine Invasion on Global Inflation

As the United States prioritized “cheap goods” over a stable economy, Europe made parallel choices that are now proving costly. Europe has become heavily reliant on Russia for crude oil and natural gas. Approximately 40% of Europe’s natural gas supply originates from Russia, making the European Union the world’s largest natural gas importer.

While European leaders could have opted for a more secure energy strategy through domestic nuclear and coal sources, they repeatedly favored the allure of cheaper, greener alternatives. Relying heavily on a nation often described as a “gangster state” for energy has backfired significantly.

Russia’s invasion of Ukraine highlighted the risks involved with this energy dependency. Following the sanctions on Russian oil and gas in February 2022, European energy prices surged. This situation severely weakened Europe’s negotiating power with Russian President Vladimir Putin.

Similar to the risks of relying on Chinese manufacturing, Europe’s dependence on Russian energy has proven detrimental. Awareness of this dependency is now prompting Europe to take corrective action, with expectations of a massive drive towards enhancing energy security.

Europe plans to invest over a trillion dollars in energy security, marking one of the largest financial commitments in history. The funds will extend to renewable energy projects, liquefied natural gas infrastructure, and nuclear energy investments.

This shift represents a comprehensive strategy; Europe will adopt an “all of the above” policy, purchasing energy from any available source that does not involve Russia. Ending reliance on Russian energy is essential for Europe’s future security.

However, similar to the U.S. strategy of reducing dependence on China, this transition entails costs exceeding one trillion dollars and will take approximately 20 years. Amid a significant “deglobalization” movement away from dependencies on nations like Russia and China, inflation rates are expected to rise.

With two of the world’s biggest economies choosing security over cost efficiency, we face a financial landscape that could lead to sustained inflation in the range of 4% to 5% annually for the rest of the 2020s.

Inflation Poses a Serious Risk to Retirees’ Finances

Unfortunately, the impending inflation wave is likely to hit hardest those who have followed conventional paths—individuals who worked hard, saved diligently, and aimed for a comfortable retirement. High inflation is already beginning to erode their savings and will likely worsen over the next decade.

This concern stems from what I refer to as the “Big Money Illusion.” In January 2022, the government reported an inflation rate of 7.5% annually, though it may be even higher due to underreporting to avoid public unrest.

For context, while inflation was peaking at that rate, government bonds yielded a meager 1.5%. This disconnect results in a net loss of 6% for investors saving to enhance their quality of life.

Understanding real returns is crucial. Real returns reflect the returns earned after adjusting for inflation. For instance, if an investment yields 10% but inflation stands at 7%, your effective gain is just 3%. Conversely, a 1% return in a bank account with 5% inflation results in a real return of negative 4%.

Real returns, or “the returns you can eat,” deeply impact essential expenditures like food, gasoline, and healthcare.

Even with gains in stock values, if inflation matches profits, your wealth doesn’t truly increase. This phenomenon becomes starkly evident when discussing real estate: if a home’s value rises 25% alongside a 25% increase in overall prices, the homeowner hasn’t actually gained wealth; they merely perceived an increase.

With inflation at 7% per annum, the real purchasing power of a dollar savings depreciates significantly. In three years, a dollar will only hold the value of 82 cents.

Worryingly, financial advisors continue to advise clients to invest predominantly in supposedly “safe” government and corporate bonds. For retirees, especially those around 70, this strategy often involves holding up to 80% of their savings in bonds—compounding the issue of negative real returns.

Over the past year, while government bond yields hovered around 1.5%, inflation persisted at 7.5%, leading to a substantial 6% decrease in wealth. This scenario is disastrous for many American retirees.

Currently, billions of dollars in real wealth are vanishing from American retirement portfolios, as countless individuals unwittingly participate in this financial erosion.

Understanding the Inflation Crisis: What You Need to Know

Investing feels like watching money vanish. Losing real wealth at a rate of 6% annually means, in six years, you’ll have 31% less, and in ten years, 46% less. American retirees are particularly vulnerable to these losses, which erode their buying power every year.

In today’s financial landscape, many advisers are leading clients into perilous situations where their wealth diminishes significantly. This trend could escalate into one of the most significant financial crises we’ve ever seen.

Governments and Their Narratives on Inflation

Expect the government to soon claim victory over inflation. Should rates drop from 7.5% to around 4% or 5%, there will be proclamations of success. However, it’s essential to remain skeptical of such claims. The underlying truth may be quite different.

The administration’s announcement in late 2021 revealed an inflation rate of about 7%, marking the highest price increases in three decades. This surge affected essential items like gas, food, cars, and housing. Such increases stemmed from consequential government spending and money printing that happened earlier.

Politicians dislike high inflation rates because they hurt voters’ financial stability. As inflation erodes savings, upset constituents often vote for change, thus motivating politicians to manipulate inflation data.

Unraveling the Inflation Mystery

Inflation is often tracked using the Consumer Price Index (CPI), which aims to reflect changes in living costs and affects over 50 million people connected to Social Security and military pension plans. It holds considerable weight regarding government finances.

Despite its prominence, the CPI frequently underestimates real inflation rates. This miscalculation can have widespread implications for retirees and government budgets. Understanding how the CPI is derived is crucial to grasping the true state of inflation—and it is simpler than it seems.

Exploring CPI: The Misleading Calculation of Housing Costs

Housing represents a significant financial burden for many, whether renting or owning. The way the government calculates housing costs, particularly through measures like “Owner’s Equivalent Rent” (OER), often fails to accurately reflect the actual expenses faced by consumers.

Stay informed and aware of how these manipulations can impact your financial future, as knowledge is the key to navigating the current economic climate.

Understanding Inflation Through Housing Costs and Their Measurement

Housing is a significant part of the Consumer Price Index (CPI), constituting approximately one third of it. This makes it the largest component of CPI and critical for economic analysis.

The Relationship Between Home Prices and Costs of Living

When people evaluate the cost of housing, they typically think about the price changes in homes and apartment buildings. For instance, if home prices rise by 25% over three years, many would conclude that housing costs have increased by the same percentage.

However, rising home prices lead to increased maintenance costs, insurance, and property taxes. As these expenses grow, owners are likely to raise rents to cover the higher costs associated with property ownership and upkeep. Common sense suggests that any accurate assessment of inflation should reflect these shifts in home prices.

A Flawed Government Approach: Owner’s Equivalent Rent

Contrary to what many might expect, the government employs a method called Owner’s Equivalent Rent (OER) to assess the housing component within the CPI. This approach is based on surveys that ask homeowners how much they believe they would pay in rent if they were renting their own homes. The collected responses provide data used to report housing cost changes.

This method is questionable at best. Homeowners often lack accurate knowledge of current rental rates and, in some cases, underestimate or misjudge rental costs entirely.

Discrepancies in Measuring Housing Costs

According to the Case-Shiller U.S. National Home Price Index—widely regarded as a key indicator of home price trends—home prices surged by an average of 18.79% year-over-year across the nation. This index is based on actual home sales, making it a more reliable source than government surveys.

The stark contrast between the government’s methodology and real estate data permitted inflation to be reported at a mere 7% in December 2021. Such conflicting data creates confusion over whom to trust: the government, which may have incentives to underreport inflation, or the real estate transactions that reflect market realities.

Considering the Larger Implications of CPI Calculations

In effect, the practice of having the government calculate and report inflation statistics can be likened to allowing a child to oversee their own candy consumption—with predictably biased results. This flawed calculation leads to significant underestimations of inflation, potentially causing many to live under the misconception of increased wealth, known as the “money illusion.”

It’s crucial to recognize that this discrepancy allows for the gradual erosion of purchasing power, costing individuals without their explicit awareness. The hidden nature of these adjustments makes it especially troubling, as it can also facilitate increased government spending without adequate accountability.

In many ways, this reflects one of America’s major financial deceptions.

The Impact of Inflation on Savings and Investments

The current inflation rate is ostensibly at 7%, while interest on savings bonds languishes at about 1.5%. This scenario poses a significant challenge for those saving for retirement or navigating their finances post-retirement.

Moreover, global shifts like deglobalization may amplify these price increases. The combination of rising costs alongside misleading inflation data compounds the economic hardship many face, pushing the situation beyond what is generally perceived.

However, there are strategies to mitigate the risk of inflation and protect one’s financial assets. We at InvestorPlace provide various resources aimed at guiding investors toward effective measures for preserving and growing wealth amidst inflationary pressures.

Strategies for Inflation-Resistant Investments

In the next section, we will explore five “inflation-proof” investments that may help stabilize your financial standing during turbulent times and provide advice on how to best construct an inflation-resilient portfolio.

Let’s begin our examination.

By Brian Hunt, InvestorPlace CEO

High inflation impacts the value of money significantly. For example, a burger that costs $1 can rise to $1.09, a seemingly minor increase that, when applied broadly, creates a noticeable financial burden.

In 2021, an average family of four spent roughly $1,071 monthly on groceries. By 2022, grocery costs spiked by 10.8%, bringing the monthly total to around $1,200—an increase of approximately $130 every month. Over a year, that results in an additional $1,560 spent on groceries alone.

While this increase might not be substantial for wealthier individuals, it represents a significant financial hit for middle-class families.

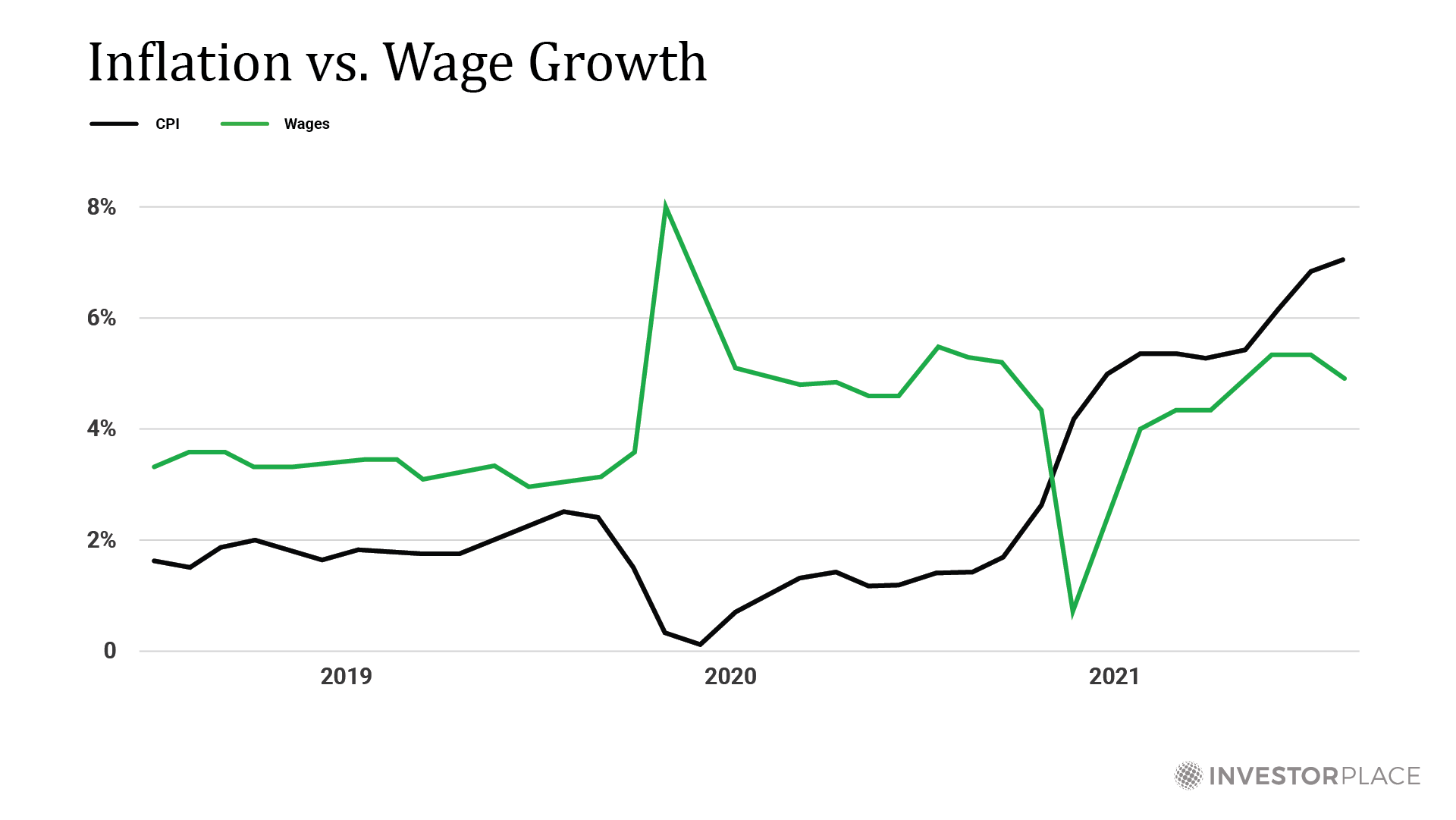

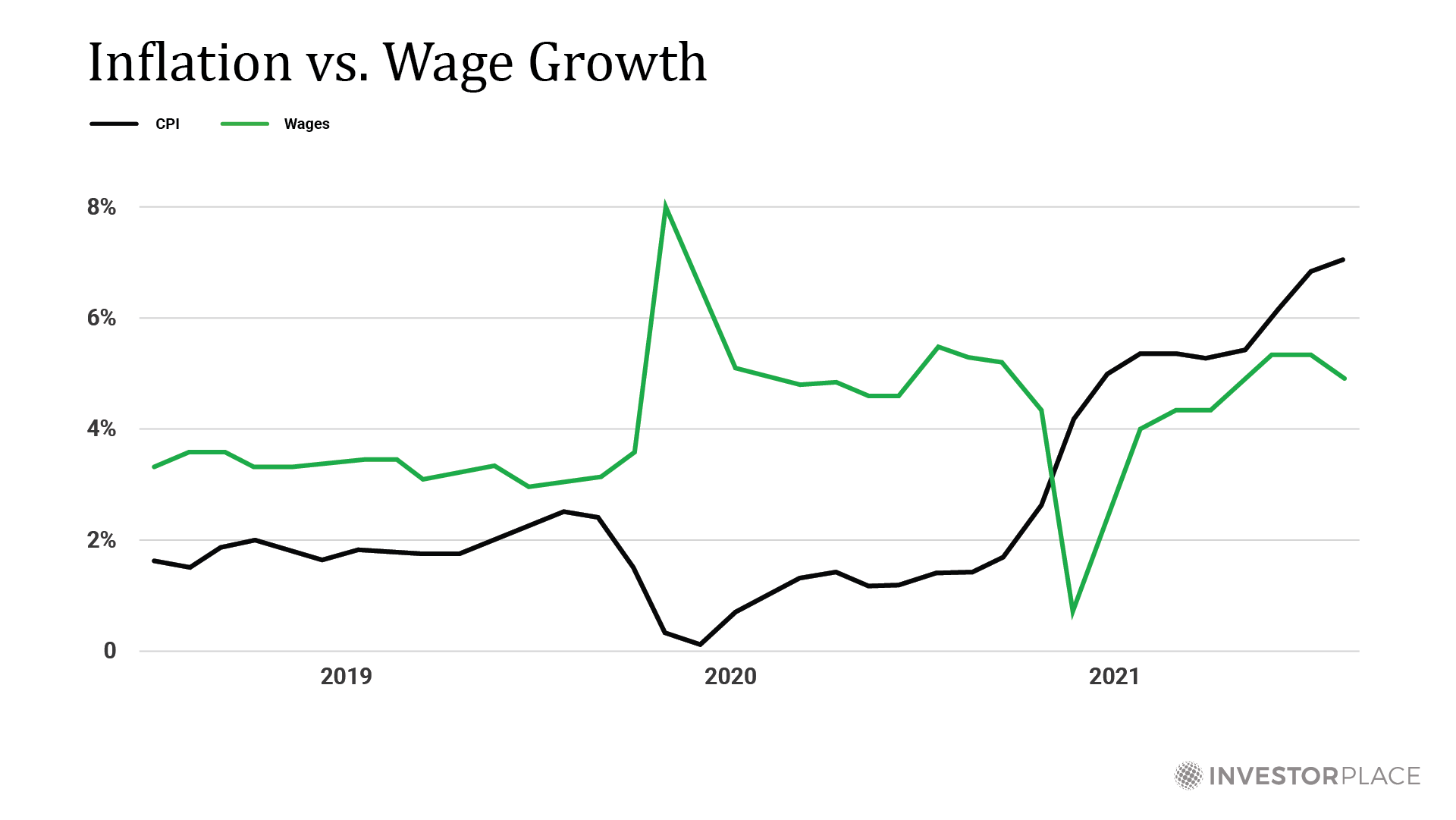

Moreover, many daily expenses—gasoline, utilities, vehicles—have also risen sharply. For working individuals, inflation outpaces wage growth, exacerbating financial difficulties.

Visualizing the Inflation Impact

Stocks as a Key Investment Strategy to Combat Inflation

This data reflects economic conditions up to the end of 2021; inflation has escalated further since then.

Understanding REAL returns is crucial. If inflation surpasses our savings or earnings, it’s vital to seek ways to remain financially ahead. In this discussion, InvestorPlace analysts—Eric Fry, Louis Navellier, and Luke Lango—will outline five investment types that can help protect and grow wealth even during high inflation periods.

We begin with a familiar option.

Investment Strategy No. 1: Investing in Stocks

By Louis Navellier

Editor of Market360, Growth Investor, Accelerated Profits, Breakthrough Stocks, and Power Options

“A people however, who are possessed of the spirit of Commerce – who see, & who will pursue their advantages, may achieve almost anything.”

While you may not have encountered this quote before, its author is widely recognized: George Washington, one of America’s Founding Fathers and its first president. Written in 1784, its relevance remains strong today.

Prominent entrepreneurs like Jeff Bezos transformed from average individuals into leaders in e-commerce with Amazon. Similarly, Mark Zuckerberg founded Facebook during his college years, leading it to become the world’s foremost social media platform. Bill Gates, founder of Microsoft, has amassed a net worth of $104 billion, as his company revolutionized the software industry with a market capitalization of $2 trillion.

These notable figures didn’t achieve their fortunes overnight. Their journeys exemplify talent and hard work, representing the essence of the American dream.

Personally, I may not be a Gates or Bezos, but I also consider my life a narrative of the American dream. Growing up as the son of a stone mason, I worked diligently to finance my education amidst the demanding neighborhoods of California’s East Bay. Today, I lead a billion-dollar financial business, enjoying the privileges that come with financial success, such as luxury vehicles and quality education for my children.

However, capitalism in its current form is evolving. As noted previously, we are navigating a vastly different landscape shaped by a global pandemic that disrupted economies, skewed data used in decision-making, and a surge in inflation not seen in 40 years. The financial environment is challenging, but stocks can offer a strong hedge against these adversities.

The Impact of Inflation on Savings

Inflation is a term that frequently arises in financial discussions.

Consider Germany’s hyperinflation post-World War I, where its currency lost value, or Venezuela’s recent economic turmoil highlighting similar inflation issues. What does inflation mean?

Inflation describes an increase in the money supply, which diminishes the value of each monetary unit—in the U.S., this unit is the dollar.

Imagine a country with a monetary system of $100 million, where businesses and individuals exchange dollars for goods and services. As people deposit some of these dollars in banks, the system functions smoothly.

Now, envision the government needing funds for welfare programs and military expenditures without sufficient revenue to cover these costs. Instead of borrowing, one common approach is printing more money.

This act of “debasement” leads to creating new currency, thus increasing the money supply. If the government opts to print an additional $20 million, the total money in circulation rises by 20%. Consequently, prices begin to elevate: a $30,000 car may increase to $36,000, reflecting this inflation.

Importantly, the quality of the goods—in this case, the car or a $5 sandwich, now costing $6—remains unaltered; they do not get bigger or better. The value of currency has simply diminished, demanding more dollars to purchase the same items. Holding large amounts of cash during inflation leads to significant losses in purchasing power.

Political leaders, often incentivized to overspend, control the value of currencies, affecting savers negatively over time. This issue is not new; it dates back to ancient times when Romans devalued their coins by reducing the precious metal content.

Devaluation of money through inflation is ongoing.

As a reference, $100 in 1982 is now equivalent to approximately $297.93 today, and this trend will likely continue.

Investing Strategies for Protecting Wealth Against Inflation

The U.S. dollar’s purchasing power has significantly decreased since 2008, with a loss of over 33% from that point to early 2022. This decline poses challenges for investors and everyday consumers alike.

Given the current inflationary climate, it’s crucial to consider effective strategies for safeguarding your wealth.

Why Stocks Serve as a Strong Hedge Against Devaluation

Let’s reflect on the economic landscape of 1980. During this year, cultural milestones such as the debut of the Rubik’s Cube and the eruption of Mount St. Helens captivated the public, while the Dow Jones Industrial Average stood at a modest 838.49. Fast forward to today, and the Dow has surpassed 30,000—an impressive rise few anticipated back then. Between 1980 and 2000, the index experienced a staggering increase of 1,187%.

Consider just a few standout performers. Microsoft surged by an extraordinary 50,000% over that same period. Home Depot and Amgen increased by 20,000% and 40,000%, respectively, while Cisco reached a peak gain of 42,000%. An investment of $5,000 in any of these companies could have blossomed into over $2 million.

This remarkable bull market occurred alongside significant inflation conditions. The average annual inflation rate from 1980 to 2000 was 4.2%. As a result, while the value of a dollar shrank to just $0.44 by 2000, this rate of inflation proved beneficial for the stock market. Historically, inflation rates around this level function as stimulants for economic growth, positioning stocks as attractive investments during inflationary periods.

It’s critical to understand the juxtaposition: while a 4.2% inflation rate translates to an erosion of savings, it simultaneously fuels stock market appreciation. Great companies manage to offset rising input costs through price adjustments, allowing their profit margins to remain stable. For instance, if the cost of materials rises, companies like Hershey or Microsoft can adjust their prices accordingly, benefiting investors as profitability rises with stock prices.

Unlike traditional savings accounts—often yielding less than 1%—investing in stocks tends to produce superior returns, even in inflating environments. However, successful investing requires more than random selection.

Identifying the right stocks necessitates thorough market analysis and insights from experienced financial analysts, which we provide at InvestorPlace.

Inflation Defense No. 1: Stocks

While stocks are powerful inflation hedges, strategic selection is key. Exchange-traded funds (ETFs) provide a practical entrance point into the stock market for those uncertain about where to start. Notable among these are the SPDR S&P 500 ETF Trust (SPY), which mimics the performance of the S&P 500, and the Cambria Shareholder Yield ETF (SYLD), composed of firms that return substantial cash flow to their shareholders through dividends and stock buybacks.

Inflation Hedge No. 2: Gold

By Brian Hunt, InvestorPlace CEO

Insurance, by definition, involves a small expenditure to mitigate against potential disasters. Whether it’s home insurance or car insurance, the goal is to safeguard asset value for the long term.

Applying this concept to wealth preservation, consider incorporating gold into your portfolio. This straightforward approach can effectively provide a hedge against potential financial crises and economic downturns.

Purchasing gold can be simple—either through direct acquisition with minimal commissions or through gold ETFs available via online brokerage accounts. This approach allows you to avoid unnecessary fees typically associated with complex financial products.

Gold as a form of wealth insurance is particularly relevant amid rising geopolitical tensions and economic instability. While some experts foresee deteriorating conditions that may affect currency values, maintaining a portion of your wealth in gold can offer a layer of protection.

As inflation and uncertainty persist, the strategic incorporation of stocks and gold into your investment strategy helps shield your financial future. By understanding these tools, you can confidently navigate the challenges posed by economic fluctuations.

With well-informed decisions and careful planning, safeguarding your wealth against inflation is achievable.

How Gold Can Protect You in a Financial Crisis

It’s prudent to consider some form of insurance against potential financial disasters. Historically, during global economic turmoil, gold has often been a haven for investors. Such scenarios can drive immense demand for gold, causing its price to surge.

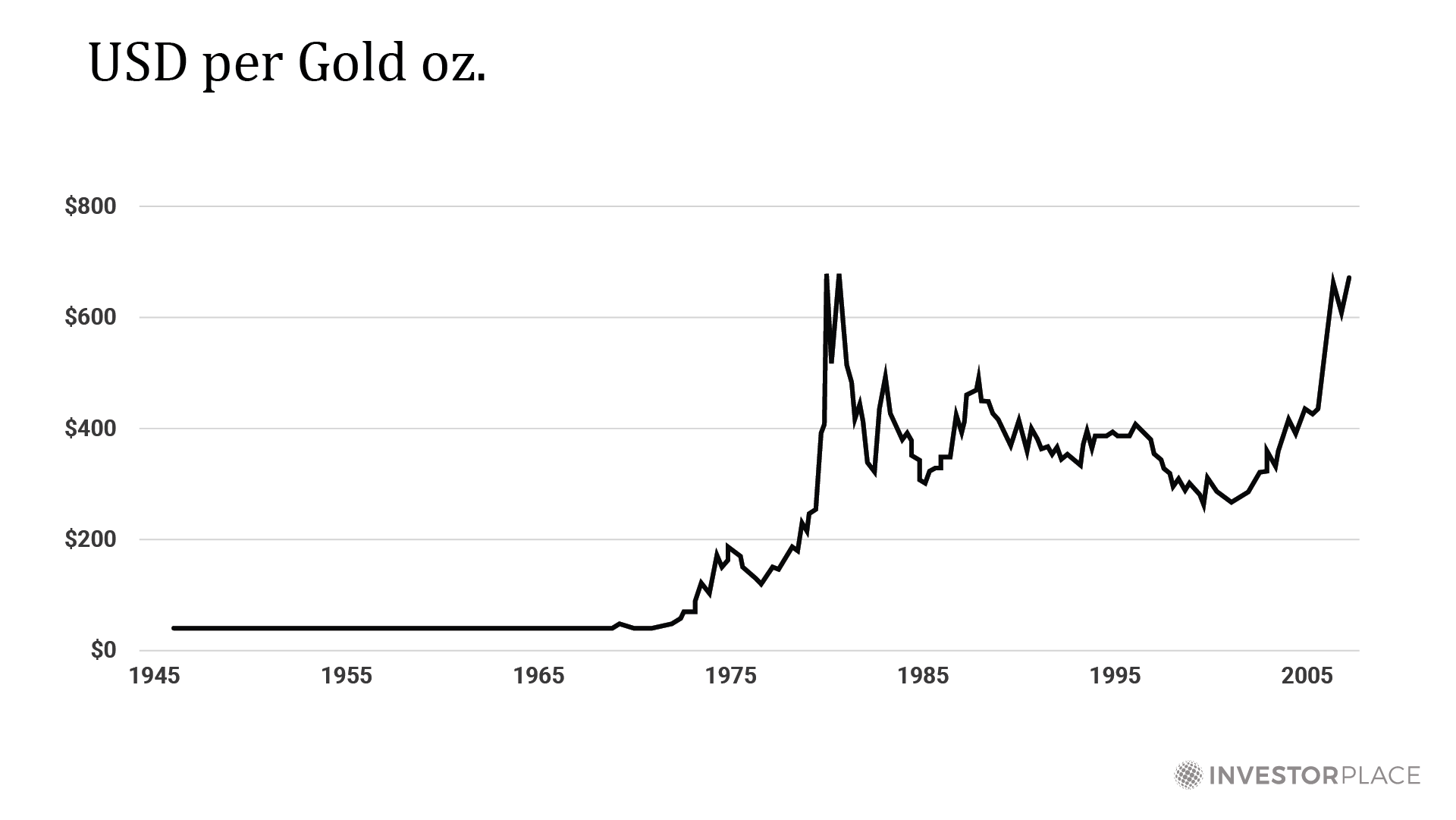

Take the decade from 1970 to 1980 as a prime example. This period was characterized by wars, recession, and extreme inflation, resulting in a difficult decade for traditional assets like stocks and bonds. In contrast, gold prices soared, gaining over 2,000% during that same span.

Gold has a long-standing reputation as a safe haven during tumultuous times. For centuries, various items have been tried as money, from cigarettes and livestock to salt and tulips. Yet, when crises arise—whether due to war, bank runs, or other calamities—gold consistently emerges as the preferred store of wealth.

Six Reasons Gold Remains a Top Choice

- Easily Transported: Unlike real estate, gold is simple to move.

- Divisible: You can split gold into smaller quantities if needed.

- No Decay: Unlike livestock, gold doesn’t deteriorate over time.

- Global Consistency: Pure gold from different sources is universally accepted.

- Intrinsic Value: Gold is valuable for its unique properties and industrial uses.

- Not Government-Made: Unlike paper currencies, gold cannot be created at will by governments.

These features have made gold the backbone of wealth preservation for over 2,000 years, thus functioning effectively as wealth insurance. Fortunately, investors don’t need to allocate a significant part of their portfolios to reap the benefits of gold.

In fact, dedicating just 5% of your portfolio to gold can provide substantial financial protection during tough times. This strategy could mean the difference between struggling to make ends meet and maintaining financial security for your family.

The Potential Value of Gold During Financial Crises

Consider a scenario where you manage a $100,000 portfolio comprised primarily of blue-chip stocks and income-generating bonds. If the anticipated financial calamity fails to materialize, your stocks and bonds may appreciate, while gold’s price would likely stabilize or decrease slightly. In this case, your overall financial performance would remain strong.

However, if a financial disaster does occur, some analysts predict that gold could reach $6,000 per ounce. Envision your portfolio facing a 33% loss in stock and bond values due to this crisis. Your $95,000 stock-bond position would shrink to approximately $63,332.

As gold’s price triples from around $2,000 to $6,000 an ounce, your initial $5,000 allocation would increase to $15,000. This would bring your total portfolio value to $78,332 after the disaster—mitigating the hit considerably.

If your outlook on financial crises is more pessimistic than most, you might choose to increase your gold stake to 15%. In this case, your portfolio would consist of 85% in stocks and bonds and 15% in gold. Under a similar financial disaster scenario, a 50% decline in your stocks and bonds valued at $85,000 would reduce that portion to $42,500. Meanwhile, your $15,000 gold position would escalate to $45,000.

As a result, your post-disaster portfolio would be worth approximately $87,500, which translates to a manageable decrease of only 12.5%. Although not ideal, this outcome is significantly better than suffering a 33% decline.

Clearly, a larger allocation toward gold can enhance your financial resilience during a potential crisis. It’s essential to assess your risk tolerance and make adjustments to your portfolio accordingly.

However, should the financial turmoil not manifest, your portfolio could still flourish.

Understanding the Benefits of Gold as Wealth Insurance

When considering your financial strategy, it’s crucial to recognize that holding less money in stocks and bonds may reduce your potential gains if the economy continues to thrive. It’s important to note that only a significant financial disaster could lead to a scenario where stocks decline by 33% while gold prices soar to $6,000.

Adjusting Your Gold Insurance Coverage

Your view on the likelihood of a financial disaster should guide your decision on how much gold to include in your portfolio. Your goals and beliefs will help determine the right amount.

If you believe the risk of disaster is low, a gold insurance policy representing 1% to 5% of your portfolio may suffice.

Conversely, if you believe a financial disaster is likely, you might consider allocating 15% to 20% of your portfolio to gold.

The timing and nature of financial crises are uncertain. Ultimately, no one can foresee when—or if—a disaster will strike.

However, purchasing “wealth insurance” in the form of gold offers a solution that requires no crystal ball. It’s straightforward, cost-effective, and provides a sense of security.

Your goal is to acquire gold and hope it never has to be utilized.

In any scenario—whether the economy thrives or falters—ownership of gold can be reassuring. Additionally, the peace of mind gained from holding gold as insurance can often exceed its financial benefits.

Exploring Gold Mining Companies for Greater Returns

Some advisors suggest that when gold’s value increases during a crisis, the companies that mine gold could experience even higher gains.

This is due to the leverage effect: as the price of gold rises significantly, the profit margins for gold mining companies can explode. For instance, if a mining company can produce gold at $1,300 per ounce and sells it for $2,000, the profit margin is $700. If the gold price climbs to $4,000, profit margins surge to $2,700, resulting in a profit increase of 3.85 times.

This financial phenomenon is known as leverage. It can amplify stock market gains remarkably.

Historically, from 2002 to 2008, the price of gold surged from $300 per ounce to $1,000 per ounce. During this uptick, Kinross Gold Corp. (KGC) saw its share price rise from $2.25 to nearly $27, representing a staggering 1,093% gain. Similarly, Yamana Gold Inc. (AUY) jumped from around $1.53 per share to more than $19, marking a 1,165% increase. During this period, a gold stock index recorded a 692% gain.

While these gains are significant, it’s essential to remember that investments in gold mining companies carry substantial risk. Mining is a capital-intensive industry, and these firms may lack control over their product pricing. If the price of gold falls, these companies can lose more than 50% of their value rapidly.

However, if a financial crisis drives gold’s value significantly higher while decreasing the value of paper currencies, the gains from these companies can potentially reach 500% or even 1,000%.

Gold embodies the concept of wealth insurance. Personally, I incorporate it into my overall wealth strategy while hoping never to need it, and I recommend it be part of yours as well.

Inflation Hedge No. 2: Gold ETFs

If purchasing physical gold or investing in mining companies does not suit you, consider some effective gold ETFs:

- VanEck Gold Miners ETF (GDX): This fund comprises the world’s largest gold mining companies.

- SPDR Gold Shares (GLD): This ETF owns physical gold and follows movements in gold prices.

Both ETFs provide the advantages of gold ownership without the need for physical storage or the hassle of selecting individual mining companies.

Inflation Hedge No. 3: Oil and Energy

By Eric Fry

Editor, Smart Money, Fry’s Investment report, The Speculator, and Absolute Return

While inflation is generally undesirable, it often boosts investments in hard assets like gold and resource stocks. For example, energy stocks yielded a total return of 73% during the inflationary 1970s, significantly outperforming the S&P 500 Index, which experienced a 16% loss after adjusting for inflation.

Energy Market Dynamics: Navigating Inflation and Oil Demand Growth

Recent research from NYU Stern and the Tuck School of Business at Dartmouth College has investigated the patterns of inflation in past decades. While it is uncertain whether the current inflationary trend will yield similar gains for energy stocks, there is no denying that inflation can benefit the energy sector.

Presently, multiple factors are contributing to the volatility within the energy market. In this article, we’ll explore how inflation ties into broader trends affecting supply and demand in energy.

Contrary to some predictions, Big Oil is far from obsolete. Instead, oil and energy companies offer a reliable hedge against inflation for discerning investors.

The Impact of Electric Vehicles on Oil Demand

Currently, more than half of every barrel of crude oil is utilized as fuel for internal combustion vehicles. As electric vehicles (EVs) gain traction, net demand for crude oil is expected to decline—eventually. However, this shift is not imminent.

Although the demand for EVs is rising sharply, the total automotive market is set to expand as well. This means the number of gas-powered vehicles on the road will continue to climb for several more years. According to the U.S. Energy Information Administration, the peak for internal combustion vehicles worldwide is projected for 2038.

Moreover, despite the anticipated rise in EV usage, demand for oil from other sectors is expected to persist past 2038. The International Energy Agency (IEA) estimates that global oil demand could increase by at least 25% by 2050. The IEA predicts, under alternative scenarios, that worldwide crude demand might reach approximately 150 million barrels per day (MBPD)—a significant rise of about 50% from current levels.

It’s important to note that renewable energy is not synonymous with oil-free energy. Producing an electric vehicle requires roughly double the energy compared to manufacturing an internal combustion vehicle, primarily due to the substantial energy needed for battery production and the extraction and refinement of metals like copper and nickel.

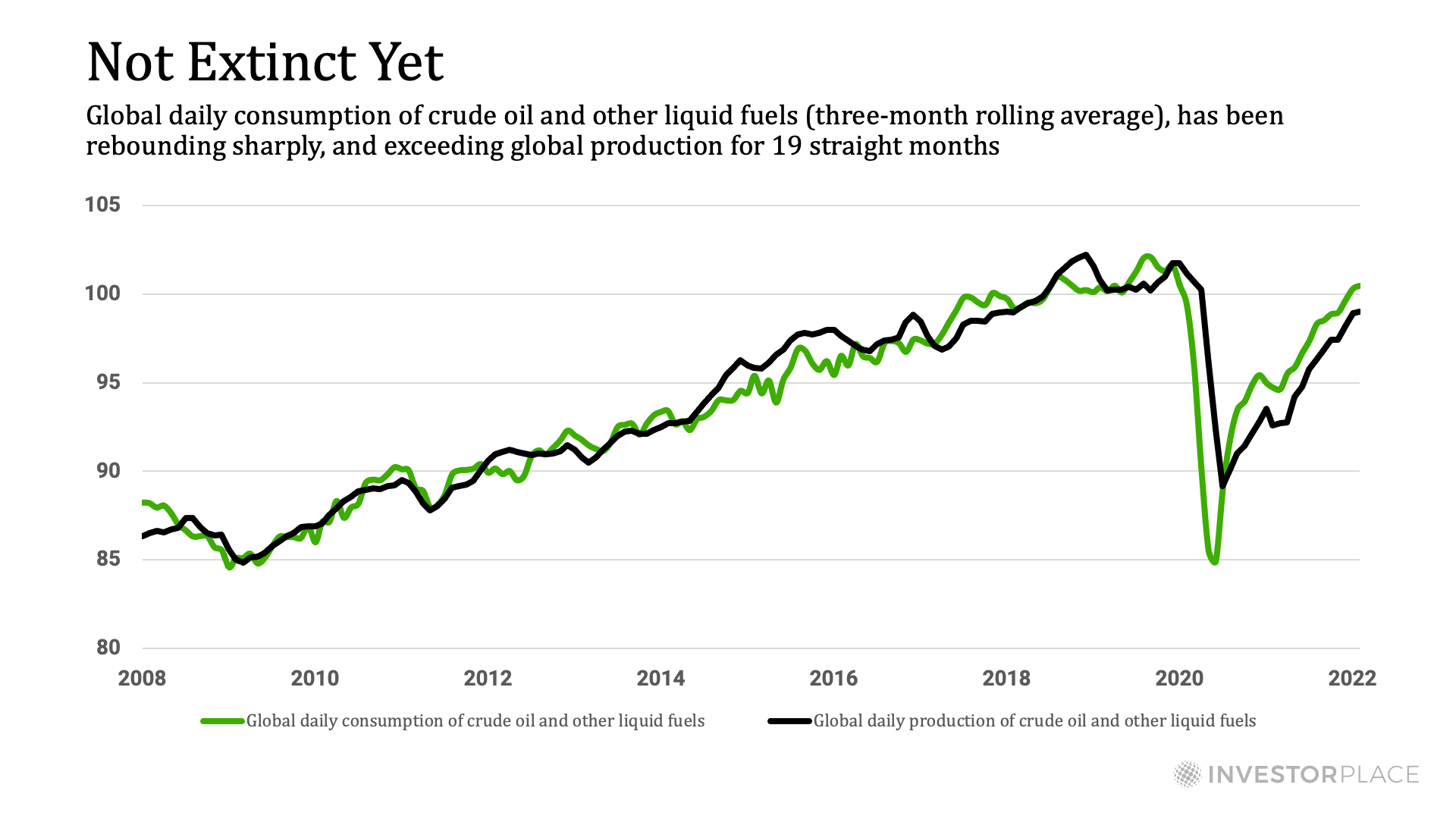

Global Oil Demand on the Rise

Globally, oil demand is recovering sharply, led by increases in China and the United States. Notably, China’s crude consumption has reached record levels, surpassing its pre-COVID peak by over 10%. In the United States, crude consumption is nearing pre-pandemic levels.

In stark contrast, many major economies still consume less oil than before COVID-19. For instance, the 38 countries within the Organization for Economic Cooperation and Development (OECD) are currently using around three MBPD less than prior to the pandemic. Additionally, the aviation sector’s crude oil consumption, which previously accounted for approximately 8% of global supply, has yet to fully recover.

Pre-pandemic, air travel demanded around eight MBPD of crude. That number dropped below one MBPD during the peak of the pandemic, but it has since improved, remaining about two MBPD lower than prior levels. A complete recovery of demand from both OECD countries and aviation could result in a global crude demand increase of about five MBPD, bringing consumption to 104 MBPD—the highest recorded level and surpassing production capabilities.

This situation raises questions about whether OPEC can meet this additional demand. Currently, the Organization of the Petroleum Exporting Countries is producing approximately 27.5 MBPD. To meet a newfound demand of five MBPD, OPEC would need to ramp up production to 32.5 MBPD. Although OPEC has a total production capacity of 33 MBPD, it has not sustained such a pace since 2016.

Interestingly, the U.S. has accounted for nearly all of the global crude production growth over the last decade, primarily through shale oil plays, which saw production almost double between 2016 and 2020. However, U.S. shale output peaked at 9.4 MBPD two years ago and currently rests at about 8.7 MBPD.

While new investments in exploration and production (E&P) could boost output somewhat, very few U.S. oil companies appear inclined to expedite such plans, which complicates the outlook for increased crude supply.

Oil Industry Hesitates to Invest Amid Rising Pressures and Market Shifts

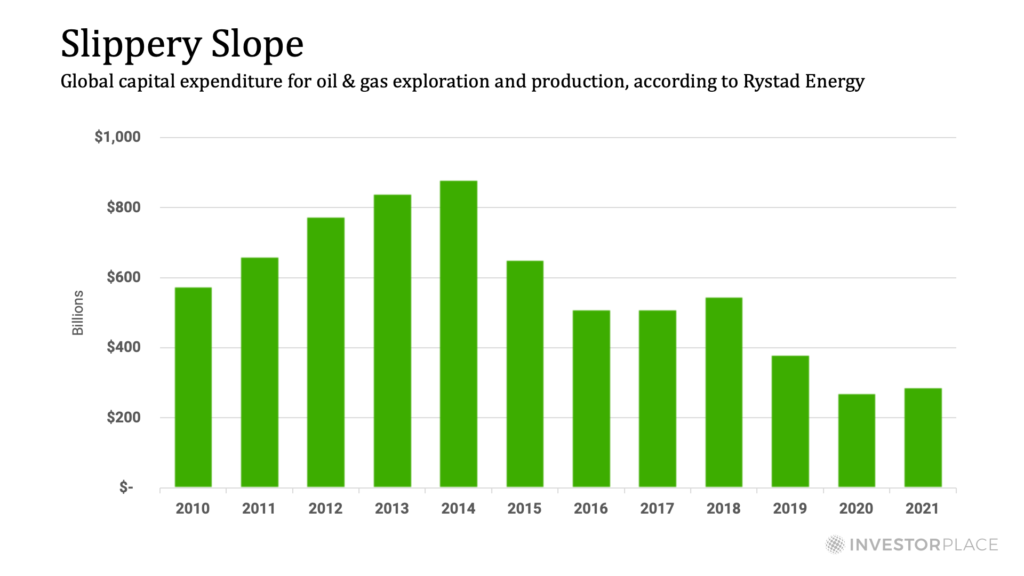

As high oil prices loom, the oil sector is cautious about repeating past mistakes of overspending on future production projects. Shareholders play a key role in this hesitance, pressing companies to prioritize paying down debt, increasing dividends, and repurchasing shares over making new exploration and production (E&P) investments.

These pressures aren’t the only challenges facing new investments; the momentum for green energy is also stifling E&P spending in the oil industry. Executives in oil companies are aware of the discussions in major financial publications like The Wall Street Journal and media appearances by investment commentators, such as Jim Cramer on CNBC. This awareness contributes to a widespread perception that electric vehicles (EVs) and renewable energy technologies pose significant risks to the oil industry’s future.

Many oil executives metaphorically perceive the rise of EVs as an ominous “Death” figure, nearing with a scythe to lead the oil industry into decline. Although this threat is not immediate, the concern has caused executives to remain conservative with their financial strategies, keeping investments on hold.

According to Rystad Energy, global investments in oil and gas exploration and production have declined by approximately 65% since their peak in 2014.

This reduction in spending poses risks for future crude oil production, potentially leading to rising prices. As oil companies cut back on exploration and development, their free cash flow is expected to increase significantly. Consequently, as this cash accumulates, companies will likely report higher earnings and enhance their capacity to return capital to shareholders.

This trend is already unfolding in the current market.

In summary, the combination of a tightening oil market and rising inflation suggests that investors should consider adding an oil stock hedge to their portfolios.

**********

Inflation Hedge No. 3: Oil and Energy

For investors seeking exposure to the oil and energy sector, the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) offers a diversified selection of oil and natural gas producers. Alternatively, the Alerian MLP ETF (AMLP) provides access to a variety of oil and gas transportation and storage assets.

**********

Inflation Hedge No. 4: Bitcoin

By Luke Lango

Editor of Hypergrowth Investing, Innovation Investor, Early Stage Investor, Crypto Investing Network, and Ultimate Crypto

During his tenure in the U.S. Senate from 2008 until 2015, Tom Coburn became well-known for his annual reports on government waste, the “Wastebook.” Each report cataloged extravagant government spending, including a notorious project that allocated $865,000 to train mountain lions to walk on treadmills.

In another instance, the 2014 Wastebook highlighted a $331,000 grant awarded to study the emotional state known as “hangry.” Perhaps most egregious was the Pentagon’s billion-dollar expenditure to destroy $16 billion worth of unneeded ammunition.

Historically, such instances highlight a broader trend of government mismanagement that citizens often face. While I maintain an optimistic outlook for the future, believing that free minds and markets will promote prosperity, I also recognize the value of safeguarding against potential instability.

Given this perspective, I advocate for owning protective measures, or “hedges,” in case the financial system experiences destabilizing events similar to those observed in 2008—a scenario that remains possible.

After all, while I don’t anticipate auto accidents—hence my use of a seatbelt—protective measures like these can provide reassurance in uncertain times. If you’re reading this, you likely share this sentiment.

Such hedges can offer you some security against potential market turmoil as you navigate ongoing financial challenges.

Understanding Currency Debasement and Bitcoin’s Role as Wealth Insurance

In this article, we will explore how governments undermine the value of your hard-earned money, and why investing in bitcoin may serve as an effective strategy to protect your wealth.

The Impact of Government Monetary Policies

Governments have consistently debased currencies throughout history. When they seek to fund extensive initiatives, such as wars or social programs, they often resort to creating additional currency units, like dollars.

Each new currency unit that enters circulation reduces the purchasing power of existing units. This process is referred to as “inflating” the money supply. As a result, inflation gradually siphons off value from the dollars in your wallet and bank account. This strategy allows governments to extract wealth from citizens without the immediate backlash that would accompany tax hikes.

For individuals saving for retirement, inflation poses a significant threat. It can drastically erode the future buying power of the funds you accumulate today.

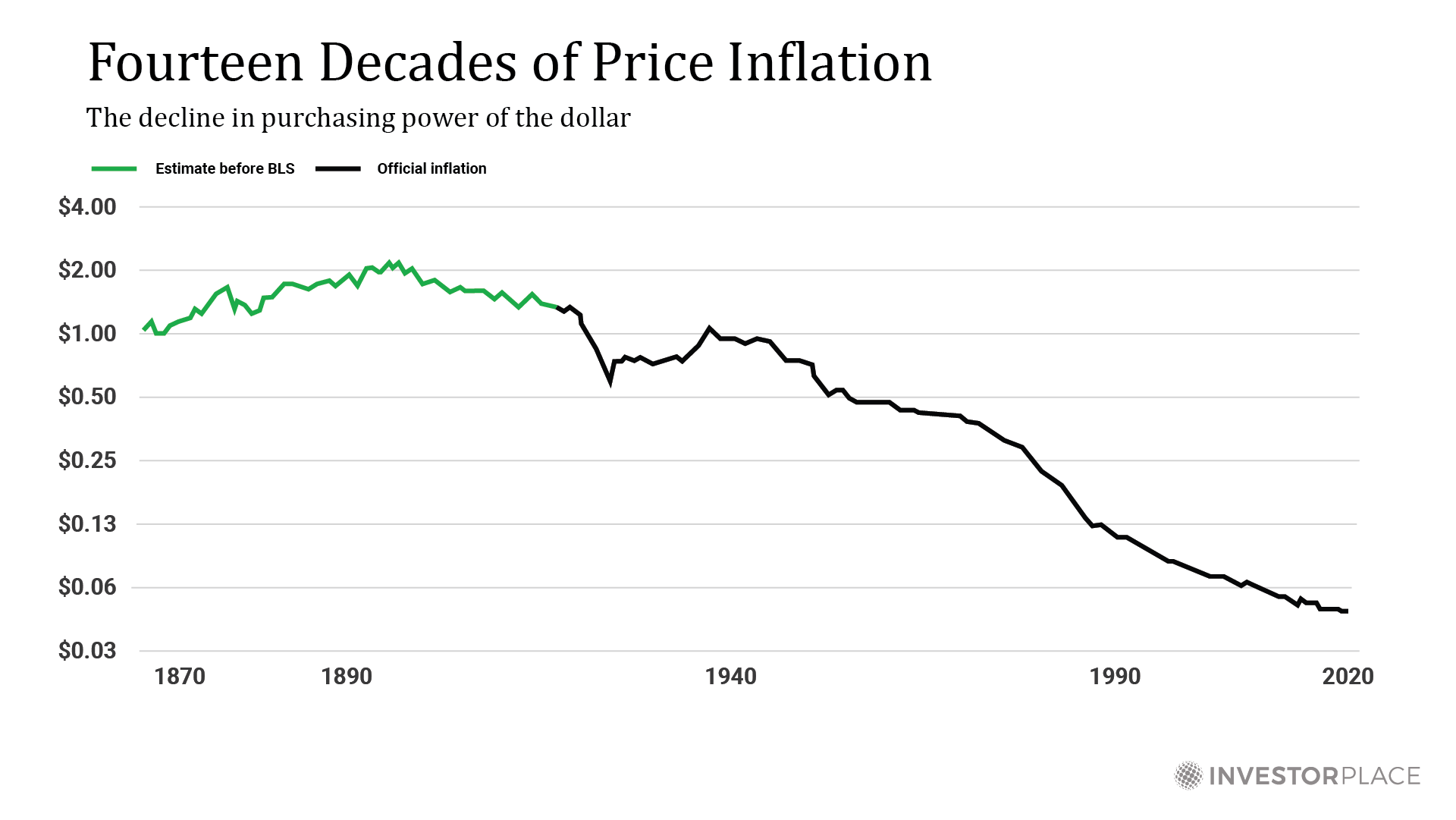

To illustrate how incessant government spending leads to currency devaluation, consider the following chart. It demonstrates that the U.S. dollar has lost over 90% of its value since 1870.

Throughout history, diligent and cautious savers have faced losses when governments with free-spending habits debase their currencies. This trend worsened significantly in the wake of major events like the COVID-19 pandemic, which exacerbated calls for increased spending.

Consequently, the appeal of digital currencies—specifically cryptocurrencies that have a fixed supply and cannot be debased—is likely to grow significantly over the next decade.

While traditional currencies tend to depreciate over time due to inflationary pressures, the finite supply of cryptocurrencies like bitcoin can protect against this devaluation. This characteristic positions cryptocurrencies as favorable alternatives to government-backed paper currencies.

Globally, governments have amassed unprecedented levels of debt and obligations they have not accounted for. Major economies show a reluctance to confront this reality, exhibiting no will to reduce spending or to curtail extravagant future commitments.

However, technological advancements offer individual savers a solution to the risks posed by irresponsible governments. As a result, people are increasingly turning to cryptocurrencies for saving, spending, borrowing, and transferring money.

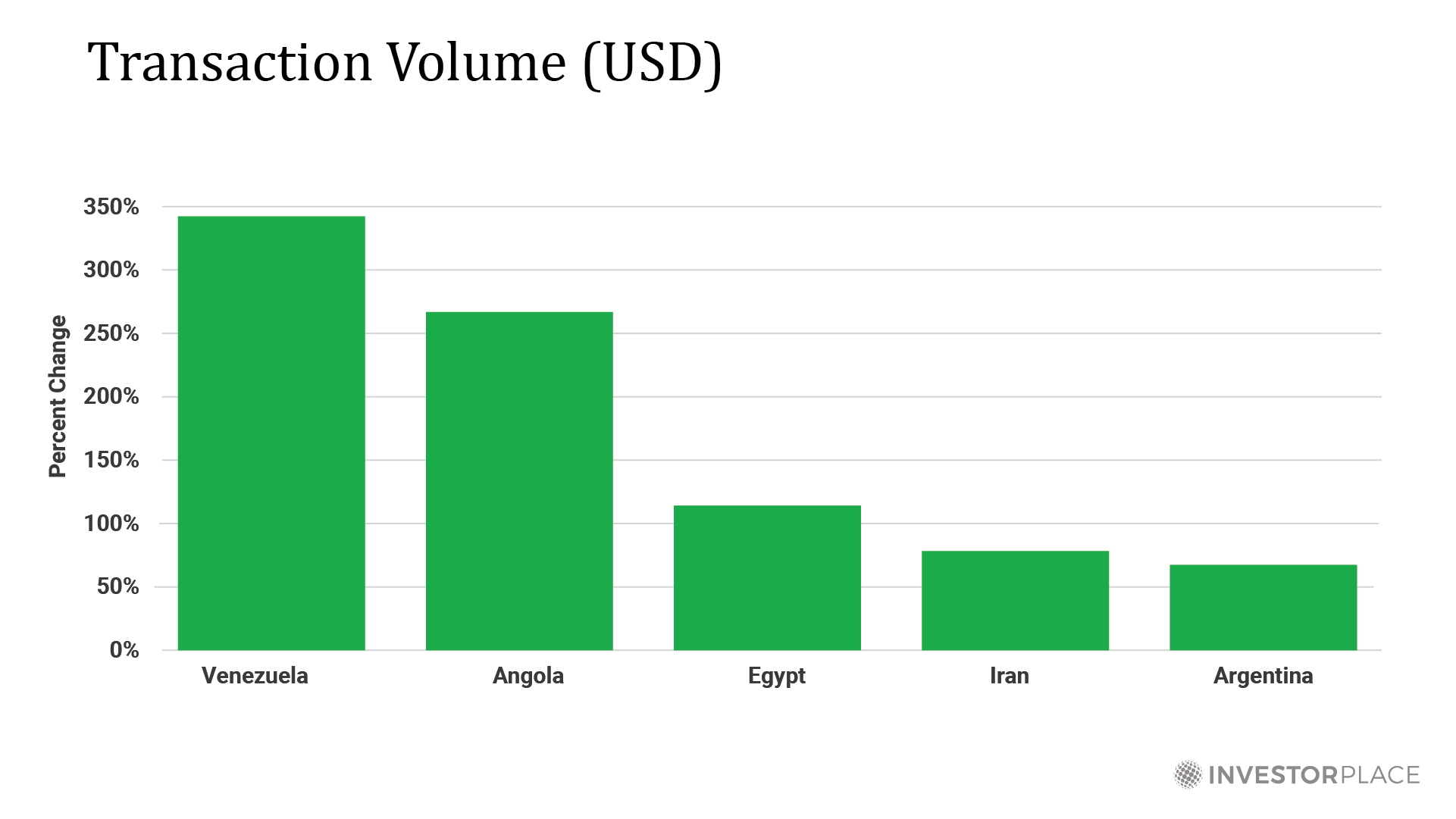

Evidence of this trend is already observable. A report by Digital Assets Data indicates that bitcoin serves as a store of value and an alternative to local fiat currencies in nations grappling with high inflation and unstable monetary systems.

As illustrated in the graph below, peer-to-peer bitcoin transactions surged in countries experiencing extreme inflation. Notably, these spikes occurred irrespective of the underlying price movements of bitcoin.

When faced with the prospect of their savings losing all value in local currencies, individuals increasingly turned to bitcoin as a safeguard against economic instability.

Exploring Bitcoin’s Role as a Hedge Against Inflation

The potential market for this new form of money is vast.

The Role of Bitcoin in Inflation Protection

Bitcoin, like gold, acts as a store of value during economic volatility. It also functions as a means of value exchange comparable to the U.S. dollar.

Unlike gold, bitcoin’s supply is fixed and predictable, capped at 21 million coins, no matter how high the demand rises.

Moreover, bitcoin is not subject to external management or government influences. There is no CEO or board to impose decisions like cash bailouts, which can destabilize traditional markets.

The cryptocurrency operates on an open-source protocol, allowing anyone to view transactions and participate in its network. This decentralized decision-making structure involves participants who have a direct stake in its future.

Understanding Bitcoin’s Volatility

Bitcoin has emerged as a valuable asset class, with its volatility presenting opportunities for significant returns. Some analysts speculate that bitcoin might evolve into the world’s digital reserve currency, potentially driving its price to $100,000 or more.

This positions bitcoin as a compelling alternative to the current $18 trillion in negative-yielding debt.

Market volatility, however, isn’t forever. A growing number of people are actively trading bitcoin. As interest in bitcoin increases, its volatility is likely to diminish, making it a more attractive option for investors.

In the long run, I anticipate a beneficial cycle of reduced volatility and increasing public engagement, ultimately expanding the reach and power of cryptocurrencies.

Considering the current inflationary climate, I maintain a strongly bullish outlook on bitcoin. It represents a modern currency solution akin to digital gold.

As cryptocurrencies gain traction, they provide a potentially more secure alternative to traditional cash holdings.

If you are new to cryptocurrency and don’t know where to begin, InvestorPlace offers guidance.

**********

Inflation Hedge No. 4: Bitcoin

To gain exposure to Bitcoin (BTC), the simplest method is to purchase it on major cryptocurrency exchanges.

**********

Inflation Hedge No. 5: Real Estate

By Brian Hunt, CEO, InvestorPlace

No discussion on wealth protection and growth is complete without highlighting real estate as a powerful investment tool.

Many investors value owning real estate for its permanent asset nature and ability to generate income.

It provides safe leverage and boasts a longstanding record of returns, making it a reliable choice for wealth preservation and growth throughout history—an essential component of any inflation-resistant portfolio.

To grasp the significance of real estate, take a moment to look outside. Urban environments reveal a myriad of structures, from apartments to office buildings and retail outlets.

Real estate permeates modern life. We inhabit homes, work in offices, visit gyms and healthcare facilities, and frequent shops—these establishments are integral to our daily existence.

Understanding the Critical Role of Real Estate in Wealth Creation

We engage in countless transactions daily, whether dining at restaurants, purchasing gasoline, groceries, or gadgets. These activities ripple through a wide array of businesses—from warehouses to self-storage units and beyond.

No matter how remote you may live, you likely reside near farms or timberland that contribute to the economy. In the United States, hundreds of millions of transactions take place each day for the essentials that fuel our lives. Central to all these exchanges is real estate.

Restaurants, offices, retail stores, grocery establishments, homes, labs, factories, storage spaces, warehouses, and hotels all necessitate physical locations. People need to occupy apartments and houses. This reality translates into billions of dollars being paid in rent every month throughout America.

We rely on real estate in a more profound way than our perceived needs for new Teslas, iPhones, clothes, or sneakers. Real estate stands as the most fundamental and essential asset globally.

Consider attempting to buy food without a grocery store, farming without fields, or running a shop without walls and a roof. These scenarios illustrate a simple truth: you need real estate.

Consequently, we all contribute to rent payments—either directly or indirectly—every single day.

When you purchase food, part of that payment covers the grocer’s rent. Visiting the doctor also means contributing to her rent. Buying a shirt involves paying a fraction of the store’s rent, while shopping on Amazon means contributing to Jeff Bezos’ rent. Even paying for a Netflix subscription includes a portion that goes toward the company’s rent.

Across America, large sums of rent payments flow seamlessly between towns, states, and coasts.

The total value of rent collected annually exceeds $1 trillion, multiple times the combined value of all automobiles and smartphones sold in the United States.

The Link Between Wealth and Real Estate

As mentioned earlier, we all pay rent in some capacity. This is why “wealth” and “real estate” can be seen as synonymous in America.

You may have sensed this connection early in life. Oftentimes, the wealthiest individuals in any community are those who own prime real estate.

Real estate equates to power and wealth, making it an essential asset class. Given the consistent demand for real estate, owning property can lead to lucrative opportunities. It offers a more predictable and safer investment avenue than the Stock market.

Investing inherently requires making predictions about the future. Consider the following:

- While pinpointing which tech companies will produce leading apps or gadgets is challenging, it’s quite easy to see that they will still have to pay for office space.

- Identifying the restaurant chains that will thrive in five years is difficult. Yet it’s clear those establishments will need to pay rent to remain operational.

- While predicting which retail stores on New York City’s iconic Fifth Avenue will succeed a decade from now presents challenges, it’s certain that all will be paying rent to survive.

In fact, making accurate predictions about which products will succeed is akin to a challenging 20-foot put in golf. In contrast, forecasting that companies will need real estate represents an easy two-inch put. Which would you prefer to stake your savings on?

This question doesn’t require any trickery.

Given the strong demand for quality real estate, such assets tend to maintain their value during inflationary periods. As overall prices rise, so too do real estate values.

Chances are, you already recognize that owning real estate is a sound strategy. Now, let’s discuss how to embark on this investment journey.

Generally, investors can engage with real estate in two primary ways: directly or indirectly.

Direct Real Estate Investment

Investing directly in real estate means purchasing and managing properties yourself. While this can be profitable, it requires a significant investment of time and effort, along with various challenges.

First, assess your understanding of the real estate landscape. As Warren Buffett advises, “Invest in what you know… and nothing more.”

Real estate offers multiple avenues: you could invest in single-family homes, vacant plots, multifamily units, office spaces, retail locations, or even specialized properties like mobile home parks. Each option requires considerable knowledge and effort to succeed.

For simplicity, let’s explore the scenario of purchasing single-family rental homes.

Initially, you must educate yourself about the housing market in your chosen area. What are typical home prices and rents? Are property values trending upward or downward? What local factors—such as schools, shopping amenities, and crime rates—affect neighborhood values?

Crucially, developing the ability to find reliable tenants is vital. Without good tenants, your investment may quickly turn sour. Assuming you do find a quality tenant, your responsibilities as a landlord begin.

If the air conditioning breaks, you bear the cost of repairs. A clogged toilet demands immediate attention, regardless of your weekend plans. If termites invade, you’ll need to budget for pest control. Additionally, hiring a competent property manager can alleviate some headaches, but that comes with its own set of challenges, including costs and trustworthiness concerns.

While direct real estate investment can yield rewards, it demands significant time and expertise. Consequently, it may not suit everyone.

So, what’s an alternative, potentially simpler way to invest in real estate?

Indirect Real Estate Investment

Another option is through the Stock market, specifically by investing in real estate investment trusts (REITs).

REITs operate by owning various income-generating properties across numerous sectors, including single-family homes, apartments, offices, and storage facilities.

Many REITs manage portfolios consisting of dozens of properties in diverse locations. A prime example is Simon Property Group Inc. (SPG), a major publicly traded REIT that owns hundreds of properties nationwide.

Understanding the Advantages of Investing in REITs

Real Estate Investment Trusts (REITs) provide a unique investment opportunity similar to Exchange-Traded Funds (ETFs) in the stock market. For instance, Boston Properties Inc. (BXP) owns over 150 office buildings, while Equity Residential (EQR) manages more than 70,000 apartment units across the U.S.

REITs can be thought of as ETFs for real estate investments. To qualify as a REIT, a company must distribute at least 90% of its taxable income to shareholders. This policy allows investors, like you, to generate substantial cash flow from your investments.

Benefits of Investing in REITs

Investing in REITs offers multiple advantages compared to traditional real estate investing.

- Enhanced Safety: Real estate investors know the risks associated with owning a property outright, especially if the market cycles turn. What happens if values drop, or if rental income cannot cover mortgage costs? Singular investments can be risky, especially if a problematic tenant emerges, leading to a lengthy eviction process.

REITs reduce these risks by allowing you to invest in a broad range of properties, sometimes numbering in the thousands. Your investment is thus diversified, which helps safeguard your wealth. An individual rental property typically requires a significant down payment, often reaching tens or hundreds of thousands of dollars. This is a classic case of “putting all your eggs in one basket.”

By investing in REITs, you have the opportunity to spread that capital over various sectors, such as residential, corporate, retail, and specialty REITs. This diversification protects your finances from negative impacts affecting a particular investment, and it positions you for potential gains across multiple sectors.

- Stability: Investing in volatile tech stocks demands emotional resilience. Prices can swing dramatically in days. In contrast, REITs generally avoid these pronounced fluctuations. Real estate values typically change gradually, lending stability to your investments.

REITs are not subject to the erratic nature of technology stock investments, making them more comfortable for investors’ nerves over time.

- Liquidity: Since REITs are traded like stocks, you can sell shares quickly to access cash if needed. This is not the case for a rental property, which involves lengthy processes and potential broker fees.

- Large Yields: REITs must distribute at least 90% of taxable income as dividends to shareholders. Consequently, they generally offer larger dividend payouts than traditional stocks. For instance, the FTSE Nareit All REITs Index currently yields 4.3%, significantly exceeding the average 2.04% yield of the S&P 500.

Furthermore, many REITs provide even greater yields, with some reaching upwards of 8%, 10%, or even 12%.

For perspective, consider these two hypothetical investments:

Investment A involves placing $25,000 into the S&P 500 at a 2.04% yield with dividends reinvested.

Investment B consists of the same amount in a high-quality REIT yielding 10%, also with dividends reinvested.

After 20 years, assuming no capital appreciation, the S&P 500 investment would have risen to $37,441, reflecting a 50% gain solely from reinvested dividends.

Conversely, the REIT would have expanded to $168,187, resulting in an astounding 570% gain from dividends alone. This showcases the significant wealth-building potential of high-yield REIT investments.

Now, let’s explore actual market data to evaluate how REITs have historically performed in comparison to other asset classes.

The Long-Term Performance of REITs

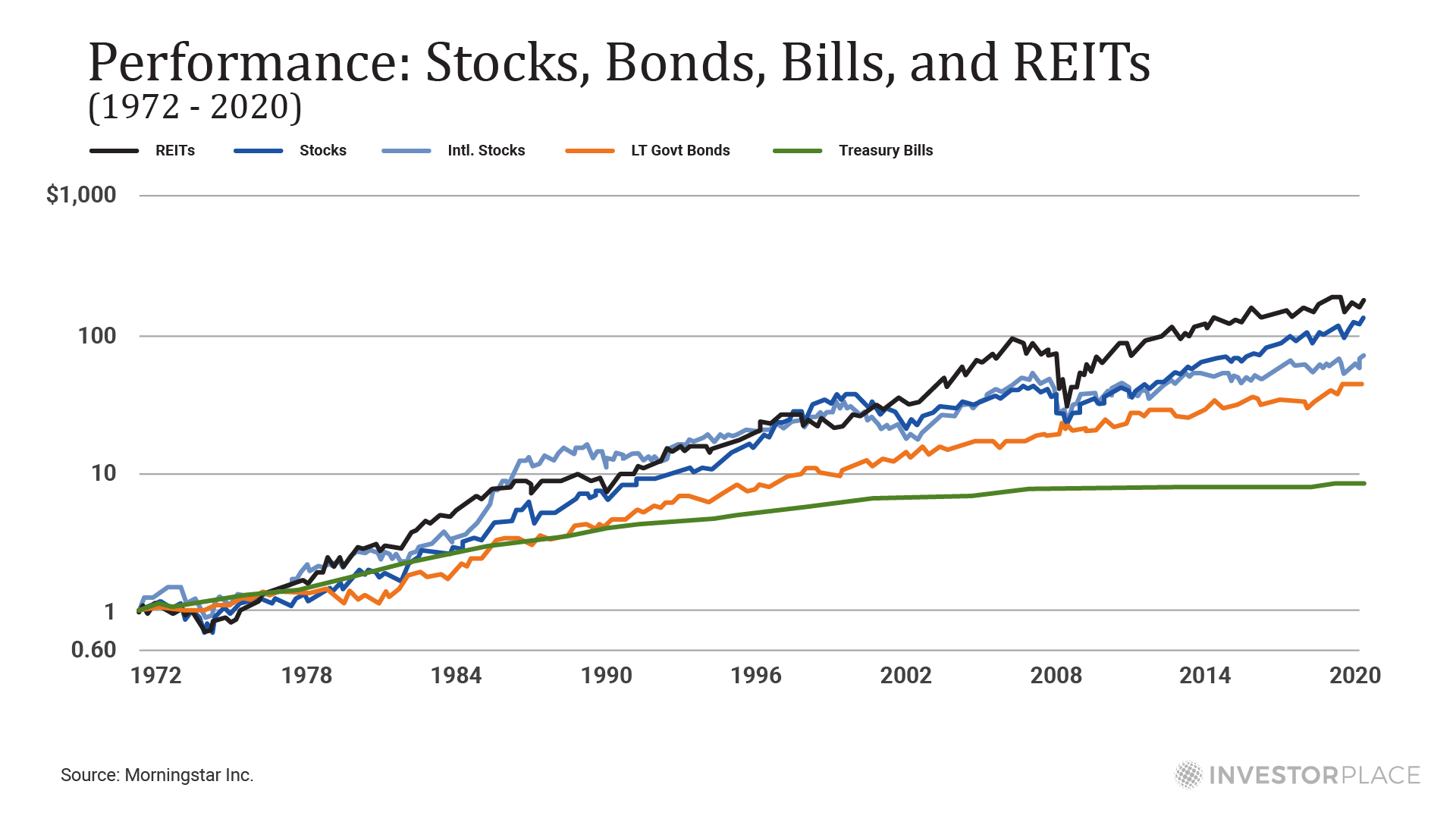

In an intriguing comparison of five major asset classes—U.S. stocks, international stocks, long-term government bonds, Treasury bills, and REITs—the performance since 1972 reveals surprising results. Many investors assume that stocks would top the ranking, but that is not the case.

The chart below from Morningstar reveals the compound rate of return for these asset classes from 1972 through 2017, based on a hypothetical $1 investment in each class.

Real Estate Investments: A Robust Hedge Against Inflation

As detailed in recent findings, Real Estate Investment Trusts (REITs) lead the pack with an impressive compound annual return of 11.8%. This figure underscores the superior performance of real estate stocks compared to traditional stocks.

Consider our hypothetical scenario with a $25,000 investment in REITs yielding 11.8% annually over a 50-year period, from 1972 to 2022. In this case, the portfolio would balloon to an impressive $6.6 million.

Conclusion: The Essential Nature of Real Estate

Once again, let’s emphasize a key point: real estate is one of the most fundamental and necessary assets worldwide.

Every type of enterprise—from restaurants and offices to homes and factories—requires physical locations. As such, billions are spent on rent monthly. In one way or another, each of us contributes to this rent cycle daily. The demand for real estate remains consistent, making the association between “wealth” and “real estate” nearly inseparable.

Owning real estate not only signifies power and wealth, but when acquired wisely, it can yield significant passive income over the long term. Importantly, the value of these assets—and the rent they generate—tend to appreciate during inflationary periods, making them an invaluable part of a strategy aimed at preserving wealth.

**********

Inflation Hedge No. 5: Invest in Real Estate

In addition to REITs, a smart way to gain exposure to the real estate sector is through the Vanguard Real Estate Index Fund (VNQ). VNQ is a low-cost, diversified fund that provides access to major real estate categories.

**********

A Strategic Approach to Wealth Growth and Protection

By Brian Hunt, InvestorPlace CEO

Every year, U.S. News & World Report compiles a list of the “Best Places to Live in the U.S.” This assessment evaluates over 100 metropolitan areas based on factors such as job opportunities, environmental quality, housing affordability, crime statistics, education, and more.

Consistently, Colorado Springs, Colorado, ranks highly on this list. Situated against the backdrop of the Rocky Mountains and filled with open spaces, it exemplifies “mountain living” and has experienced steady population growth since 1960, earning its reputation as a desirable location.

Protecting Your Wealth: Financial Lessons from Cheyenne Mountain Complex

Colorado Springs is not just famous for its stunning mountain views.

In the 1950s, during the Cold War, the U.S. military designated Colorado Springs as the location for its most critical military command post. This decision came in response to fears of a nuclear conflict with the Soviet Union, as military leaders sought a highly secure base from which to manage America’s nuclear capabilities.

Following World War II, the military conducted an extensive national survey to find the safest location. Colorado Springs was chosen due to its significant distance from coastlines—making it less vulnerable to missile attacks—its geological stability, and its proximity to the granite expanse of Cheyenne Mountain.

By burying the command center deep within Cheyenne Mountain, which is composed of solid rock, the military could create a facility capable of withstanding various attacks, including nuclear ones.

Construction began in 1961 when the U.S. Army Corps of Engineers excavated hundreds of thousands of tons of rock. Inside Cheyenne Mountain, they built a comprehensive military command center shielded by more than 2,000 feet of granite.

The entrance features massive 25-ton steel doors, and the interior structures are mounted on enormous steel springs designed to absorb the impact of a nuclear explosion.

At its peak, over 1,000 military personnel operated within the complex, which housed extensive supplies of water, fuel, and food, as well as its own electrical plant, ensuring self-sufficiency during national emergencies. Today, the Cheyenne Mountain Complex serves as the Alternate Command Center for NORAD and U.S. Northern Command and functions as a training facility.

This facility is an example of what military experts classify as a “hardened” structure.

The term hardened is commonly used in military contexts to describe buildings that are exceptionally fortified and resistant to attacks, especially those constructed underground. These structures are among the most robust in existence, combining layers of rock, concrete, and steel to achieve a bomb-proof design.

The Cheyenne Mountain Complex stands out as the most hardened structure in the world.

It is nuclear bomb-proof.

Over the past three decades, we’ve learned the importance of “hardening” our financial strategies and investment portfolios. Everyone aims to protect their wealth with a financial equivalent of the Cheyenne Mountain Complex.

As detailed in our recent report, inflation is likely to persist. To safeguard your wealth, Louis Navellier, Luke Lango, Eric Fry, and I have identified five top investments that can shield you from ongoing inflation.

We advocate for creating and maintaining a “hardened” financial life as one of the wisest choices you can make for yourself and your family.

Your ability to earn, save, and grow your savings should enjoy the same level of protection as the Cheyenne Mountain Complex.

InvestorPlace, as one of the leading investment research firms, carefully selects and recommends numerous stocks and bonds each year for investors.

Nevertheless, even the best investment ideas lose their value if they do not align with your financial situation and goals.

Building a Crisis-Proof Investment Portfolio for Long-Term Safety

Every discerning investor aims to create a resilient portfolio that shields against crises and inflation while offering growth potential. An optimal investment strategy not only thrives during prosperous times but also safeguards your wealth in challenging periods.

This chapter provides step-by-step guidance on constructing a robust, all-weather investment portfolio.

The Importance of Smart Asset Allocation in Your Portfolio

In the realm of investments, “Stock picking” often steals the spotlight. Financial news frequently highlights specific companies and their Stock prices, captivating those looking for exciting investment opportunities. However, success in investing hinges far more on effective asset allocation than on individual stock selection, especially in inflationary contexts.

Asset allocation outlines how your wealth is distributed among various asset categories, including stocks, bonds, cash, commodities, precious metals, and real estate. Over an investor’s career, the influence of asset allocation on wealth creation significantly outweighs that of stock picking, with a ratio potentially exceeding 100 to 1.

Unfortunately, many investors invest substantial effort in stock selection while neglecting to understand prudent asset allocation principles. This oversight can lead to excessive risk-taking with their savings.

For those committed to maintaining a secure financial future, asset allocation becomes a focal point. The key is to diversify across private businesses, public equities, real estate, precious metals, cash, and other financial instruments—many of which serve as hedges against inflation, as discussed earlier in this guide.

Ideally, a well-rounded asset mix curtails exposure to significant losses in any single area. Sound investment practices dictate a strategy that avoids concentrating investments in one Stock or asset class.

Consider the case of Enron in the late 1990s: employees viewed the company as a beacon of innovation, leading many to invest their retirement funds entirely in Enron Stock. When the fraud was exposed, these employees faced disastrous losses as their asset allocation rested entirely on one failing company.

Such a strategy exemplifies extremely poor and reckless asset allocation.

Similarly, during the U.S. real estate boom of 2005 and 2006, many individuals invested all their resources in property, often over-leveraging their investments. When the housing market collapsed, countless investors experienced devastating financial losses, rendering them vulnerable due to inadequate diversification.

These examples underscore the dangers of an overly concentrated asset allocation strategy, particularly in uncertain economic periods.

Keeping a significant portion of your wealth tied to one Stock or asset class creates vulnerability to drastic downturns. Such an approach increases your financial fragility, which counters the goal of developing a resilient investment portfolio.

Recognizing the risks associated with a singular focus on an asset class reinforces the need for a diversified portfolio. Think of it as maintaining a balanced diet, where incorporating various food groups ensures overall health.

Your investment options include several asset classes we’ve previously mentioned, among others:

- Stocks

- Bonds

- Gold

- Commodities

- Real Estate

- Bitcoin

- Privately Held Companies

There is no universally applicable asset allocation strategy; each individual’s ideal mix will depend on personal factors such as age, risk tolerance, and financial objectives.

A 50-year-old preparing for college expenses may approach asset allocation differently than a 32-year-old without family obligations. Likewise, a 75-year-old retiree will have unique considerations compared to both younger individuals.

Despite these differences, many share a common aim: to build a diversified, resilient asset collection generating consistent income, regardless of economic conditions.